Brunswick Corp., the parent of Life Fitness, Hammer Strength and Cybex, reported that on an adjusted basis, operating earnings were down 3 percent in the second quarter despite a 6.3 percent revenue gain. Fitness segment sales inched up 1 percent.

“During the first half of 2018, we launched or completed a number of substantial strategic and operational enhancements that we believe will strengthen our marine portfolio and continue to increase long-term shareholder value,” said Brunswick Chairman and Chief Executive Officer Mark Schwabero. “We continue to have a favorable outlook on the marine business, which is benefitting from unprecedented demand for outboard engines, exciting new products, the successful execution of our strategy to grow the parts and accessories businesses, and a global marine market that remains healthy. As a result, our combined marine business had adjusted revenue growth of 8 percent in the quarter, with continued adjusted operating earnings growth versus second quarter 2017,” Schwabero continued.

“Our product leadership strategy was significantly advanced in the quarter, as Mercury completed its largest launch of outboard engines in the company’s history, comprised of 19 total models of V6 and V8 engines from 175 to 300 horsepower. Shipment of these products began in the quarter as expected; however, ramp-up to full run-rate production will continue into the third quarter. There is substantial demand for these products that is far exceeding expectations. Consistent with our prior plans, we anticipate significant production increases in the second half of 2018, enabled by recent investments in capacity expansions. However, we expect that demand will outpace production into 2019, and we are aggressively working on plans to further increase capacity,” Schwabero continued.

“Revenue trends in the boat business reflect strong performance in many of our brands, including Boston Whaler and our pontoon business. Year-to-date market trends have slightly trailed initial expectations, but our long-term favorable view of the industry has not changed and is supported by positive dealer and customer sentiment, as well as the ongoing demand for our industry leading products and brands. Our production plans reflect the current market conditions, and as a result, our pipelines are appropriately positioned at this point in the season. Our adjusted margins in the first half were down slightly, but we anticipate strong performance over the second half, and mid-teens operating leverage for the year in the boat segment,” Schwabero continued.

“In our Fitness segment, we continue to focus on stabilizing our operating performance and executing against our digital initiatives, with growing acceptance evidenced by our recently announced technology-enhanced partnerships with Retro Fitness, Apple, and Orangetheory Fitness. Steady market conditions resulted in slight top-line growth and sequential quarterly gross margin performance is beginning to stabilize, which is consistent with the plan discussed on our first quarter call,” Schwabero continued.

“Overall, our second quarter operating performance, combined with a lower effective tax rate and fewer shares outstanding, produced a 9 percent increase in diluted earnings per common share, as adjusted, over the prior year,” Schwabero concluded.

Discontinued Operations

As a result of the June 25, 2018 announcement regarding Sea Ray, starting in the second quarter of 2018, the results of the entire Sea Ray business are reported in continuing operations for GAAP purposes. However, as adjusted, non-GAAP results exclude the Sea Ray Sport Yacht and Yacht operations that are being wound down.

Second Quarter Results

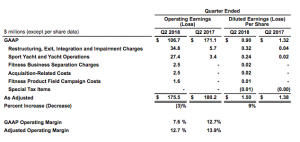

For the second quarter of 2018, Brunswick reported net sales of $1,400.9 million, up from $1,352.0 million a year earlier, with $19.9 million and $53.1 million of sales related to Sport Yacht and Yacht operations in the second quarter of 2018 and 2017, respectively. On a GAAP basis, diluted EPS was $0.90, and diluted EPS, as adjusted, was $1.50. 2018 and 2017 second quarter earnings results, including reconciliations of GAAP and as adjusted amounts, are shown below:

Review of Cash Flow and Balance Sheet

Cash and marketable securities totaled $446.1 million at the end of the second quarter, down $12.9 million from year-end 2017 levels. The reduction includes ne cash provided by operating activities during the first six months of the year of $200.9 million, which improved by $29.1 million versus the prior year, including more favorable seasonal changes in working capital and a tax refund received in the first quarter.

In addition, net cash used for investing and financing activities of $210.3 million during the first half of 2018 reduced cash and marketable securities balances. Investing and financing activities during the year-to-date period included $90.3 million of capital expenditures, $70.0 million of common stock repurchases, and $33.1 million of dividend payments.

Marine Engine Segment

The Marine Engine segment, which manufactures and distributes marine propulsion systems and related parts and accessories, reported net sales of $834.3 million in the second quarter of 2018, up 9 percent from $766.2 million in the second quarter of 2017. International sales, which represented 29 percent of total segment sales in the quarter, were up 11 percent compared to the prior year period. For the quarter, the Marine Engine segment reported operating earnings of $149.1 million, which includes $2.5 million of acquisition-related costs. This compares with operating earnings of $148.3 million in the second quarter of 2017.

Strong growth in both the outboard engine and parts and accessories businesses drove sales increases in the quarter. Operating earnings comparisons were affected by increases in sales volumes, as well as favorable impacts from changes in sales mix and foreign currency exchange rates, although smaller than anticipated. Changes in operating earnings also include higher than expected costs related to unfavorable plant efficiencies associated with production ramp-up for new products and warehouse management systems integration, as well as planned spending increases for new product promotion and development.

Boat Segment

The Boat segment, which manufactures and distributes recreational boats, reported net sales of $394.9 million for the second quarter of 2018, a decrease from $412.1 million in the second quarter of 2017. Net sales included $19.9 million and $53.1 million of Sport Yacht and Yacht sales in the second quarter of 2018 and 2017, respectively. International sales, which represented 29 percent of total segment sales in the quarter, increased by 4 percent compared to the prior year period. For the second quarter of 2018, the Boat segment reported operating losses of $32.2 million, which included $33.5 million of restructuring, exit, integration, and impairment charges and losses of $27.4 million related to the Sport Yacht and Yacht operations in excess of restructuring charges. This compares with operating earnings of $24.7 million in the second quarter of 2017, which included $3.4 million of operating losses in the Sport Yacht and Yacht operations and $1.2 million of restructuring, exit, integration, and impairment charges. The Boat segment’s revenue comparisons included the significant declines in Sport Yacht and Yacht operations noted above, along with solid growth in the aluminum freshwater and recreational fiberglass boat businesses, as well as Boston Whaler. The decrease in segment operating earnings was primarily the result of the items discussed in the previous paragraph. Excluding these charges, operating earnings declined slightly, reflecting less favorable plant efficiencies at certain of our boat facilities due in part to new product integrations and the benefit from higher net sales.

Fitness Segment

The Fitness segment, which manufactures and distributes strength and cardiovascular fitness equipment and active recreation products, reported net sales in the second quarter of 2018 of $252.2 million, an increase of 1 percent from $250.5 million in the second quarter of 2017. International sales, which represented 48 percent of total segment sales in the quarter, increased nominally when compared to the second quarter of 2017. For the quarter, the Fitness segment reported operating earnings of $14.3 million, which included $1.6 million of costs related to an additional product field campaign and restructuring, exit, integration, and impairment charges of $0.6 million. This compares with operating earnings of $18.5 million in the second quarter of 2017, which included $4.5 million of restructuring, exit, integration, and impairment charges. The Fitness segment’s revenue comparisons reflected solid growth in commercial strength driven by sales to domestic health clubs, mostly offset by declines in cardio products led by continued weakness in Cybex sales. The decline in operating earnings resulted from higher freight costs, cost inflation and inefficiencies, and an unfavorable impact from changes in sales mix, which more than offset benefits from sales increases.

2018 Outlook

“Our outlook for 2018 remains generally consistent with our recently updated three-year strategic plan targets and reflects another year of outstanding revenue and earnings growth, with excellent cash flow generation,” said Schwabero.

“We expect our marine business’ top-line performance to benefit from a steady global marine market, new products, and the successful execution of our M&A strategy, a evidenced by our announced acquisition of Power Products. In the Fitness segment, we plan to benefit from recently introduced new products, including console and technology enhancements that we believe will stimulate demand. We now expect consolidated revenue growth of 8 percent to 9 percent for the full-year, including the impact of announced acquisitions, international demand impacts from tariffs, and changes in foreign currency exchange rates.

“For the full-year, we continue to anticipate improvement in both gross and operating margins in our combined marine business, as we plan for ongoing benefits from new products and volume leverage. These factors, along with certain pricing actions, should more than offset impacts related to cost inflation, as well as enacted tariffs and known trade policy changes. In the Fitness business, we continue to project a decline in margins. However, year-over-year comparisons are expected to stabilize in the fourth quarter consistent with discussions on our last earnings call.

“We are narrowing the range for our full-year expectations of diluted EPS, as adjusted, to $4.55 to $4.65, which takes into account benefits from the announced Power Products acquisition, as well as the incremental interest expense incurred in connection with the financing of the transaction, and the inclusion of Sea Ray’s Sport Boat and Cruiser business. This guidance also takes into account the impact of tariffs, recent unfavorable changes in foreign exchange rates, and the other balanced risks and opportunities facing our businesses,” Schwabero concluded.