DSW Inc. significantly raised the company’ guidance for the year after reporting second-quarter results that came in well above Wall Street’s targets.

DSW Inc. Reports Second Quarter 2018 Financial Results

- Second quarter revenue increased 16.4 percent to $795 million; comparable sales increased 9.7 percent. Wall Street’s consensus estimate was $689.4 million.

- Second quarter Reported loss of $0.48 per diluted share, including charges of $1.11 per diluted share primarily related to its Canadian acquisition.

- Second quarter Adjusted EPS of 63 cents per diluted share. Analyst’s consensus target had been 46 cents.

- Raised 2018 guidance for adjusted earnings for ongoing business to $1.60 to $1.75 per diluted share.

- Consolidation of its go-forward Canadian business to be slightly accretive in 2018.

- Announces the exit of the Town Shoes banner.

- Board of Directors declared quarterly dividend of 25 cents per share.

Chief executive officer, Roger Rawlins stated, “We are thrilled to report record sales and earnings results this quarter as our merchandise strategy and marketing investment fueled strong customer engagement, traffic and transaction activity, resulting in a 10 percent comp. The strong results we’ve had this spring demonstrate we’re successfully activating customers and increasing lifetime value. I’m proud of the progress we’re making, and with our updated earnings outlook, we look forward to sales reaching $3 billion for the first time in DSW’s history.”

“After completing our strategic assessment of the Canadian marketplace, we have decided to close its smallest retail banner and focus on the three largest family footwear banners, which we believe have the most potential for future growth and profitability,” Rawlins added.

Second Quarter Operating Results

- Total revenue increased by 16.4 percent to $795 million, including $72.5 million from the consolidation of its Canadian retail business.

- Comparable sales increased 9.7 percent for the same 13-week periods ended August 4, 2018 and August 5, 2017. Comparable sales exclude results from its Canada Retail segment.

- Reported gross profit, as a percent of sales, increased by 280 bps, due to favorable merchandise margin and occupancy leverage.

- Reported operating expenses, as a percent of sales, increased by 220 bps, driven by marketing investments, acquisition-related costs and restructuring expenses.

Six Months Operating Results

- Total revenue increased 9.6 percent to $1.5 billion, including $72.5 million from the consolidation of its Canadian retail business.

- Comparable sales increased 5.8 percent compared to last year’s 1.3 percent decrease.

- Reported gross profit, as a percent of sales, increased by 170 bps, driven by favorable merchandise margin and business mix.

- Reported operating expenses, as a percent of sales, increased by 160 bps, due to marketing investments, lease exit costs, acquisition-related costs and restructuring expenses.

- Reported net loss was $14.1 million, or $0.18 loss per diluted share, including pre-tax charges totaling $98.4 million, or $1.20 per diluted share, primarily related to the acquisition of the Canadian retail business and the exit of Ebuys.

- Adjusted net income was $82.4 million, or $1.02 per diluted share, a 47 percent increase to last year. This includes a loss of $0.01 per diluted share from the operations of the Town Shoes banner, which will be mostly exited by the end of the fiscal year.

Integration of New Canada Retail Segment

- As part of the two step acquisition, the company completed the remeasurement of previously held assets, including the equity investment and note receivable from its initial investment in 2014, resulting in a non-cash charge of $34.0 million.

- As a result of the current enterprise value exceeding the fair value of the acquired net assets, the company recorded a goodwill impairment of $36.2 million.

- Upon the completion of its comprehensive review, the company will focus on its largest retail banners, Shoe company, Shoe Warehouse and DSW Designer Shoe Warehouse. The company will exit its full price, mall-based Town Shoes banner, which operates 38 locations, mostly by the end of the fiscal year.

- The acquisition is expected to generate approximately $215 million in revenues and will be slightly accretive to Adjusted Earnings in 2018.

Second Quarter Balance Sheet Highlights

- Cash and investments totaled $289 million compared to $271 million in the second quarter last year.

- The company ended the quarter with inventories of $597 million compared to $527 million last year.

- Excluding inventories from its Canadian acquisition, inventories per square foot increased by 12.0 percent and increased by 2.0 percent on a two-year basis.

- Regular Dividend DSW Inc.’s Board of Directors declared a quarterly cash dividend of $0.25 per share. The dividend will be paid on October 5, 2018 to shareholders of record at the close of business on September 24, 2018.

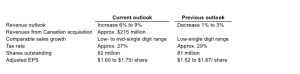

Fiscal 2018 Annual Outlook

The company updated its full year outlook for adjusted earnings in the range of $1.60 to $1.75 per diluted share, compared to its previous range of $1.52 to $1.67 per diluted share. Guidance does not include charges related to exit costs, restructuring or acquisition-related expenses or operating losses from the Town Shoes banner, which will mostly close by the end of the fiscal year.

Photo courtesy DSW