Callaway Golf Company reported earnings rose 93.6 percent in the second quarter to $60.9 million, or 63 cents a share.

Revenues rose 30.1 percent to $396.3 million. Results were well above Callaway’s projections in the range of 44 to 48 cents a share. Sales were expected in the range of $365 to $375 million.

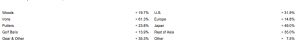

These record financial results were driven by increased sales in all operating segments, all major product categories and all major regions. For the second quarter of 2018, compared to the second quarter of 2017, net sales increased as follows:

As a result of the company’s better-than-expected first half, the company increased its full year 2018 sales guidance to $1,210 million, $1,225 million as compared to its prior guidance of $1,170 million, $1,185 million. The company also increased its full year 2018 earnings per share guidance to $0.95, $1.00 compared to prior guidance of $0.77-$0.82.

“The excellent start in Q1 has continued through Q2,” commented Chip Brewer, president and chief executive officer of Callaway Golf company. “Business around the globe remains strong with all major regions reporting significant sales growth and our new businesses, particularly TravisMathew, performing at or above plan. On the product side, we have strength across the entire line, especially with the Rogue line of woods and irons as well as the new Chrome Soft golf balls. We also continued to benefit from favorable market conditions. As a result, our EBITDA increased 62 percent during the second quarter compared to the prior year. I continue to be extremely pleased with our performance and our longterm outlook.”

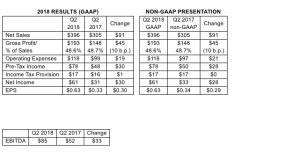

Summary of Second Quarter 2018 Financial Results

The company announced the following GAAP and non-GAAP financial results for the second quarter of 2018 (in millions, except EPS):

For the second quarter of 2018, the company’s net sales increased $91 million (30 percent) to $396 million, compared to $305 million for the same period in 2017. Net sales increased in all operating segments and regions and across all major product categories. The increase in net sales is attributable to the strength of the company’s 2018 product line and continued brand momentum, a $6 million favorable impact resulting from changes in foreign currency rates, an increase in product launches during the first half of the year and improved market conditions. In addition, second quarter net sales of gear and accessories increased significantly as a result of the company’s acquisition of TravisMathew in the third quarter of 2017.

For the second quarter of 2018, the company’s gross margin decreased 10 basis points to 48.6 percent compared to 48.7 percent for the second quarter of 2017. This slight decrease was impacted by higher product costs as more technology is incorporated into the new launches, but was partially offset by increases in average selling prices, the TravisMathew business, which is accretive to gross margins, and the net favorable translation impact of changes in foreign currency rates.

Operating expenses increased $19 million to $118 million in the second quarter of 2018 compared to $99 million for the same period in 2017. This increase is primarily due to the addition in 2018 of operating expenses from the TravisMathew business as well as some variable expenses associated with higher core business net sales.

Second quarter 2018 earnings per share increased $0.30 (91 percent) to $0.63, which is a record second quarter for the company, compared to $0.33 for the second quarter of 2017. On a non-GAAP basis, 2017 second quarter earnings per share was $0.34, which excludes $0.01 per share related to the impact of the non-recurring OGIO transaction and transition expenses. The increased earnings in 2018 reflect the increased sales in the core business, the addition of the TravisMathew business, operating expense leverage, favorable foreign currency rates and hedging activities and a lower tax rate due to the tax reform legislation enacted at the end of 2017.

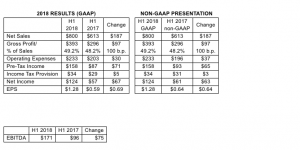

Summary of First Half 2018 Financial Results

The company announced the following GAAP and non-GAAP financial results for the first half of 2018 (in millions, except EPS):

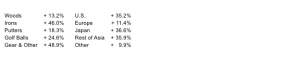

For the first half of 2018, the company’s net sales increased $187 million (30 percent) to $800 million, compared to $613 million for the same period in 2017. Net sales increased in all operating segments and all regions, and across all major product categories. The increase in net sales is attributable to the strength of the company’s 2018 product line and continued brand momentum, a $17 million favorable impact resulting from changes in foreign currency rates, an increase in product launches during the first half of 2018 versus 2017 and improved market conditions. In addition, first half net sales of gear and accessories increased significantly as a result of the company’s acquisition of TravisMathew in the third quarter of 2017. For the first half of 2018, compared to the first half of 2017, net sales increased as follows:

For the first half of 2018, the company’s gross margin increased 100 basis points to 49.2 percent compared to 48.2 percent for the first half of 2017. This increase reflects an overall increase in average selling prices, the addition of the TravisMathew business, which is accretive to gross margins, and the net favorable translation impact of changes in foreign currency rates, partially offset by higher product costs as more technology is incorporated into the new launches.

Operating expenses increased $30 million to $233 million in the first half of 2018 compared to $203 million for the same period in 2017. This increase is primarily due to the addition in 2018 of operating expenses from the TravisMathew business, as well as some variable expenses associated with higher core business net sales.

First half 2018 earnings per share increased $0.69 (117 percent) to $1.28, which is a record first half for the company, compared to $0.59 for the first half of 2017. On a non-GAAP basis, 2017 first half earnings per share was $0.64, which excludes $0.05 per share related to the impact of the non-recurring OGIO transaction and transition expenses. The increased earnings in 2018 reflect the increased sales in the core business, the addition of the TravisMathew business, operating expense leverage, favorable foreign currency rates and hedging activities and a lower tax rate due to the tax reform legislation enacted at the end of 2017.

Business Outlook for 2018

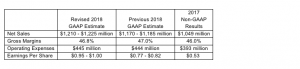

Full Year 2018

Given the company’s financial performance during the first half of 2018, the company is increasing its full year 2018 financial guidance as follows:

The company’s revised 2018 net sales estimate of $1,210 million-$1,225 million represents an increase of $40 million over its prior estimate. This would result in net sales growth of 15 percent-17 percent in 2018 compared to 2017. The estimated incremental sales growth versus previous estimates is expected to be driven by further increases in the core business (currently estimated at 8-10 percent full year sales growth compared to 2017, on a currency neutral basis), and increases in the TravisMathew business. The increases in core business are expected to be driven by the Rogue line of woods and irons, the new Chrome Soft golf balls, including continued success of the Truvis golf balls, and healthy market conditions. As a result of an overall strengthening of foreign currencies during the first half of 2018, the company currently estimates that changes in foreign currency rates will positively impact 2018 full year net sales by approximately $14 million, a $5 million decrease from when the company last gave guidance as the U.S. dollar strengthened during the second quarter of 2018.

The company currently estimates that its 2018 gross margin will decrease 20 basis points from the prior estimate. This decrease is expected to be driven in most part by a strengthening of the U.S. dollar.

The company estimates that its 2018 operating expenses will increase $1 million compared to prior estimates. Variable expenses related to higher sales are being mostly offset by a strengthening U.S. dollar. The company continues to realize operating expense leverage as the top line continues to expand.

The company increased its GAAP earnings per share guidance to $0.95-$1.00, primarily due to the projected increase in net sales, operating expense leverage and a lower estimated tax rate. The company’s 2018 earnings-per-share estimates currently assume a tax rate of approximately 21.5 percent and a base of 97 million shares.

The cadence of the company’s golf equipment launches in 2018 is skewed toward the first half of the year compared to 2017. As a result, all of the company’s projected sales and earnings growth for 2018 is expected to occur during the first half of the year. Consistent with the company’s expectations at the start of the year, the second half of the year is planned to decrease slightly compared to the same period in 2017. For the full year, the company expects sales growth of 15 percent-17 percent in 2018 compared to 2017.

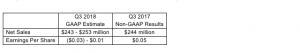

Third Quarter 2018

The company currently estimates the following results for the third quarter of 2018 compared to 2017 non-GAAP results for the same period:

The company expects flat to 4 percent sales growth in the third quarter of 2018 compared to the same period in 2017. This projection reflects no major product launches in the third quarter of 2018 versus the 2017 launch of the company’s EPIC Star Irons and Hybrids, as well as the launch of the Odyssey Works Red & Black Putters. The addition of the TravisMathew business will partially offset the negative launch timing, and foreign currencies are expected to be slightly negative in the quarter.

The company’s GAAP earnings per share for the third quarter of 2018 is estimated to decrease by $0.04-$0.08 compared to $0.05 of non-GAAP earnings-per-share for the third quarter of 2017. GAAP earnings-per-share for the third quarter of 2017 was $0.03. This projected decrease is due to launching fewer new products compared to the same period in 2017, while continuing to invest in the core and new businesses, and is partially offset by the favorable impact of the TravisMathew business. The company’s 2018 third quarter earnings-per-share estimates assume approximately 97 million shares, which is consistent with the third quarter of 2017.

Photo courtesy Callaway