Crocs, Inc. saw yet another quarter of triple-digit sales  and earnings growth, but the companys stock price fell more than 31% for the week following their earnings release, due primarily to lower-than-expected guidance for 2008.

and earnings growth, but the companys stock price fell more than 31% for the week following their earnings release, due primarily to lower-than-expected guidance for 2008.

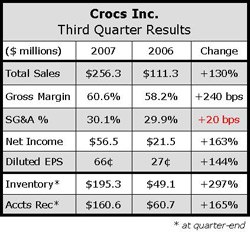

Overall sales were up 130% with footwear accounting for 87% of revenues. Sales of Crocs classics represented 35% of footwear sales.

To keep pace with this growth, Crocs opened a new, much larger distribution facility in Europe , increased production capacity, upgraded world wide IT systems and added personnel. Crocs now has 14 manufacturing facilities, including five third party operators in China and one each in Italy, Romania, Bosnia, the Ukraine and Florida; and, as of October, Vietnam, along with company-owned plants in Canada, Mexico, and Brazil. Production currently stands at approximately 6.8 million pairs per month with the ability to increase capacity to beyond 7.5 million pairs “quite seamlessly.” There are 15 company-operated distribution centers around the world with a global head count at approximately 5700 employees.

Domestically, Crocs management saw a continuation of the trends from the first half of the year coupled with “very strong demand” for new fall product. Since the end of July, Crocs has added roughly 500 stores in the U.S. , bringing the domestic store count now to approximately 12,500.

Management feels that the Crocs brand has a bigger opportunity to expand the distribution of Crocs branded footwear in the U.S. than previously thought.

In the first quarter, Crocs will open Foot Locker as a new account. Management said that this will be a global opportunity for Crocs and that Foot Locker will be carrying “primarily new Crocs product offerings and not classics.” There will also be some Foot Locker-specific product and Crocs will sell its licensed product through Champs. While they will not open in all Foot Locker stores immediately, Crocs will be present in “a good number of doors in Q1” with that number growing through the second quarter.

International business revenues increased 220% and represented 51% of total Crocs sales. Performance was driven by Europe , where the brand is growing its awareness with sales up over 375% from last year. Crocs presence is strongest in the

U.K. , Benelux, Germany and Scandinavia. Management expects this market to continue to “grow significantly” in the years ahead.

The gross margin increase during the quarter was driven by higher percentages of total sales in Europe and Asia , as well as increased sales of the Jibbitz product. The increase in SG&A as a percent of sales was said to be a result of increased global marketing expense. Crocs management said that they have been “sensing additional opportunities in Brazil, China , and India ” so the company “aggressively increased investments” in personnel and infrastructure. Net income was up due to better margins and a better tax rate.

Looking ahead, Crocs management raised guidance for the 2007 fiscal year and now projects net sales to range between $820 million and $830 million with EPS coming in between $1.94 and $1.98 per share.

For 2008, Crocs is currently forecasting sales and earnings per share to increase between 35% and 40% with the growth weighted in H1.

>>> No longer seen as a growth stock? Looks like Wall Street was expecting the triple-digit growth to go on indefinitely