Garmin today announced results for the third quarter ended September 30, 2017.

The company raised its full-year guidance after reporting that double-digit revenue and operating profit growth in outdoor, aviation, and marine led to an above-plan second quarter.

Highlights for the third quarter 2017 include:

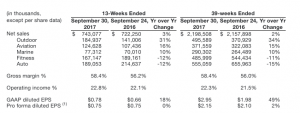

- Total revenue of $743 million, growing 3 percent over the prior year, with outdoor, aviation, marine and fitness collectively growing 9 percent over the prior year quarter and contributing 75 percent of total revenue.

- Gross margin improved to 58.4 percent compared to 56.2 percent in the prior-year quarter.

- Operating margin improved to 22.8 percent compared to 22.1 percent in the prior-year quarter.

- Operating income was $170 million, growing 6 percent over the prior-year quarter.

- GAAP EPS was 78 cents, an 18 percent improvement over the prior year quarter, and pro forma EPS was 75 cents, consistent with the prior-year quarter.

- Completed the acquisition of Navionics S.p.A., a privately-held worldwide provider of electronic navigational charts and mobile applications for the marine industry.

- Launched several new wearables within the fitness segment, including the Vívoactive 3, Vívomove HR, Vívosport and Vívofit Jr. 2 featuring Disney, Star Wars and Marvel branded bands and mobile app adventures.

Pro-forma EPS was flat at 75 cents, but ahead of Wall Street’s consensus target of 66 cents a share. Garmin’s net sales rose to $743.1 million, above the average estimate of $721.2 million.

“We continued our strong performance through the third quarter with double digit revenue and operating profit growth in outdoor, aviation, and marine,” said Cliff Pemble, president and chief executive officer of Garmin Ltd. “We are well positioned for the remainder of 2017 with a strong lineup of new products and opportunities in each business segment.”

Outdoor

During the third quarter of 2017, the outdoor segment grew 31 percent driven by strong demand for wearables. Gross margin improved to 64 percent while operating margin improved to 37 percent, resulting in operating income growth of 38 percent. Garmin recently entered new product categories with the introduction of the Descent dive watch, bringing a sleek design to underwater adventurers, and the Impact bat swing sensor. Looking forward, the company is focused on growth opportunities in wearables and inReach product introductions.

Aviation

The aviation segment posted revenue growth of 16 percent, driven by growth in both aftermarket and OEM sales. Gross and operating margins were 73 percent and 27 percent, respectively, resulting in 12 percent operating income growth. Garmin recently announced the TXi series of touchscreen flight displays with engine monitoring solutions. During the fourth quarter, the company began shipping the previously announced GFC 600, providing pilots with advanced autopilot capabilities in an aftermarket solution. Looking forward, it is focused on maximizing ADS-B mandate opportunities and gaining share in the OEM market.

Marine

The marine segment posted solid third quarter revenue growth of 10 percent driven by our strong lineup of chartplotters and fishfinders. Gross margin increased year over year to 58 percent, while operating margin improved to 24 percent. For the third consecutive year Garmin was recognized as the Manufacturer of the Year by the NMEA (National Marine Electronics Association), winning a total of nine awards across a broad range of product categories. The company recently completed the acquisition of Navionics S.p.A., a privately held provider of electronic navigational charts and mobile applications. In addition, it announced its 2018 lineup of marine electronics with updated EchoMap and Striker products.

Fitness

Revenue in the fitness segment declined 12 percent during the quarter, with gross and operating margins of 58 percent and 20 percent, respectively. The decrease in revenue was primarily driven by the decline of the basic activity tracker market and the timing of recent product introductions, partially offset by growth in the running category. During the third quarter, we launched several new wearables including the Vívoactive 3, bringing Garmin Pay contactless payment solutions to the wrist, Vívomove HR, an analog watch with wrist heart rate and smart notifications and Vívosport, a slim activity tracker with built-in GPS and smart notifications. In addition, Garmin launched its Vívofit Jr. 2, featuring Disney, Star Wars and Marvel bands and mobile app adventures.

Auto

Auto segment revenue declined 12 percent in the third quarter of 2017, primarily due to the ongoing PND market contraction partially offset by solid growth in OEM and niche categories such as camera, truck, fleet and RV. Gross and operating margins were 44 percent and 8 percent, respectively. The company recently introduced Garmin Speak with Amazon Alexa, bringing digital assistant functionality to the vehicle.

Additional Financial Information

Total operating expenses in the quarter were $264 million, an increase of 7 percent over the prior year. Research and development increased 11 percent, primarily due to engineering personnel costs related to wearable product offerings and aviation. Selling, general and administrative expenses increased 5 percent, primarily due to legal related costs. Advertising decreased 2 percent, primarily due to lower cooperative advertising somewhat offset by increases in outdoor media.

The effective tax rate in the third quarter was 20.8 percent, up from 16.5 percent in the prior-year quarter. The year-over-year increase in the effective tax rate is primarily due to the company’s election to align certain Switzerland corporate tax positions with evolving international tax initiatives and income mix by jurisdiction, partially offset by the benefit associated with the release of income tax reserves. In the third quarter of 2017, it generated $153 million of free cash flow (see attached table for reconciliation of this non-GAAP measure). Garmin continued to return cash to shareholders with its quarterly dividend of approximately $96 million and share repurchases activity, which totaled approximately $11 million in the third quarter. The company has about $1 million remaining in the share repurchase program authorized through December 31, 2017. It ended the quarter with cash and marketable securities of approximately $2.4 billion.

2017 Guidance

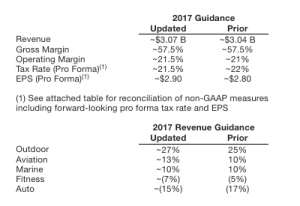

Based on its performance through the first three quarters of 2017, Garmin is updating its full-year guidance. It now anticipates revenue of approximately $3.07 billion, driven primarily by higher expectations for its outdoor, aviation and auto segments partially offset by lower expectations for the fitness segment. The outlook for marine is unchanged. The company anticipates its full-year pro forma EPS will be approximately $2.90 based on gross margin of approximately 57.5 percent, operating margin of approximately 21.5 percent and a full year pro forma effective tax rate of approximately 21.5 percent.

Photo courtesy Garmin