Macy’s Inc. reported fourth-quarter earnings that topped Wall Street’s targets while providing an upbeat outlook for the year.

“We are committed to returning Macy’s, Inc. to comparable sales growth in 2018 and will build on the momentum we created in the fourth quarter of 2017. Macy’s, Inc. had a solid fourth quarter, including strong performance in January, and the full year exceeded our expectations for annual comparable sales and adjusted earnings per diluted share. We are encouraged to see a trend improvement in our brick and mortar business, and we had the 34th consecutive quarter of double-digit growth in our digital business,” said Jeff Gennette, Macy’s, Inc. chairman and chief executive officer. “Consumer spending was strong in the fourth quarter, and we were ready with improved execution and great products across all categories. We were disciplined with our promotional cadence and maintained a good inventory position. We head into 2018 with an improved base business, healthy inventories, a focused and engaged organization and a clear path to return Macy’s to growth.”

“In 2017, we tested and iterated a number of merchandising and strategic initiatives as part of our North Star Strategy. These initiatives contributed to our fourth quarter performance, and in 2018 we are ready to scale as well as test additional revenue-driving initiatives. We are also encouraged by customer response to our new Star Rewards loyalty program,” said Gennette. “On the path to growth in 2018, we will continue to improve our execution, strengthen our product offerings and make the necessary investments to be competitive with today’s demanding consumer.”

Sales

Sales in the fourth quarter of 2017 totaled $8.666 billion, an increase of 1.8 percent, compared with sales of $8.515 billion in the fourth quarter of 2016. Comparable sales on an owned basis were up 1.3 percent in the fourth quarter and up 1.4 percent on an owned plus licensed basis. Total sales in the fourth quarter of 2017 reflect a 14th week of sales, whereas comparable sales are on the same 13-week basis as fiscal 2016.

Sales in fiscal 2017 totaled $24.837 billion, down 3.7 percent from total sales of $25.778 billion in fiscal 2016. Comparable sales on an owned basis declined 2.2 percent in fiscal 2017. Comparable sales on an owned plus licensed basis declined by 1.9 percent in fiscal 2017. Total sales for fiscal 2017 reflect a 53rd week of sales, whereas comparable sales are on the same 52-week basis as fiscal 2016.

Earnings Per Share

Fourth quarter 2017 earnings per diluted share were $4.31 compared to $1.54 per share in the fourth quarter of 2016. Fiscal 2017 earnings per diluted share were $5.04 compared to $1.99 per share in fiscal 2016. Adjusted EPS came in at $2.82, ahead of Wall Street’s consensus target of $2.69.

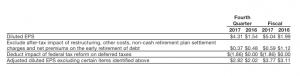

The following chart shows fourth quarter and fiscal 2017 earnings per diluted share excluding restructuring and other costs, non-cash retirement plan settlement charges, net premiums on the early retirement of debt and the impact of federal tax reform on the company’s deferred taxes. Results for 2016 exclude restructuring and other costs and non-cash retirement plan settlement charges.

Fourth quarter and fiscal 2017 adjusted earnings per diluted share were positively impacted by 7 cents due to the change in the effective annual tax rate due to federal tax reform.

Fourth Quarter and Fiscal-Year 2017 Adjusted Diluted Earnings Per Share (EPS) Results

When it reported its holiday sales on January 4, Macy’s said it expected adjusted EPS in the range of $3.59 and $3.69.

When it reported its holiday sales on January 4, Macy’s said it expected adjusted EPS in the range of $3.59 and $3.69.

Operating Income

Macy’s, Inc.’s operating income for the fourth quarter of 2017 totaled $1.213 billion, or 14.0 percent of sales, compared to $815 million, or 9.6 percent of sales, for the fourth quarter of 2016. Operating income for the fourth quarter of 2017 totaled $1.397 billion, or 16.1 percent of sales, excluding restructuring and other costs of $152 million and non-cash retirement plan settlement charges of $32 million. Operating income for the fourth quarter of 2017 includes $234 million in book gains for the sale of the Union Square Men’s building (or 48 cents per diluted share), which was sold in fiscal 2016. Operating income for the fourth quarter of 2016 totaled $1.062 billion, or 12.5 percent of sales, excluding $230 million of impairments, store closings and other costs and non-cash retirement plan settlement charges of $17 million.

For fiscal 2017, Macy’s, Inc.’s operating income totaled $1.807 billion, or 7.3 percent of sales, compared with operating income of $1.315 billion, or 5.1 percent of sales, for fiscal 2016. Operating income for fiscal 2017 totaled $2.098 billion, or 8.4 percent of sales, excluding $186 million of restructuring and other costs and $105 million of non-cash retirement plan settlement charges.

Macy’s, Inc.’s fiscal 2016 operating income included $479 million of impairments, store closing and other costs. Excluding these items, as well as non-cash settlement charges related to the company’s retirement plans of $98 million, operating income for fiscal 2016 was $1.892 billion or 7.3 percent of sales.

Cash Flow

Net cash provided by operating activities was $1.944 billion in fiscal 2017, compared with $1.801 billion in fiscal 2016. Net cash used by investing activities in fiscal 2017 was $373 million, compared with $187 million in fiscal 2016. Operating cash flows net of investing were $1.571 billion in fiscal 2017, compared with operating cash flows net of investing of $1.614 billion in fiscal 2016. During 2017, the company demonstrated its commitment to a strong balance sheet by utilizing excess cash to delever and reduce its debt by approximately $950 million.

Store Openings/Closings

In the fourth quarter of 2017, the company opened two new freestanding Bluemercury beauty specialty stores for a total of 137 stores.

In fiscal 2017, the company opened 36 Bluemercury stores, two Macy’s stores, 30 Backstage off-price stores within existing Macy’s stores and one Bloomingdale’s licensed location in Kuwait. The company closed 16 Macy’s stores, all as previously disclosed. This includes the closure of the Waterfront store in Homestead, PA, which was announced at the end of the fourth quarter.

In February 2018, the company announced that it will close its Redmond Town Center main store in Redmond, WA, in early 2019. This brings the total to 83 of the approximately 100 store closures announced in August 2016.

Real Estate Update

In fiscal 2017, the company’s asset sales totaled $411 million in cash proceeds. These sales included stores as well as non-store real estate such as warehouses, outparcels and parking garages. Over the last three fiscal years, Macy’s, Inc. has completed transactions totaling approximately $1.3 billion in cash proceeds.

Heading into fiscal 2018, Macy’s, Inc. continues to opportunistically evaluate its real estate portfolio to identify opportunities where the redevelopment value of its real estate exceeds that of non-strategic operating locations. The company also continues to focus on creating additional value from its flagship stores while adding vitality to the retail experience.

In February 2018, the company signed an agreement to sell floors 8 through 14 of its State Street store in Chicago to a private real estate fund sponsored by Brookfield Asset Management. Brookfield intends to convert these largely unused floors into dynamic, creative office space. As part of this transaction, Macy’s, Inc. will receive a total of $30 million ($27 million of consideration and a $3 million contribution for certain improvements), as well as upside participation in the ultimate value creation associated with the conversion of the upper floors to office space. This transaction will enable the company to make Macy’s on State Street a more vibrant shopping destination. The company anticipates closing this transaction in the first half of fiscal 2018.

The company is now exploring opportunities to sell the approximately 240,000 gross square foot I. Magnin portion of the main Union Square building in San Francisco. Macy’s Union Square comprises multiple buildings, and the former I. Magnin flagship building, situated at the corner of Stockton and Geary Streets, is a separate structure well-suited for development. As previously announced, Macy’s sold the Union Square Men’s building and is incorporating the men’s business into the main store. The company is also making additional enhancements to the Union Square main building through the conversion of street-level selling space into high-end retail shops that will be leased to third parties. The Union Square main building will remain the largest department store in the Bay Area and will comprise approximately 700,000 gross square feet.

Macy’s, Inc. continues to work with Brookfield as part of its strategic alliance. The companies have agreed to certain terms on nine assets (of the approximately 50-asset portfolio), which Brookfield will redevelop once it has received the necessary approvals. Upon the completion of certain approvals, Macy’s, Inc. will either sell its interests in the individual assets to Brookfield or contribute them to individual joint ventures. If sold, the cumulative value is estimated to be approximately $50 million. Additionally, Macy’s, Inc. would be entitled to an increased purchase price if certain financial targets are achieved for the three largest assets. The company expects that these developments will add vibrancy and desirability to the vicinity, enhancing the retail experience in these locations.

Looking Ahead

The company is strategically investing to accelerate the rollout of a number of near-term growth initiatives impacting stores, technology and merchandising. The company has also developed an employee incentive program to drive results and engagement with associates at every level of the organization, with an emphasis on its hourly associates. These investments are expected to support the company’s return to comparable sales growth in fiscal 2018.

Guidance for fiscal 2018 reflects the new accounting standards related to revenue recognition and retirement benefits. Macy’s, Inc. has recast its quarterly preliminary and unaudited income statements and balance sheets for 2016 and 2017, which can be found on the investor relations page at www.macysinc.com.

For fiscal 2018, the company expects comparable sales on both an owned and an owned plus licensed basis to be flat to up 1 percent. Total sales are expected to be down between 0.5 percent and 2 percent in fiscal 2018. Adjusted earnings per diluted share of $3.55 to $3.75 are expected in fiscal 2018, excluding anticipated settlement charges related to the company’s defined benefit plans. Adjusted earnings per diluted share include anticipated asset sale gains of $300 million to $325 million in fiscal 2018, compared to $544 million in asset sale gains for fiscal 2017. The company anticipates an effective annual tax rate of 23.25 percent for fiscal 2018.

Total sales guidance is provided on a 52-week basis in 2018 compared to a 53-week basis in 2017. Comparable sales guidance is provided on a 52-week basis in both 2018 and 2017.