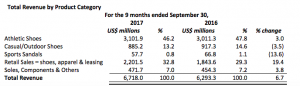

Yue Yuen Industrial Limited reported recorded revenue of $6.72 billion in the nine months ended September 30, 2017, representing 6.7 percent growth compared to the revenue of $6,293.3 million recorded in the same period in 2016. Profit attributable to owners of the company increased by 4.5 percent to $395.9 million compared to $378.8 million recorded in the same period in 2016.

During the period, a non-recurring profit totaling $20.9 million was recognized, of which included $8.3 million of gain due to fair value changes on derivative financial instruments as well as $9.9 million gain on disposal of associates. Excluding all items of non-recurring in nature, the recurring profit attributable to owners of the company amounted to $375 million, representing an increase of 4 percent compared to that in the same period in 2016.

Business Review

Revenue

Total revenue for footwear manufacturing activity in the period increased by 1.5 percent, whereas the volume of shoes sold increased by 1.1 percent to 238.7 million pairs as compared with the same period last year. Both volume and average selling price (ASP) recorded increase over the period.

The group’s retail business, including Pou Sheng and others, grew by 19.4 percent to $2,201.5 million in the nine months period when compared to revenue of $1,843.6 million for the same period last year. In RMB terms, Pou Sheng revenue for the first nine months in 2017 increased by 14.1 percent to RMB13,883.3 million compared to RMB12,164.8 million in the same period last year.

The group’s retail business, including Pou Sheng and others, grew by 19.4 percent to $2,201.5 million in the nine months period when compared to revenue of $1,843.6 million for the same period last year. In RMB terms, Pou Sheng revenue for the first nine months in 2017 increased by 14.1 percent to RMB13,883.3 million compared to RMB12,164.8 million in the same period last year.

Gross Profit

During the period, the group’s gross profit increased by 9.2 percent to $1,705.3 million. Gross profit for the manufacturing business involving leading international brands was up 3.6 percent to $934.7 million, with a gross profit margin of 20.7 percent for the period. The improvement was mainly due to operational efficiency improvement as a result of direct labor cost savings. Pou Sheng had a gross profit improvement of 6.3 percent to $701.9 million (or in RMB terms, 10.2 percent to RMB 4,796.6 million) due to the higher store sales.

Selling & Distribution Expenses And Administrative Expenses

For the group, selling and distribution expenses for the nine months were $705.9 million (2016: $590.1 million), equivalent to approximately 10.5 percent (2016: 9.4 percent) of revenue. The increase in selling and distribution expenses was mainly attributable to rising staff costs in the retail business. In RMB terms, Pou Sheng’s selling and distribution expenses increased 19.5 percent when compared to the same period last year. Administrative expenses for the period were $477.1 million (2016: $455.0 million), equivalent to approximately 7.1 percent (2016: 7.2 percent) of revenue. The increase in administrative expenses was attributable mainly to salary increase.