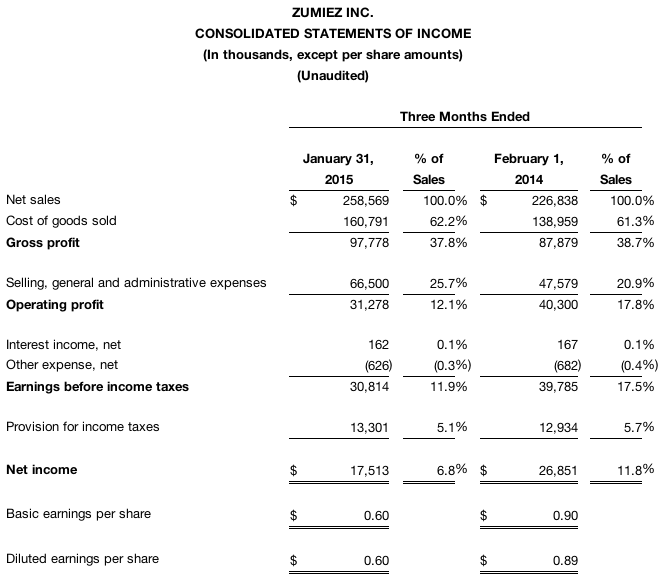

Zumiez Inc. reported total net sales for the fourth quarter increased 14.0 percent to $258.6 million from $226.8 million a year ago. Comparable sales increased 8.3 percent compared to a 2.2 percent decrease for the 13-week period ended Feb. 1, 2014.

Net income in the fourth quarter of fiscal 2014 decreased 34.8 percent to $17.5 million, or 60 cents per diluted share, from net income of $26.9 million, or 89 cents per diluted share, in the fourth quarter of the prior fiscal year. The results for fiscal 2014 include Blue Tomato acquisition charges of $6.9 million, or approximately 20 cents per diluted share, including $6.4 million for the accrual of contingent earn-out payments and $0.5 million for the amortization of intangible assets. The results for fiscal 2013 include a $5.8 million benefit, or approximately 16 cents per diluted share, for the reversal of contingent earn-out accruals associated with the acquisition of Blue Tomato, a $3.3 million benefit, or approximately 7 cents per diluted share, for the correction of an error related to the accounting for rent expenses, and a $0.6 million expense, or approximately 2 cents per diluted share, for the amortization of intangible assets associated with the Blue Tomato acquisition. Also included in the fiscal 2013 fourth quarter results is a benefit to the provision for income taxes of $0.8 million, or approximately 3 cents per diluted share, for the release of a valuation allowance of net operating losses in foreign subsidiaries.

Full Year Results

Total net sales for fiscal 2014 (52 weeks) increased 12.0 percent to $811.6 million from $724.3 million in fiscal 2013 (52 weeks). Comparable sales for the 52-week period ended January 31, 2015 increased 4.6 percent compared to a 0.3 percent decrease for the 52-week period ended February 1, 2014. Net income in fiscal 2014 decreased 6.0 percent to $43.2 million, or $1.47 per diluted share compared to net income in the prior fiscal year of $45.9 million, or $1.52 per diluted share. Results for the fiscal year 2014 include $6.4 million, or approximately 19 cents per diluted share, for the accrual of contingent earn-out payments associated with the acquisition of Blue Tomato, and $2.3 million, or approximately 6 cents per diluted share, for the amortization of intangible assets. Results for the fiscal year 2013 include a benefit of $2.6 million, or approximately 8 cents per diluted share, for the reversal of contingent earn-out accruals associated with the acquisition of Blue Tomato, a $2.7 million benefit, or approximately $0.06 per diluted share, for the correction of an error related to the accounting for rent expenses, a $2.3 million expense, or approximately 6 cents per diluted share, for the amortization of intangible assets associated with the Blue Tomato acquisition, and $1.3 million, or approximately $0.03 per diluted share, for costs associated with the conditional settlement of a California class action wage and hour lawsuit. Also included in the fiscal 2013 results is a benefit to the provision for income taxes of $0.4 million, or approximately 1 cent per diluted share, for the release of a valuation allowance to net operating losses in foreign subsidiaries.

Cash and Current Marketable Securities

At January 31, 2015, the company had cash and current marketable securities of $154.6 million, compared to cash and current marketable securities of $117.2 million at February 1, 2014. The increase in cash and current marketable securities is a result of cash generated through operations, partially offset by capital expenditures and stock repurchases.

Rick Brooks, Chief Executive Officer of Zumiez Inc., stated, “Our strong fourth quarter operating performance was an extremely gratifying way to finish fiscal 2014. The investments we've made in developing world class omnichannel capabilities, expanding our international presence and providing our people with the tools necessary to best meet the needs of our customers, helped fuel our results and fortify our leading lifestyle position. We are confident that our strategies will yield consistent earnings growth and deliver solid returns for our shareholders over the long-term.”

Fiscal 2015 First Quarter Outlook

The company is introducing guidance for the three months ending May 2, 2015. Net sales are projected to be in the range of $176 to $178 million resulting in net income per diluted share of approximately $0.08 to $0.10, which includes an estimated $1.1 million, or approximately $0.03 per diluted share, for charges associated with the acquisition of Blue Tomato. This guidance is based on an anticipated comparable sales increase in the range of 3 percent to 4 percent for the first quarter of fiscal 2015. The company currently intends to open approximately 57 new stores in fiscal 2015, including up to 7 stores in Canada and 6 stores in Europe.