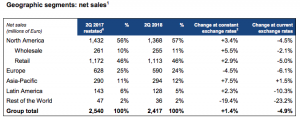

Luxottica Group S.p.A. reported net sales accelerated in the second quarter, growing by 1.4 percent at a currency-neutral basis. The results were driven by the strong performance of the Retail division and e-commerce platforms as well as solid growth in North America and Asia-Pacific.

On a reported basis, sales were down 4.9 percent at current exchange rates to €2,417 million.

Retail division’s net sales were €1,516 million, expanding by 4.3 percent at constant exchange rates (-2.8 percent at current exchange rates). Comparable store sales were up by 1.3 percent, an acceleration compared to the first quarter of the year.

Luxottica said this confirmed the effectiveness of strategic initiatives aimed at improving the operating model and the ability of the Group’s retail brands to execute them. For the third consecutive quarter, Sunglass Hut, with sales up 5.5 percent at constant exchange rates, grew in its main geographies. Retail brands in China, including Ray-Ban stores, and Australia confirmed a strong increase in sales. In North America, LensCrafters’ sales were back to growth, with improving comparable store sales even if still slightly negative.

Wholesale division’s net sales were €901 million, down 3.1 percent at constant exchange and off 8.2 percent at current exchange rates. The dceclines reflected a temporary slowdown in Europe due to new commercial policies and a delayed sun season. On the other hand, North America and Asia-Pacific each reported strong performance following the restructuring of their distribution network.

Proprietary eyewear brands include Ray-Ban, Oakley, Vogue Eyewear, Persol, Oliver Peoples and Alain Mikli. Licensed brands include Giorgio Armani, Burberry, Bulgari, Chanel, Coach, Dolce&Gabbana, Ferrari, Michael Kors, Prada, Ralph Lauren, Tiffany & Co., Valentino and Versace.

The net sales from group’s e-commerce platforms in the second quarter were up by 16 percent at constant exchange rates. Ray-Ban.com confirmed it is the main driver of the Group’s digital business, benefiting in the quarter from the exclusive launch online of special collections, such as Ray-Ban Reloaded, and the brand-new campaign for Ray-Ban Studios, which strengthened the link between the brand, music and millennials.

Adjusted operating income was €781 million, up 0.5 percent at constant exchange rates and -13.1 percent at current exchange rates. Reported operating income was €763 million, ahead 1.7 percent at constant exchange rates and -12.2 percent at current exchange rates.

Adjusted net income was €545 million, ahead 11.6 percent at constant exchange rates and 3.9 percent at current exchange rates. Reported net income was €530 million, rising 9.8 percent at constant exchange rates and -5.7 percent at current exchange rates.

“I’m pleased with the very good group results. The growth in the markets where we completed the new commercial strategy, including North America and Asia, confirm the value and effectiveness of the initiatives undertaken. We look with confidence at Europe’s prospects, the region where we are reorganizing our distribution strategy,” commented Leonardo Del Vecchio, executive chairman of Luxottica. “We are continuing to invest in product excellence and innovation. Our ‘made in Japan’ manufacturing capability and Barberini’s lenses further expand our luxury portfolio. The group’s digital evolution is ongoing. Our e-commerce business is more and more important in our strategy and our communication is now focused on digital and social media”

“Considering the positive trends we are also seeing in July, we confirm our outlook for 2018.”

Regarding the proposed combination between Luxottica and Essilor, the two companies are finalizing discussions with the Chinese competition authority and remain confident to obtain its approval by the end of the month. In parallel, the two companies are also finalizing their discussions with the Turkish antitrust authority and evaluating the timing for the closing of the transaction.

Luxottica renewed the license agreement for design, production and worldwide distribution of prescription frames and sunglasses for the Philippe Starck and Starck Eyes brands. The agreement has a duration of five years and is automatically renewable for a further five years.

Group’s Performance in the First Half of 2018

In the first six months of 2018, group revenues reached €4,553 million (+0.3 percent at constant exchange rates, -7.7 percent at current exchange rates).

Wholesale division sales were €1,731 million (-3.6 percent at constant exchange rates, -9.6 percent at current exchange rates), with the strong growth in North America partially offsetting the temporary slowdown in Europe due to the new commercial policies and unseasonal weather conditions.

The Retail business net sales accelerated in the second quarter and were €2,822 million in the first half of the year (+2.8 percent at constant exchange rates, -6.5 percent at current exchange rates), thanks to the contribution of Sunglass Hut, of Ray-Ban stores, OPSM in Australia, as well as the excellent performance of e-commerce platforms.

The group’s adjusted operating income, substantially in line with the first half of 2017 at constant exchange rates (with an adjusted operating margin 3,5 slightly improving at 18.3 percent), was €781 million at current exchange rates.

Adjusted operating income excluded organizational simplification and restructuring costs for certain business areas as well as non-recurring costs for a total of approximately €19 million.

The Wholesale division’s adjusted operating margin at constant exchange rates was 28.4 percent, down 20 basis points; the margin of the Retail division increased to 15.7 percent, up by 60 basis points.

On an adjusted basis and at constant exchange rates, net profit increased by 11.6 percent, benefiting from the lower cost of debt, the benefits of the Italian Patent Box and from American tax reform and amounting to €545 million at current exchange rates. Record adjusted net margin of 12.8 percent increased by 130 basis points at constant exchange rates compared to the first half of 2017. EPS (earnings per share) on an adjusted basis was €1.14 (1.38 dollars at the average €/US$ exchange rate of 1.2104).

The strong free cash flow generation in the first half of the year reached approximately €400 million.

Net debt as of June 30, 2018 was approximately €900 million, down by 19.2 percent compared to the same period last year, with a net debt/adjusted EBITDA ratio of 0.5x.

North America – In the second quarter, North America net sales grew by 3.4 percent at constant exchange rates and accelerated compared to the performance of the first three months of the year in both divisions. Wholesale business sales increased by 5.5 percent at constant exchange rates with the positive contribution from all sales channels, in particular department stores and key accounts.

The positive results of the Retail division, with sales up 2.9 percent at constant exchange rates, were driven by Sunglass Hut, which in the quarter opened approximately 170 shop-in-shops in Bass Pro and Cabela’s locations, in addition to contributions from Target Optical and Ray-Ban.com.

LensCrafters reported positive net sales, at +2 percent at constant exchange rates, and an improvement in comparable stores sales.

Europe – After twelve consecutive quarters of solid growth, Europe reported a decline in sales in the first six months of 2018. A decline of 4.5 percent at constant exchange rates in the second quarter was due to the effect of the new trade policies and the delayed start of the sun season, which led customers to be more cautious in their orders. In the second quarter, against falling wholesale net sales, an effective retail strategy led the excellent performance of the division, with the contribution of all the chains.

Asia-Pacific – In the second quarter, Asia-Pacific’s net sales at constant exchange rates were up by 7.5 percent. Greater China is growing double digits after completing the restructuring of the distribution channel and thanks to the positive contribution from Hong Kong. Australia confirmed the solid growth of previous quarters, accompanied by positive performance from Japan and India. The Retail division’s net sales accelerated in the second quarter of the year, leveraging on the strong result of the retail brands in Australia and China, where Ray-Ban continued to expand.

Latin America – In the second quarter, Latin America reported net sales up by 2.3 percent at constant exchange rates. Brazil contributed to the results thanks to the solid growth of the Óticas Carol franchise business, with 80 new openings in the first six months of the year. Mexico posted growing sales, in particular due to the expansion of Sunglass Hut.