Amer Sports reported a slightly higher loss on a modest sales gain in the second quarter, the company’s smallest quarter of the year. Amer still expects a “solid” second half, driven by up to double-digit pre-order growth in Winter Sports Equipment, Arc`teryx, Sports Instruments and strong expected order position in Precor, which just won the company’s largest ever customer contract.

Amer Sports’ brands include Salomon, Arc`teryx, Peak Performance, Atomic, Mavic, Suunto, Wilson and Precor.

Amer Sports Half Year Financial Report January-June 2018

April-June 2018

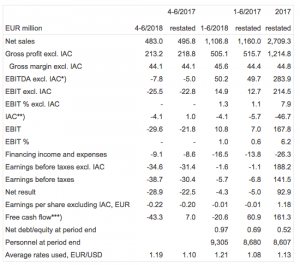

- Net sales were €483.0 million (April-June 2017: 495.8). In local currencies, net sales increased by 2 percent.

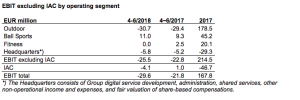

- EBIT excluding items affecting comparability was €-25.5 million (-22.8). Items affecting comparability were €-4.1 million (+1.0).

- Earnings per share excluding IAC were €-0.22 (-0.20). Earnings per share were €-0.25 (-0.19).

- Solid view on H2, driven by up to double-digit pre-order growth in Winter Sports Equipment, Arc`teryx, Sports Instruments and strong expected order position in Precor, which just won the company’s largest ever customer contract.

- Outlook for 2018 unchanged.

- Peak Performance acquisition will further contribute to profit and growth as of Q3.

January-June 2018

- Net sales were €1,106.8 million (January-June 2017: €1,160.0 million). In local currencies, net sales increased by 2 percent.

- Gross margin was 45.6 percent (44.4).

- EBIT excluding IAC was €14.9 million (12.7). Items affecting comparability were €-4.1 million

(-5.7). - Earnings per share excluding IAC were €-0.01 (-0.01). Earnings per share were €-0.04 (-0.04).

- Free cash flow €-20.6 million (+60.9), reflecting inventory building for the second half pre-order deliveries.

Outlook

In 2018, Amer Sports’ net sales in local currencies, as well as EBIT excl. IAC, are expected to increase from 2017. Due to ongoing wholesale market uncertainties, the quarterly growth and improvement are expected to be uneven. The company will prioritize sustainable, profitable growth, focusing on its five strategic priorities (Apparel and Footwear, Direct to Consumer, China, U.S. and Connected Devices and Services) whilst continuing its consumer-led transformation.

Heikki Takala, President and CEO:

“Q2 is our smallest quarter, during which we prepare for the significantly bigger H2 and we spend Opex and build inventory against confirmed pre-orders and expected demand. For H2 2018, our initiative pipeline is robust, and we expect strong growth in Arc`teryx, Winter Sports Equipment, Sports Instruments and Fitness, which is boosted by the largest ever customer deal we just won for two years.

“Our strategic focus areas continue to deliver well, driven by Arc`teryx, China, Own Retail and e-commerce. Encouragingly, after two years of low growth in the U.S., we are now starting to rebound towards mid-single-digit growth. As always, we focus on our Sustainable Growth Model, and throughout 2018, we continue to renew our Footwear distribution footprint for better alignment with our target consumer profile and brand equity, leading to some adverse topline impact especially in EMEA. Encouragingly, in the U.S., our Footwear continues to grow at double-digit level, and going into 2019, we expect to re-ignite Footwear growth globally.

“In Q2, we closed the acquisition of Peak Performance, which will further contribute to our growth and profit as of H2 and accelerate the company transformation towards areas of faster growth, higher profitability and better asset efficiency. With focus on long-term value creation, we are looking forward to another year of growth and improvement in 2018.”

Key Figures

*) EBITDA excl. IAC = EBIT excluding items affecting comparability and depreciation and amortization

**) Items affecting comparability (IAC) are material items or transactions, which are relevant for understanding the underlying operational financial performance of Amer Sports when comparing profit of the current period with previous periods. These items can include, but are not limited to, capital gains and losses on business disposals, acquisition and disposal-related costs, significant write-downs, provisions for planned restructuring and other items that are not related to normal business operations from Amer Sports’ management view.

***) Cash flow from operating activities – net capital expenditures – change in restricted cash (Net capital expenditures: Total capital expenditure less proceeds from sale of assets).Ne

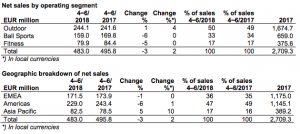

Sales and EBIT April-June 2018

Amer Sports’ net sales in April-June 2018 were €483.0 million (April-June 2017: €495.8). In local currencies, net sales increased by 2 percent.

Gross margin was 44.1 percent (44.1). EBIT excl. items affecting comparability (IAC) were €-25.5 million (€-22.8). Items affecting comparability were €-4.1 million. Increased sales in local currencies had a positive impact on EBIT of approximately €5 million. Operating expenses increased by approximately €10 million. Other income and expenses and currencies had a positive impact on EBIT of approximately €2 million. EBIT was €-29.6 million (-21.8).

Amer’s full financial statement is here.