Helen of Troy Limited, the parent of Hydro Flask, reported earnings and revenue in the third quarter exceeded expectations, but the company trimmed its full-year sales outlook citing deceleration of growth in China e-commerce.

Julien R. Mininberg, chief executive officer, stated: “The company’s third quarter performance was in line with our expectations, bringing our year to date results to 8.1 percent net sales growth and 12.4 percent adjusted diluted EPS growth. Investment in our Leadership Brands continued to drive top line momentum in the quarter, growing their net sales 4.9 percent. The company’s total online sales increased by 6.0 percent, representing 18.0 percent of our total net sales for the quarter. Net sales in our Housewares segment grew double digits, propelled by point of sale growth, incremental domestic distribution, higher online sales, and incremental sales from new product introductions. Our Health & Home segment faced a tough comparison to the strong third quarter of last fiscal year, compounded by a slowdown in China ecommerce and foreign exchange headwinds. Our Beauty segment continues to focus on appliances, which benefited from new product introductions and online growth.”

Mininberg continued: “Our adjusted operating margin for the quarter primarily reflects our strategic choices to increase incremental digital marketing spend and new product introductions for our Leadership Brands. As expected, this quarter, we also started to feel the impact of tariffs ahead of the pricing actions we began implementing in the third quarter and which will largely take effect over the next two quarters. Retailers and consumers are just now beginning to digest higher prices, which could affect short-term shipments and consumption. We believe, however, that our pricing choices are right for the long-term health of the business.”

Mininberg concluded: “As we look to fiscal 2020, which begins this March, we have made our strategic choices for a second phase of Helen of Troy’s transformation. This next phase is designed to build on the successes of the past five years. We will focus on driving further improvements to our current businesses, our geographic footprint, our global shared services, and the overall strength of our organization. We will also seek to add to our Leadership Brand portfolio through acquisition. We believe we have the balance sheet, the capabilities, the culture, and the passionate, owner-minded people to take our transformation to the next level. We look forward to sharing more during our next investor day, which is currently planned for late Spring.”

Consolidated Operating Results – Third Quarter Fiscal 2019 Compared to Third Quarter Fiscal 2018

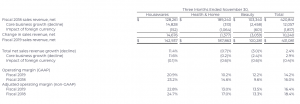

- Consolidated net sales revenue increased 2.4 percent to $431.1 million compared to $420.8 million, primarily driven by a core business increase of $12.1 million, or 2.9 percent, reflecting an increase in brick and mortar sales in its Housewares segment and growth in consolidated online sales. Wall Street’s consensus estimate had been $425.8 million.

- Net sales from Leadership Brands increased 4.9 percent to $343.4 million, compared to $327.3 million. These factors were partially offset by a decline in the personal care category and the discontinuation of certain brands and products in the Beauty segment, a deceleration of growth in China ecommerce, and the unfavorable impact from foreign currency fluctuations of approximately $1.8 million, or 0.4 percent. The company reclassified $2.9 million of expense from selling, general and administrative expense (“SG&A”) to a reduction of net sales revenue for the third quarter of fiscal 2018 to conform with ASU 2014-09 “Revenue from Contracts with Customers”. Please refer to Note 9 of the accompanying schedules to the press release for additional information.

- Consolidated gross profit margin decreased 0.1 percentage point to 42.2 percent, compared to 42.3 percent. The decrease is primarily due to less favorable product mix and the impact of tariff increases, partially offset by the favorable margin impact from growth in its Leadership Brands.

- Consolidated SG&A as a percentage of sales increased by 1.9 percentage points to 28.0 percent of net sales compared to 26.1 percent. The increase is primarily due to higher advertising expense, increased freight costs, increased share-based compensation expense and higher product claim expense. These factors were partially offset by the favorable comparative impact of foreign currency exchange and forward contract settlements, the favorable comparative impact of restructuring charges in the same period last year and lower amortization expense.

- Consolidated operating income was $61.3 million, or 14.2 percent of net sales, compared to $67.3 million, or 16.0 percent of net sales. The decrease in consolidated operating margin primarily reflects higher advertising expense, the impact of tariff increases, higher freight expense and increased share-based compensation expense. These factors were partially offset by the favorable comparative impact of foreign currency exchange and forward contract settlements, the net favorable comparative impact of restructuring charges of $1.1 million, lower amortization expense and the favorable margin impact from Leadership Brand growth.

- The effective tax rate was 6.9 percent, compared to 8.2 percent for the same period last year. The year-over-year decline in the effective tax rate is primarily due to shifts in the mix of taxable income in its various tax jurisdictions.

- Income from continuing operations was $54.3 million, or $2.06 per diluted share on 26.4 million weighted average shares outstanding, compared to $58.6 million, or $2.15 per diluted share on 27.3 million weighted average diluted shares outstanding. Income from continuing operations for the third quarter of fiscal 2019 includes an insignificant amount of after-tax restructuring charges, compared to $0.04 per share in the same prior year period.

- Loss from discontinued operations was $4.9 million, or $0.18 per diluted share, compared to a loss of $89.1 million, or $3.27 per diluted share, for the same period last year.

- Adjusted EBITDA (EBITDA excluding restructuring charges, the Toys “R” Us (“TRU”) bankruptcy charge, non-cash asset impairment charges, and non-cash share based compensation, as applicable) decreased 8.3 percent to $74.5 million compared to $81.3 million.

On an adjusted basis for the third quarters of fiscal 2019 and 2018, excluding restructuring charges, the TRU bankruptcy charge, non-cash asset impairment charges, non‐cash share-based compensation, and non-cash amortization of intangible assets, as applicable:

- Adjusted operating income decreased $6.9 million, or 8.9 percent, to $70.6 million, or 16.4 percent of net sales, compared to $77.6 million, or 18.4 percent of net sales. The 2.0 percentage point decrease in adjusted operating margin primarily reflects higher advertising expense, the impact of tariff increases, higher freight expense and increased share-based compensation expense. These factors were partially offset by the favorable comparative impact of foreign currency exchange and forward contract settlements, lower amortization expense and the favorable margin impact from Leadership Brand growth.

- Adjusted income from continuing operations decreased $4.9 million, or 7.1 percent, to $63.2 million, or $2.40 per diluted share, compared to $68.1 million, or $2.50 per diluted share. Wall Street’s consensus estimate had been $2.36. The 4.0 percent decrease in adjusted diluted EPS from continuing operations was primarily due to lower operating income from the Health & Home segment, partially offset by higher adjusted operating income from the Housewares segment, lower interest expense, lower tax expense, and the impact of lower weighted average diluted shares outstanding.

Segment Operating Results – Third Quarter Fiscal 2019 Compared to Third Quarter Fiscal 2018

Housewares net sales increased by 11.4 percent, or $14.7 million, due to point of sale growth and incremental distribution with existing domestic brick and mortar customers, an increase in overall online sales, and new product introductions. These factors were partially offset by lower club channel sales and a reduction in inventory by a key online retailer. Operating margin was 20.9 percent compared to 23.2 percent. The 2.3 percentage point decrease was primarily due to higher advertising expense, higher annual incentive compensation expense related to strong current year performance, higher freight expense, and higher rent expense related to previously-announced new office space. These factors were partially offset by the margin impact of more favorable product and channel mix and the favorable impact of increased operating leverage from net sales growth. Housewares adjusted operating income increased 2.7 percent to $32.6 million, or 22.8 percent of segment net sales, compared to $31.7 million, or 24.7 percent of segment net sales.

Health & Home net sales decreased 0.7 percent, primarily due to the unfavorable impact of net foreign currency fluctuations of $1.1 million, or 0.6 percent, and a core business decline of $0.3 million, or 0.2 percent. The core business decline primarily reflects lower online sales and the unfavorable comparative impact from international distribution gains in the prior year period. This was compounded by a deceleration of growth in China ecommerce and a corresponding buildup of inventory in the channel. These factors were partially offset by incremental distribution and shelf space gains with existing domestic customers and strong seasonal category growth. Operating margin was 10.2 percent compared to 14.6 percent. The decrease was primarily due to higher advertising expense, increased promotional spending and trade support with retail customers, tariff increases, a less favorable product and channel mix, and higher personnel expense. These factors were partially offset by the favorable comparative impact of foreign currency exchange and forward contract settlements. Health & Home adjusted operating income decreased 23.7 percent to $24.5 million, or 13.0 percent of segment net sales, compared to $32.1 million, or 17.0 percent of segment net sales.

Beauty net sales decreased 3.0 percent, or $2.5 million, reflecting a decrease in brick and mortar sales, a decline in the personal care category and the discontinuation of certain brands and products. These factors more than offset growth in the online channel, an increase in international sales, and new product introductions in the retail appliance category. Segment net sales were unfavorably impacted by net foreign currency fluctuations of approximately $0.6 million, or 0.6 percent. Operating margin was 12.2 percent compared to 9.6 percent. The increase is primarily due to the net favorable comparative impact of pre-tax restructuring charges of $1.1 million year-over-year, lower amortization expense, and personnel cost savings from its restructuring plan, referred to as Project Refuel. These factors were partially offset by higher advertising expense and higher freight expense. Beauty adjusted operating income decreased 1.2 percent to $13.6 million, or 13.5 percent of segment net sales, compared to $13.7 million, or 13.3 percent of segment net sales.

Balance Sheet and Cash Flow Highlights – Third Quarter Fiscal 2019 Compared to Third Quarter Fiscal 2018

- Cash and cash equivalents totaled $19.1 million, compared to $19.9 million

- Total short- and long-term debt was $339.7 million, compared to $426.2 million, a net decrease of $86.5 million

- Accounts receivable turnover was 69.4 days, compared to 65.4 days

- Inventory was $300.6 million, compared to $278.1 million. Inventory turnover was 3.4 times compared to 2.8 times.

- Net cash provided by operating activities from continuing operations for the first nine months of the fiscal year increased $6.6 million to $109.5 million. The increase was primarily due to an increase in income from continuing operations, higher share-based compensation and an increase in cash provided from accounts payable. These factors were partially offset by an increase in cash used for inventory and a dispute settlement payment of $15.0 million.

Fiscal 2019 Annual Outlook

For fiscal 2019, the company is updating its outlook for consolidated net sales revenue to be in the range of $1.535 to $1.550 billion, which implies consolidated sales growth of 3.8 percent to 4.8 percent after accounting for the expected impact from the adoption of ASU 2014-09 “Revenue from Contracts with Customers” (Revenue Recognition Standard) in fiscal 2019 with conforming reclassifications to fiscal 2018. Previously, growth was projected between 3.8 percent to 5.5 percent.

The company’s sales outlook now includes the following items, which together account for the $10 million reduction to the high end of the range and primarily impact the Health & Home segment:

- An expected unfavorable impact from pricing actions that have not been resolved with a key customer in two of its product categories; and

- A deceleration of growth in China e-commerce, with corresponding high inventory levels in the channel for one of its product categories and the impact that we believe trade tensions are having on both the U.S. and Chinese consumers.

The company’s net sales outlook continues to assume the severity of the cough/cold/flu season will be in line with historical averages, which unfavorably impacts the year-over-year comparison by 1.1 percent. The company’s net sales outlook also assumes that December 2018 foreign currency exchange rates will remain constant for the remainder of the fiscal year.

Finally, the company’s net sales outlook now reflects the following expectations by segment:

- Housewares net sales growth of 11 percent to 13 percent compared to the prior expectation of 9 percent to 11 percent;

- Health & Home net sales growth of 2 percent to 4 percent, including an unfavorable impact of approximately 2.3 percent from the average cough/cold/flu season assumption, compared to the prior expectation of 5 percent to 7 percent; and

- Beauty net sales decline in the low- to mid-single digits, which remains the same.

Previously, Health & Home net sales growth was expected at 5 percent to 7 percent. The growth rates for Housewares and Beauty remain the same.

Despite the decline in the high end of its net sales outlook range, the company is increasing its GAAP diluted and Non-GAAP adjusted diluted EPS outlook to reflect the lower share count from open market repurchases made during the third quarter. The company now expects consolidated GAAP diluted EPS from continuing operations of $6.35 to $6.51, and non-GAAP adjusted diluted EPS from continuing operations in the range of $7.70 to $7.95, which excludes any asset impairment charges, restructuring charges, share-based compensation expense and intangible asset amortization expense. Previously, the company expected EPS from continuing operations of $6.31 to $6.46 and non-GAAP adjusted diluted EPS from continuing operations in the range of $7.65 to $7.90,

The company continues to expect the year-over-year comparison of adjusted diluted EPS from continuing operations to be impacted by an expected increase in growth investments in support of the company’s Leadership Brands of 18 percent to 22 percent in fiscal 2019.

The company’s diluted EPS from continuing operations outlook assumes that December 2018 foreign currency exchange rates will remain constant for the remainder of the fiscal year. The diluted earnings per share outlook is now based on an updated estimated weighted average diluted shares outstanding of 26.0 million for the fourth quarter of fiscal 2019, reflecting the impact of open market share repurchases made in the third quarter of fiscal 2019.

As previously announced, the company has initiated Project Refuel, which continues to target annualized profit improvement of approximately $8.0 million to $10.0 million over the duration of the plan. The plan is estimated to be completed by the first quarter of fiscal 2020, and the company expects to incur total cumulative restructuring charges in the range of $5.0 million to $5.5 million over the period of the plan.

The company now expects a reported GAAP effective tax rate range of 7.3 percent to 8.4 percent, and an adjusted effective tax rate range of 6.9 percent to 7.7 percent for the full fiscal year 2019.

The likelihood and potential impact of any fiscal 2019 acquisitions and divestitures, future asset impairment charges, future foreign currency fluctuations, or further share repurchases are unknown and cannot be reasonably estimated; therefore, they are not included in the company’s sales and earnings outlook.