Continuing to feel the impact of a slow start to the boating season due to “harsh winter and spring weather,” West Marine Inc. reported second-quarter earnings slid 17.7 percent to $18.3 million, or 75 cents a share, falling short of Wall Street's consensus estimate of 86 cents. It also slashed its guidance for the year and postponed its store remodeling plans in the second half.

Continuing to feel the impact of a slow start to the boating season due to “harsh winter and spring weather,” West Marine Inc. reported second-quarter earnings slid 17.7 percent to $18.3 million, or 75 cents a share, falling short of Wall Street's consensus estimate of 86 cents. It also slashed its guidance for the year and postponed its store remodeling plans in the second half.

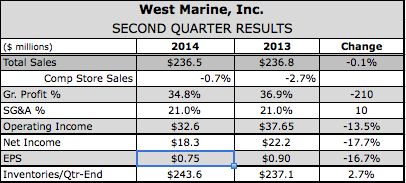

Revenues reached $236.5 million, a decrease of 0.1 percent. Comparable-store sales slid 0.7 percent. Gross margins in the quarter eroded 210 basis points to 34.8 percent.

On the positive side, sales in categories the chain is expanding – footwear, apparel, apparel accessories, fishing products and paddle sports equipment – were up by 13.9 percent, led by a 74 percent year-over-year gain in SUPs and kayaks, and a 41 percent gain in women's apparel. But core product sales were down 2.4 percent.

On a conference call with analysts, Matt Hyde, West Marine's CEO, said gains in sales to its professional customers were offset by slight declines in its Retail business due to a slow start to the boat season this year, particularly in the northeast and Great Lakes regions of the country. While gains were seen for much of June, its 2-week promotional event leading up to July 4 was a disappointment. He added, “Results from our retail business were more difficult the further north and east that you go. This was partially offset by mid-single digit comparable store increases in our entire southeast region.”

He reminded investors that that marine industry is undergoing a retail transformation, as well as changes in demographics, usage and technology. On the positive side, a customer research project undertaken in May and June showed “it was clear that our customers' passion for the lifestyle of recreating on and around the water remained strong. Boating, paddling, fishing, water recreation remain deeply rooted in the American culture.”

However, the research showed that younger consumers prefer “smaller, simpler boats.” While West Marine was perceived as the leader in saltwater boats, the surveys showed the chain could “do a better job serving the freshwater boater and water sport enthusiast.”

Hyde also said that while West Marine has permission to offer broader range of products including apparel, fishing, paddle sports and footwear, “we're not top-of-mind for these expanded product categories.”

Through May, West Marine completed 11 revitalization store projects that feature light remodeling, space optimization, product assortment changes and associate training. Hyde said that while the results are “very preliminary, we are seeing strong gains in the revitalized stores that are 12,000 square feet or bigger.” Nonetheless, the chain is postponing revitalization projects originally planned for the fall “so that we may gather more learnings to refine our plan and to get a more immediate return on capital with the spring rollout.”

E-commerce sales declined 2.3 percent for the quarter due to implementation delays and fixes required in connection with the transition to a new e-commerce platform. West Marine remains committed to its three to five-year goal for e-commerce to represent 15 percent of sales, up from 7.2 percent of sales in the first half.

With a greater promotional cadence expected this year, West Marine now expects full year EPS in the range of 19 to 25 cents, down from a previous-range of 39 to 45 cents. That compares to 32 cents earned in 2013. Comparable store sales are now anticipated to range from down 1.0 percent to up 1.5 percent, compared with guidance calling for 3.5 percent to 6.0 percent gains previously. Revenues are expected in the range of $665 million to $680 million versus $695 million to $710 million previously.