Acushnet Holdings Corp., the parent of Titleist and FootJoy, reported adjusted EBITDA climbed 18.9 percent in the third quarter as sales gained 6.7 percent.

“I am pleased to report that the Acushnet team continues to execute well on our enduring mission to steward two of the most revered brands in golf – Titleist and FootJoy,” said David Maher, Acushnet’s president and chief executive officer. “Our solid third quarter results, performance year to date and positive momentum highlight the strength of our strategy and proven ability to execute. At our core, Titleist Pro V1 golf balls continue to lead the field by a wide margin, accounting for 73 percent of balls played on the worldwide tours during the 2018 season and 71 percent of worldwide wins, including all four men’s Major Championships and all five women’s Major Championships. We believe this continued pyramid of influence validation drives dedicated golfers around the world to understand and appreciate Titleist Pro V1 as the clear performance and quality leader.”

“Our results in the quarter and year to date were driven by our equipment innovation engine, which has successfully launched new Titleist Ball, Club and Gear and FootJoy Performance Wear products throughout 2018,” continued Maher. “Keys to our sales growth in the quarter included the launch of our new TS drivers and fairways – one of our more successful and comprehensive metals introductions – and the continued strong performance of the new AVX, Tour Soft and Velocity golf balls. In addition, the new 2018 Vokey SM7 wedges, Scotty Cameron Select putters and Titleist 718 irons all continued their strong performance in the quarter. We note that each of these successful, new products was launched within the past 12 months. Looking forward, we are optimistic about our pipeline of new products across all categories and are confident in our ability to maintain this innovation, performance and quality momentum as we head into next season.”

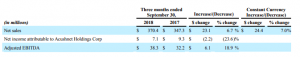

Summary of Third Quarter 2018 Financial Results

Consolidated net sales for the quarter increased by 6.7 percent, up 7.0 percent on a constant currency basis, driven by increased sales of Titleist golf clubs primarily driven by higher sales volume of drivers and fairways resulting from our newly introduced TS models and wedges and increased sales of Titleist golf balls primarily driven by a sales volume increase attributed to our AVX premium performance golf balls.

On a geographic basis, consolidated net sales in the United States increased by 10.7 percent in the quarter. Net sales in regions outside the United States were up 2.1 percent, up 2.9 percent on a constant currency basis. On a constant currency basis, Korea was up 4.2 percent and EMEA up 3.8 percent.

Segment specifics:

- 6.0 percent increase in net sales (6.2 percent increase on a constant currency basis) of Titleist golf balls primarily driven by a sales volume increase attributed to our new AVX premium performance golf balls launched in the second quarter.

- 16.9 percent increase in net sales (17.4 percent increase on a constant currency basis) of Titleist golf clubs primarily driven by higher sales volume of drivers and fairways resulting from our newly introduced TS models launched in the third quarter and higher sales volume and higher average selling prices of our wedges launched in the first quarter of 2018.

- 1.3 percent decrease in net sales (1.0 percent decrease on a constant currency basis) of Titleist golf gear. This decrease was primarily due to a sales volume decline in travel gear, largely offset by a sales volume increase in Titleist gloves and higher average selling prices across all categories of the gear business.

- 0.8 percent decrease in net sales (0.3 percent decrease on a constant currency basis) in FootJoy golf wear primarily resulted from a sales volume decline in footwear partially offset by a sales volume increase in apparel.

Net income attributable to Acushnet decreased by $2.2 million to $7.1 million, down 23.6 percent year over year, primarily as a result of an increase in income tax expense, which was partially offset by an increase in income before taxes. The increase in income tax expense was due to an unfavorable discreet, non-cash, tax adjustment of $5.1 million, related to the transition tax originally recorded in 2017, which resulted from clarifications that were issued by the U.S. Treasury during the quarter.

Adjusted EBITDA was $38.3 million, up 18.9 percent year over year. Adjusted EBITDA margin was 10.4 percent for the third quarter versus 9.3 percent for the prior year period.

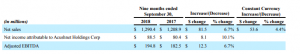

Summary of First Nine Months 2018 Financial Results

Nine months ended September 30

Nine months ended September 30

Consolidated net sales for the first nine months increased by 6.7 percent, up 4.4 percent on a constant currency basis, driven by an increase of Titleist golf clubs due to higher sales volumes of irons and wedges and increased sales of Titleist golf balls driven by a sales volume increase attributed to our AVX premium performance golf balls

On a geographic basis, consolidated net sales in the United States increased by 7.0 percent in the nine month period. Net sales in regions outside the United States were up 6.4 percent, up 1.6 percent on a constant currency basis with Korea up 2.5 percent, rest of world up 2.2 percent, and EMEA up 1.6 percent.

Segment specifics:

- 3.7 percent increase in net sales (2.0 percent increase on a constant currency basis) of Titleist golf balls primarily driven by a sales volume increase attributed to our new AVX premium performance golf balls and our Tour Soft and Velocity performance golf balls launched in the second quarter and first quarter, respectively, partially offset by a sales volume decline in Pro V1 and Pro V1x golf balls which are in their second model year.

- 19.2 percent increase in net sales (16.9 percent increase on a constant currency basis) of Titleist golf clubs primarily driven by higher sales volumes of our iron series introduced in the third quarter of 2017, our wedges launched in the first quarter of 2018 and our newly introduced TS drivers and TS fairways, which were launched in the third quarter of 2018, partially offset by lower sales volumes of our previous generation drivers and fairways.

- 0.1 percent increase in net sales (2.4 percent decrease on a constant currency basis) of Titleist golf gear. The decrease in constant currency was primarily due to a sales volume decline in our travel gear and golf bag categories, partially offset by higher average selling prices across all categories of the gear business.

- 1.3 percent increase in net sales (1.3 percent decrease on a constant currency basis) in FootJoy golf wear. The decrease in constant currency primarily resulted from a sales volume decline in footwear, partially offset by higher average selling prices across all FootJoy categories and a sales volume increase in apparel.

Net income attributable to Acushnet improved by $8.1 million to $88.5 million, up 10.1 percent year over year, primarily as a result of an increase in income from operations, partially offset by an unfavorable discreet, non-cash, tax adjustment of $3.6 million, related to the transition tax originally recorded in 2017, which resulted from clarifications that were issued by the U.S. Treasury during the nine months ended September 30, 2018. Adjusted EBITDA was $194.8 million, up 6.7 percent year over year. Adjusted EBITDA margin was 15.1 percent for the first nine months, unchanged from the prior year period.

2018 Outlook

- Consolidated net sales are expected to be approximately $1,620 to 1,630 million.

- Consolidated net sales on a constant currency basis are expected to be in the range of up 2.1 percent to 2.8 percent.

- Adjusted EBITDA is expected to be approximately $227 to 233 million.

Photo courtesy Acushnet