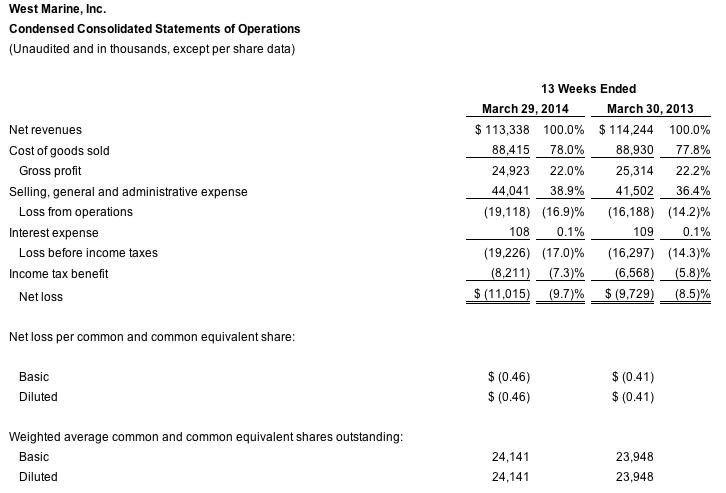

West Marine Inc. reported net revenues were $113.3 million in its first quarter ended Mar. 29, a decrease of 0.8 percent compared to last year. Comparable store sales decreased by 1.7 percent. The net loss in the period widened slightly to $11.0 million, or 46 cents a share, from $9.7 million, or 41 cents, a year ago.

Progress on our growth strategies during the first quarter was as follows:

- eCommerce: Sales from our eCommerce website were up 0.9 percent and represented 8.2 percent of total sales, compared to 8.0 percent last year. We believe the initial transition to our new eCommerce platform negatively impacted eCommerce results this quarter, as expected. Our three to five-year goal is for eCommerce to represent 15 percent of sales.

- Store optimization: Sales through our optimized stores increased to 37.6 percent of total sales compared to 29.5 percent last year. Our three to five-year goal is to deliver 50 percent of our total sales through optimized stores.

- Merchandise expansion: Sales in these product lines, which include footwear, apparel, clothing accessories, fishing products and paddle sports equipment, were up by 7.6 percent, with Core product sales down 1.8 percent, compared to last year.

- Pre-tax loss was $19.2 million compared to a pre-tax loss of $16.3 million last year.

- Despite the first quarter results, the company is reaffirming its 2014 full-year pre-tax guidance, with pre-tax income expected to be in the range of $16.0 million to $18.5 million, compared to pre-tax income of $15.3 million for 2013.

- The company remained debt-free at quarter-end and had $115.4 million available on its revolving credit line at the end of the period.

Net loss for the first quarter was $11.0 million, or ($0.46) per share, compared to net loss of $9.7 million, or ($0.41) per share for the first quarter last year.

Total inventory at the end of the first quarter was $245.2 million, a $7.3 million, or 3.1 percent, increase versus the balance at March 30, 2013, and a 1.7 percent increase on an inventory per square foot basis. Inventory turns for 2014 were down 5.2 percent versus the first three months of last year.

Return on Invested Capital (“ROIC”) for the 52-week period ended March 29, 2014 was 5.5 percent, which compares to 6.4 percent ROIC for the 52-week period ended March 30, 2013. ROIC based on GAAP net income was 5.1 percent and 6.7 percent for the 52-week periods ended March 29, 2014 and March 30, 2013, respectively. Earnings before interest, taxes, depreciation and amortization (“EBITDA”) for the first quarter of 2014 was a loss of $15.0 million compared to a loss of $12.5 million for the same period last year.

2014 Guidance

We are reaffirming our expectation for pre-tax income to be in a range of $16.0 million to $18.5 million. Our GAAP diluted earnings per share is expected to be in the range of $0.39 to $0.45. Comparable store sales for full-year 2014 are anticipated to be up 3.5 percent to 6.0 percent, with total revenues expected to be in the range of $695 million to $710 million. We are estimating EBITDA to be in the range of $35.0 million to $37.5 million. We anticipate capital expenditures for fiscal 2014 to be in the range of $30 million to $34 million.

While the first quarter was disappointing, it is still early in the season for us. Our ability to hit sales and earnings guidance will be dependent on a continuing return to more normal weather as we move into peak season, which would drive boat usage and sales of our core products. In areas with more typical weather, we have been seeing favorable sales trends. Additionally, most of our major 2014 strategic investments are now taking effect, as planned. Given the sales softness thus far, we are managing expenses while we continue to invest in our growth strategies. At this point, given the above factors, we are maintaining our guidance for the year.