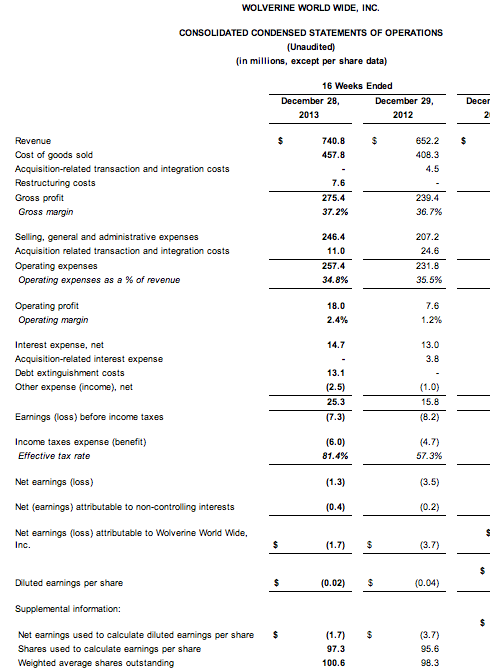

Wolverine Worldwide Inc. narrowed its net loss in the fourth quarter ended Dec. 28, to $1.7 million, or 2 cents a share, from $3.7 million, or 4 cents, a year ago. Fourth quarter sales on a pro-forma basis inched up 0.6 percent to $736.4 million.

Full-year results include a full 52-week contribution from the company's

October 2012 acquisition of the Sperry Top-Sider, Saucony, Stride Rite,

and Keds brands (the “PLG Acquisition”). References to adjusted

financial results exclude transaction and

integration expenses related to the PLG Acquisition, restructuring

charges related to the company's manufacturing operations, non-cash

retail store impairment charges, and expenses related to the October

2013 debt refinancing, where applicable.

Highlights from the year and fourth quarter 2013 include:

Consolidated

full-year revenue increased to a record $2.69 billion, representing

growth of 5.6 percent versus prior year pro forma revenue of $2.55

billion and growth of 64.0 percent versus prior year reported revenue of

$1.64 billion. All three of the company's branded operating groups

contributed to the 2013 record revenue results, with the most

significant contributions to revenue growth coming from the Sperry

Top-Sider, Saucony, Keds, and Merrell brands.

Consolidated

fourth quarter revenue was a record $740.8 million, growth of 0.6

percent vs. prior year pro forma revenue of $736.4 million and growth of

13.6 percent versus prior year reported revenue of $652.2 million.

Adjusted

full-year gross margin increased 120 basis points to 39.8 percent. The

strong gross margin improvement was driven by a mix shift towards

higher margin consumer-direct channels, select price increases taken at

the beginning of the year, efficiency gains in our owned manufacturing

operations and lower LIFO expense. These were partially offset by

higher product costs and unfavorable variances on FX forward contracts.

Reported gross margin was 39.6 percent.

Adjusted full-year

earnings increased 25.4 percent to a record $1.43 per fully diluted

share. Reported earnings for the full year were $0.99 per fully diluted

share.

In the fourth quarter, adjusted fully diluted earnings

were $0.22 per share. As noted during the company's previous earnings

call, fourth quarter earnings were negatively impacted by incremental

pension and incentive compensation expense and a higher tax rate and

share count. Reported earnings in the fourth quarter were $(0.02) per

fully diluted share.

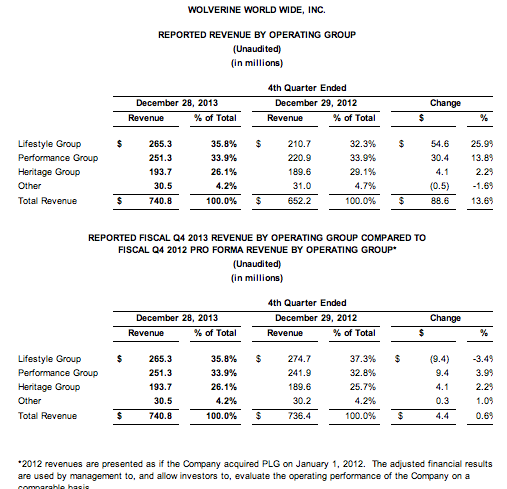

Among its three segments in the fourth quarter:

- Lifestyle Group revenues rose 25.9 percent on a recorded basis to, $265.3 million from $210.7 million. On a pro-forma basis, sales were down 3.4 percent to $265.3 million. The segment includes the Sperry Top-Sider, Stride Rite Children's Group, Hush Puppies, Keds, and Soft Style brands.

- Performance Group rose 13.8 percent to $251.3 million from $220.9 million. Pro-forma sales increased 3.9 percent to $251.3 million. The segment includes Merrell, Saucony, Chaco, Patagonia Footwear, and Cushe.

- Heritage Group's revenues inched up 2.2 percent to $193.7 million from $189.6 million. Heritage Group sales rose 2.2 percent to $193.7 million. The segment includes Wolverine, Caterpillar Footwear, Bates, Sebago, Harley-Davidson Footwear, and HyTest.

Operating free cash flow for the full fiscal

year was a record $157.6 million. The company ended the year with cash

of $214.2 million and net debt of $935.8 million, with the latter down

$142.8 million from the prior year end.

“Fiscal 2013 was a

year of many milestones for the company, highlighted by record earnings

per share and our fourth consecutive year of record revenue,” said Blake

W. Krueger, chairman and chief executive officer. “We integrated the

newly acquired brands into our business and successfully executed

numerous global growth initiatives across our brand portfolio while also

expanding and strengthening our direct-to-consumer platform. Even as a

sluggish retail environment and very cold weather in the U.S. tempered

growth for our Sperry Top-Sider and Stride Rite brands during the fourth

quarter, many of our other brands, including Merrell, delivered

excellent results. For the year, nearly every geographic region grew

nicely, with the only exception being the EMEA region that still

delivered results consistent with our expectations. In addition, we

were particularly pleased with the accelerated momentum in the Latin

America and Asia Pacific regions during the back half of 2013, important

regions for future growth across our portfolio and, particularly, for

our newly acquired brands.

“As we begin fiscal 2014, we are

pleased with the tremendous progress we have made over the past few

years to position the company for continued success around the world.

Our fanatical focus on product creation and innovation is delivering

exciting products to our global consumers, and we continue to tell

compelling marketing stories each season all while our talented and

motivated teams deliver revenue growth and increased profitability

across the portfolio. We remain steadfastly focused on achieving

impressive returns for our shareholders in any macroeconomic

environment.”

Don Grimes, senior vice president and chief

financial officer, commented, “The company delivered exceptional

financial results in fiscal 2013, and we couldn't be more pleased with

our strong cash flow generation and debt retirement since the close of

the PLG Acquisition in October 2012. Our focus remains on growing our

wonderful collection of lifestyle brands and driving continued excellent

cash flow.”

Additional details:

- Adjusted full-year

operating expenses were $830.0 million, or 30.8 percent of revenue,

which compares to 29.4 percent of revenue in the prior year. The

increase in operating expense as a percentage of revenue was driven by

incremental pension and incentive compensation expenses, incremental

amortization expense related to purchase price accounting for the PLG

Acquisition, a higher mix of consumer direct activities, and investments

in key brand-building initiatives. Reported operating expenses were

$872.2 million. - Inventory at year end was meaningfully lower than the

prior year, decreasing 8.2 percent. The company employs a “narrow and

deep” inventory philosophy that ensures its brands are in stock on key

styles, and the normalized fall/winter weather patterns in the fourth

quarter led to early product sell-outs for several of the brands in the

portfolio.

Grimes concluded, “A more challenging 2013 holiday selling

season and lingering uncertainty in the U.S. are balanced with 2014

expectations for continued double-digit growth from our brands in Latin

America and Asia Pacific. International efforts for our newly acquired

brands will begin showing results in the back half of the year and are

expected to gain meaningful momentum into 2015.”

In light of

these expectations, the company is offering the following guidance for

fiscal 2014 (excluding carryover expenses related to the final

integration activities related to the PLG Acquisition and remaining

restructuring charges related to the company's owned manufacturing

operations):

- Full-year consolidated revenue in the range of

$2.775 to $2.85 billion, representing growth in the range of 3 percent

to 6 percent versus reported fiscal 2013 revenue of $2.69 billion. - Slight full-year gross margin expansion.

- Modest full-year operating expense leverage, driven partially by lower year-over-year pension expense.

- Full-year interest expense of approximately $47 million.

- Full-year effective tax rate of approximately 28 percent.

- Fully diluted weighted average shares outstanding of approximately 100 million.

- Adjusted

fully diluted earnings per share in the range of $1.57 to $1.63,

representing growth of 10 percent to 14 percent versus the fiscal 2013

adjusted earnings per share of $1.43. Reported fully diluted earnings

per share are expected in the range of $1.52 to $1.58.

The company's portfolio of brands includes: Merrell®,

Sperry Top-Sider®, Hush Puppies®, Saucony®, Wolverine®, Keds®, Stride

Rite®, Sebago®, Cushe®, Chaco®, Bates®, HYTEST®, and Soft Style®. The

company also is the global footwear licensee of brands including

Cat®, Harley-Davidson®, and Patagonia®.