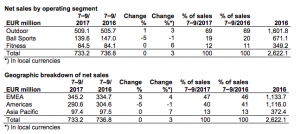

Amer Sports returned to growth on a currency-neutral basis in the third quarter as a 7 percent gain in the Asia Pacific region and a 4 percent climb in the EMEA region offset a 1 percent slide in the Americas. The gains were driven again by apparel, own retail, e-commerce and China.

July-September 2017

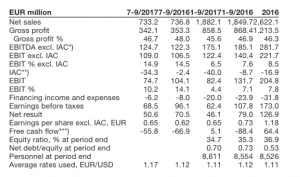

- Net sales €733.2 million (July-September 2016: 736.8). In local currencies, net sales increased by 3 percent. Growth was solid in EMEA and China, whilst the US market continued to be challenging.

- Gross margin 46.7 percent (48).

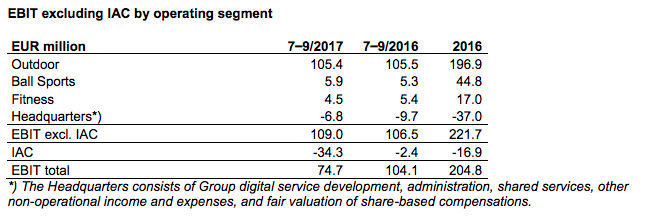

- EBIT excluding items affecting comparability (IAC) €109 million (106.5). Items affecting comparability were €-34.3 million (-2.4), mostly related to the ongoing restructuring announced in February 2017.

- Earnings per share excl. IAC €0.65 (0.62).

- Free cash flow €-55.8 million (-66.9).

- Outlook for 2017 unchanged.

January-September 2017

- Net sales €1,882.1 million (January-September 2016: 1,849.7). In local currencies, net sales increased by 2 percent.

- Gross margin 45.6 percent (46.9).

- EBIT excluding IAC €122.4 million (140.4). Items affecting comparability were €-40 million (-8.7).

- Earnings per share excl. IAC €0.65 (0.73).

- Free cash flow €5.1 million (-88.4).

Outlook

In 2017, Amer Sports’ net sales in local currencies are expected to increase from 2016, despite short-term market softness. EBIT excl. IAC is expected to be approximately at the level of 2016.

The growth in 2017 is expected to be biased to the second half of the year. EBIT excl. IAC includes further accelerated investment into the company`s transformation toward omni-channel and digital to win in the fast changing market place. The company will continue to focus on growing the core business and the five prioritized areas: Apparel and Footwear, US, China, Business to Consumer, as well as digitally connected devices and services.

*) EBITDA excl. IAC = EBIT excluding items affecting comparability and depreciation and amortization

**) Items affecting comparability are material items or transactions, which are relevant for understanding the financial performance of Amer Sports when comparing profit of the current period with previous periods. These items can include, but are not limited to, capital gains and losses, significant write-downs, provisions for planned restructuring and other items that are not related to normal business operations from Amer Sports` management view. A single item affecting comparability has to represent more than one cent per share on annual basis.

***) Cash flow from operating activities – net capital expenditures – change in restricted cash (Net capital expenditures: Total capital expenditure less proceeds from sale of assets).

Heikki Takala, President And CEO

“In the third quarter we returned to profitable growth, as expected. Growth was broad-based, and in line with our strategy, driven again by Apparel, own retail, e-commerce and China. Encouragingly, we continued to gain speed in Fitness, and we laid foundation for a rebound in Sports Instruments as we rolled out the complete Spartan product family. We made again significant progress in the company omni-channel transformation to win in the changing market place. We executed the announced restructuring, and we are already delivering significant cost efficiencies, ahead of schedule. Furthermore, we continued to drive cash flow improvement ahead of our target.

“In August, we announced our new 2020 financial targets, focus on profitable growth, now with special emphasis given to profitability. We continue to capitalize on our proven growth drivers, most notably softgoods, Direct to Consumer, and China, and we are transforming the company at maximum speed to stay ahead of the game as the market place and the consumer habits are evolving rapidly. In a challenging market, we are making strong progress in executing the strategy, capitalizing on all levers of our value creation model. ”

Net Sales And EBIT Jult-September 2017

Amer Sports’ net sales in July-September 2017 were €733.2 million (July-September 2016: 736.8), and were at previous year’s level. In local currencies, net sales increased by 3 percent.

Gross margin was 46.7 percent (48). The decline was due to less favorable hedges partly offset by the increased share of own retail and e-commerce sales.

EBIT excl. items affecting comparability (IAC) was €109 million (106.5). Items affecting comparability were €-34.3 million. Increased sales in local currencies contributed to EBIT by approximately €8 million. Declined gross margin had a negative impact of approximately €10 million on EBIT. Operating expenses decreased by approximately €12 million. Other income and expenses and currencies had a negative impact of approximately €7 million on EBIT. EBIT was €74.7 million (104.1).

The restructuring announced in February 2017 is proceeding ahead of the original schedule. Items affecting comparability include restructuring expenses of €31.3 million, of which €22.2 million is non-cash.

Net financial expenses totaled €6.2 million (8), including net interest expenses of €7.4 million (6.9). Net foreign exchange gains were €0.9 million (losses 0.3). Other financing income were €0.3 million (expenses 0.8).

Earnings before taxes totaled €68.5 million (96.1) and taxes were €17.9 million (25.6). Earnings per share excl. IAC were €0.65 (0.62). Earnings per share were €0.43 (0.60).

Amer Sports is a sporting goods company with internationally recognized brands including Salomon, Wilson, Atomic, Arc’teryx, Mavic, Suunto, and Precor.

Photo courtesy Salomon