American Outdoor Brands Corporation, the parent of Smith & Wesson, M&P and Thompson/Center Arms, again reduced its guidance for the year due to ongoing challenges in firearms while reporting sluggish second-quarter results that generally came in line with guidance.

Second Quarter Fiscal 2018 Financial Highlights

- Quarterly net sales were $148.4 million, in-line with the company’s guidance range, compared with $233.5 million for the second quarter last year, a decrease of 36.4 percent.

- Gross margin for the quarter was 34.2 percent compared with 41.8 percent for the second quarter last year.

- Quarterly GAAP net income was $3.2 million, or $0.06 per diluted share, compared with net income of $32.5 million, or $0.57 per diluted share, for the comparable quarter last year. Second quarter 2018 and 2017 GAAP net income per diluted share include expenses of $2.8 million and $3.0 million, respectively, for amortization, net of tax, related to acquisitions.

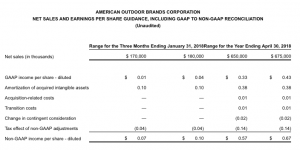

- Quarterly Non-GAAP net income was $6.3 million, or $0.11 per diluted share, compared with $39.1 million, or $0.68 per diluted share, for the comparable quarter last year. GAAP to non-GAAP adjustments to net income exclude a number of acquisition-related costs, including amortization, fair value inventory step-up and backlog expense, one-time transition costs, and discontinued operations, as well as the associated tax effect on non-GAAP adjustments. For a detailed reconciliation, see the schedules that follow in this release.

- Quarterly non-GAAP Adjusted EBITDAS was $23.1 million, or 15.5 percent of net sales, compared with $72.4 million, or 31.0 percent of net sales, for the comparable quarter last year.

- During the second quarter, the company completed the purchase of substantially all of the assets of Gemini Technologies, Incorporated, a provider of high quality suppressors and accessories for the consumer, law enforcement, and military markets, for $10.9 million. The company also completed the purchase of substantially all of the assets of Fish Tales, LLC, a provider of premium sportsman knives and tools for fishing and hunting, including the knife brand, Bubba Blade™, for approximately $12.1 million.

James Debney, American Outdoor Brands Corporation president and chief executive officer, commented, “Our results for the second quarter were within our guidance range despite challenging market conditions. Lower shipments in our Firearms business reflected a significant reduction in wholesaler and retailer orders versus the prior year, and were partially offset by higher revenue in our Outdoor Products & Accessories business. Total revenue for the quarter faced a challenging comparison to last year, when we believe strong consumer demand was driven by personal safety concerns and pre-election fears of increased firearm legislation.”

“In Firearms, shipments of our new M&P branded polymer products in full-size, compact, and concealed carry models helped to offset lower orders in other product categories. While we were pleased that our firearm inventory at distributors declined slightly during the quarter, we believe that orders were negatively impacted by heightened channel inventory from multiple manufacturers at retail. As expected, our internal inventories peaked during the quarter, as we prepared for a number of new firearm product launches. Since then, we have reduced our internal production output levels and our outsourced capacity to help lower inventories and better balance production to demand. For the second half of fiscal 2018, our focus remains on ensuring that our internal manufacturing resources are aligned with demand. In addition, we intend to introduce several exciting new products, and execute on long-term organic growth initiatives that support our vision of being the leading provider of quality products for the shooting, hunting, and rugged outdoor enthusiast,” concluded Debney.

Jeffrey D. Buchanan, executive vice president, chief financial officer, and chief administrative officer, commented, “We ended the quarter with cash of $68.2 million and net debt of approximately $223 million. While cash flow for our second quarter was flat, as expected, we are forecasting positive cash flow for the balance of our fiscal year, as we lower our internal inventory levels in conjunction with the upcoming holiday buying season, new product launches, and winter distributor buying shows which take place during our fourth fiscal quarter.”

Financial Outlook

Previously, for the year ended April 30, 2018, the parent of Smith & Wesson, M&P and Thompson/Center Arms, expected GAAP earnings between 77 and 97 cents, non-GAAP earnings in the range of $1.04 to $1.24 and sales between $700 million and $740 million.

The company reports two segments: Firearms and Outdoor Products & Accessories. Firearms manufactures handgun and long gun products sold under the Smith & Wesson, M&P, Thompson/Center Arms and Gemtech brands as well as provides forging, machining and precision plastic injection molding services. Outdoor Products & Accessories provides shooting, hunting and outdoor accessories, including reloading, gunsmithing and gun cleaning supplies, tree saws, vault accessories, knives, laser sighting systems, tactical lighting products and survival and camping equipment. Brands in Outdoor Products & Accessories include Smith & Wesson, M&P, Thompson/Center Arms, Crimson Trace, Caldwell Shooting Supplies, Wheeler Engineering, Tipton Gun Cleaning Supplies, Frankford Arsenal Reloading Tools, Lockdown Vault Accessories, Hooyman Premium Tree Saws, BOG POD, Golden Rod Moisture Control, Schrade, Old Timer, Uncle Henry, UST, Imperial and Bubba Blade.

Photo courtesy Smith & Wesson