Iconix Brand Group Inc. reported net earnings on an adjusted basis fell 54 percent in the first quarter on a 17 percent revenue decline. Results were in line with expectations.

John Haugh, CEO of Iconix, commented, “Following intense focus on our balance sheet resulting in the successful resolution of all near-term debt obligations, we are excited to speak with the investor community to discuss progress on our growth initiatives. During the quarter, we launched Umbro with Target. The product looks great and customers are responding favorably. We are thrilled to bring Umbro’s world leadership in soccer apparel and equipment to a valuable partner like Target.

We have demonstrated our ability to successfully reposition some of our core brands and we continue to work closely with our best-in-class licensees to maintain the strength of our long-term partnerships, while evaluating opportunities to drive brand portfolio growth.”

“We are thus maintaining our revenue and free cash flow guidance for the year.”

2018 Guidance

• Reiterating previously announced full year revenue guidance of $190 million to $220 million

• On track to deliver approximately $12 million of full year cost-savings, aligning expenses with revenue base

• Previous GAAP net income guidance of approximately $7 million to $17 million, being increased to $17 million to $27 million principally due to the Q1 gain on extinguishment of debt and the elimination of non-cash interest expense related to its 5.75 percent convertible notes

• Reiterating non-GAAP net income guidance of $20 million to $30 million

• Reiterating full year free cash flow guidance of $50 million to $70 million

It should be noted that GAAP net income will be affected by non-cash adjustments to fair value from the company’s 5.75 percent Convertible Notes discussed below. Such periodic adjustments to fair value cannot be estimated in advance and thus are not taken into account in guidance.

First Quarter 2018 Financial Results

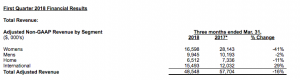

Revenue is adjusted for approximately $1.0 million of revenue from the SE Asia joint venture which was deconsolidated in 2017.

For the first quarter of 2018, total revenue was $48.5 million, a 17 percent decline as compared to $58.7 million in the prior year quarter. Such decline was expected principally as a result of the transition of its Danskin, Ocean Pacific and Mossimo DTR’s in the company’s Women’s segment. Revenue in the first quarter of 2017 included approximately $1.0 million of licensing revenue from the company’s Southeast Asia joint venture, which was de-consolidated in the second quarter of 2017. As a result, there was no comparable revenue for this item in the first quarter of 2018. Excluding Southeast Asia, revenue declined approximately 16 percent for the first quarter of 2018.

In the first quarter 2018 the company adopted a new revenue recognition accounting standard (ASU No. 2014-09 Revenue from Contracts with Customers – Topic 606). Adoption of the standard decreased Q1 2018 revenue by approximately $1.9 million but is expected to increase full-year 2018 revenue by approximately $2.5 to $3 million.

SG&A Expenses

Total SG&A expenses in the first quarter of 2018 were $28.6 million, a 13 percent increase compared to $25.4 million in the first quarter of 2017. However, 2018 includes a number of unique items, including special charges, restructuring costs and a non-cash purchase accounting adjustment. Adjusting for these items in 2018 and special charges in 2017, SG&A decreased approximately $1.1 million or 5 percent. Stock-based compensation was $1.0 million in the first quarter of 2018 as compared to $1.7 million in the first quarter of 2017.

Gain on Sale of Trademarks

Gain on sale of trademarks in the first quarter of 2018 were $1.1 million. The gain on sale of trademarks for the current quarter was related to the completion of the sale of the Sharper Image and Badgley Mischka trademarks from certain of the company’s international joint ventures.

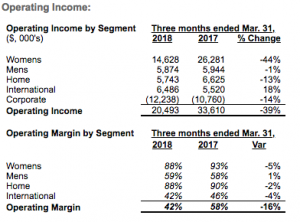

Operating income for the first quarter of 2018 was $20.5 million, as compared to $33.6 million in the first quarter of 2017. Operating margin for the first quarter 2018 was 42 percent as compared to 58 percent in the first quarter 2017. However, when excluding special charges, restructuring costs, non-cash purchase accounting adjustments and gain on sale of trademarks from 2018 results and special charges from 2017 results, operating income is $25.8 million and $35.8 million in 2018 and 2017, respectively, and operating margin is 53 percent and 61 percent in 2018 and 2017, respectively.

Interest Expense

Interest expense in the first quarter of 2018 was $14.5 million, as compared to interest expense of $15.0 million in the first quarter of 2017. The company’s reported interest expense includes non-cash interest related to 1.50 percent Convertible Notes of approximately $3.0 million in the first quarter of 2018 as compared to $4.0 million in the first quarter of 2017.

Other Income

In the first quarter of 2018, the company recognized a $24.4 million gain resulting from the company’s accounting for the 5.75 percent Convertible Notes which require recording the fair value of this debt at the end of each period with any change from the prior period accounted for as other income or loss in the current period’s income statement. The first quarter of 2018 also includes a gain of $4.5 million related to the early extinguishment of a portion of the company’s 1.50 percent Convertible Notes and a $1.0 million gain related to the final payment received from the sale of the company’s minority interest in Complex Media in 2016. This compares to a loss of $5.5 million related to the early extinguishment of a portion of the company’s term loan in the first quarter of 2017. The company has excluded these amounts from its non-GAAP results.

Provision for Income Taxes

The effective income tax rate for the first quarter of 2018 is approximately 4.4 percent, which resulted in a $1.7 million income tax provision, as compared to an effective income tax rate of 46.0 percent in the prior year quarter, which resulted in a $5.9 million income tax provision. The decrease in the effective tax rate for the first quarter is primarily as a result of the release of a portion of the valuation allowance on deferred tax assets, as well as the impact of the gain related to the mark-to-market adjustment from the company’s 5.75 percent Convertible Notes in the current quarter, of which a large portion was a permanent difference and therefore no tax was provided. Excluding any mark-to-market adjustments from the company’s 5.75 percent Convertible Notes, Iconix said the company expects the full year 2018 tax rate to be approximately 32 percent and approximately 30 percent on a GAAP basis and non-GAAP basis, respectively.

GAAP Net Income and GAAP Diluted EPS

GAAP net income from continuing operations attributable to Iconix Brand Group, Inc. for the first quarter of 2018 reflects income of $32.7 million as compared to income of $4.4 million in the first quarter of 2017. GAAP diluted EPS from continuing operations for the first quarter of 2018 reflects income of $0.51 as compared to income of $0.06 in the first quarter of 2017.

Non-GAAP net income from continuing operations for the first quarter of 2018 was $5.7 million as compared to $12.3 million in the first quarter of 2017. Non-GAAP diluted EPS from continuing operations for the first quarter of 2018 was 10 cents as compared to 21 cents in the first quarter of 2017.

The company generated $15.4 million of free cash flow in the first quarter of 2018, an 18 percent increase as compared to $13.0 million in the first quarter of 2017.

Iconix Brand Group, Inc. owns, licenses and markets a portfolio of consumer brands including: Candie’s, Bongo, Joe Boxer, Rampage, Mudd, Mossimo, London Fog, Ocean Pacific, Danskin, Rocawear, Cannon, Royal Velvet, Fieldcrest, Charisma, Starter, Waverly, Zoo York, Umbro, Lee Cooper, Ecko Unltd., Marc Ecko, Artful Dodger and Hydraulic. In addition, Iconix Owns Interests In The Material Girl, Ed Hardy, Truth Or Dare, Modern Amusement, Buffalo and Pony brands.