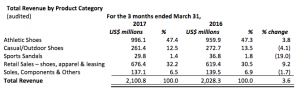

Yue Yuen recorded revenue of $2,100.8 million in the three months ended March 31, 2017, representing 3.6 percent growth compared to the revenue recorded in same period in 2016 of $2,028.3 million.

Profit attributable to owners of the company increased by 30.6 percent to $124.5 million compared to $95.3 million recorded in the same period in 2016. During the period, a non-recurring profit totaling $19.2 million was recognized, of which included $9.4 million of gain due to fair value changes on derivative financial instruments and $9.8 million of gain on disposal of associates. Excluding all items of non-recurring in nature, the recurring profit attributable to owners of the company amounted to $105.3 million, representing an increase of 29.5 percent compared to that in the same period in 2016.

Business Revenue Review

Total revenue for footwear manufacturing activity in the period increased by 1.4 percent, whereas the volume of shoes sold increased by 0.7 percent to 80.7 million pairs as compared with the same period last year.

With regards to the retail, wholesale and sport services business in the Greater China region, revenue increased by 9.1 percent to $676.4 million compared to $619.9 million recorded in the same period last year. Pou Sheng International (Holdings) Limited (“Pou Sheng’) has adopted RMB as its reporting currency from USD since its 2016 interim results in order to reduce the impact of foreign exchanges rate movements on its reported results and to provide shareholders with an accurate reflection of the group’s retail business underlying performance. In RMB terms, Pou Sheng revenue for the first three months in 2017 increased by 14.4 percent to RMB4,674.1 million compared to RMB4,086.1 million in the same period last year.

Gross Profit

During the period, the group’s gross profit increased by 6.2 percent to $526 million. Gross profit for the manufacturing business involving leading international brands was up 7.1 percent to $299 million, with a gross profit margin of 21 percent for the period. The improvement in manufacturing business was mainly due to better operational efficiency during the period, while rising wages for workers were partly offset by a reduction in material costs.

Selling & Distribution Expenses And Administrative Expenses

For the group, selling and distribution expenses for the three months were $213.7 million (2016: $192.7 million), equivalent to approximately 10.2 percent (2016: 9.5 percent) of revenue. The increase in selling and distribution expenses was attributable to expansion of directly operated stores and promotion events for Pou Sheng. In RMB terms, Pou Sheng’s selling and distribution expenses increased 18.9 percent when compared to the same period last year. Administrative expenses for the period were $151 million (2016: $150.1 million), equivalent to approximately 7.2 percent (2016: 7.4 percent) of revenue, remaining stable. Since cost pressures continue to be significant for both the manufacturing and retail businesses, the management of both units will continuously look for ways to improve productivity.

Fair Value Changes On Derivative Financial Instruments

For the three months ended March 31, 2017, the group recorded a gain of $9.4 million due to fair value changes on derivative financial instruments, compared to a gain of $14.5 million in the same period in 2016.

Share Of Results From Associates And Joint Ventures

During the first three-month period, the share of results from associates and joint ventures recorded a combined profit of $14.2 million, compared with a combined loss of $4 million recorded in the same period last year. The improvement was mainly due to the absence of an impairment loss recognized on certain assets of the joint ventures during the same period last year.