West Marine, Inc., which has been expanding its selection of apparel, footwear and paddlesports under a CEO hired from REI, reported net revenues increased 8.9 percent in the fourth quarter ended Jan. 3, enabling the company to grow its top line for the year.

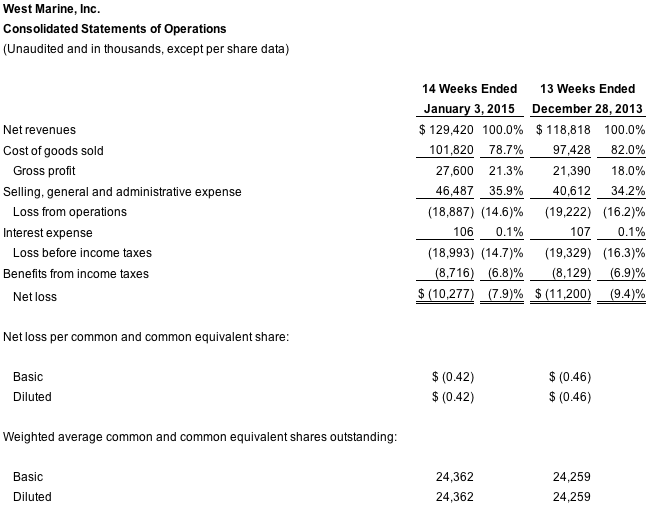

Net revenues for the fourth quarter increased by $10.6 million, or 8.9

percent, to $129.4 million compared to $118.8 million for the fourth

quarter of 2013. Net loss for the fourth quarter was $10.3 million

compared to a net loss of $11.2 million for the fourth quarter of 2013.

Pre-tax income was $4.0 million and earnings before interest, taxes, depreciation and amortization (“EBITDA”) was $22.6 million, compared to pre-tax income of $15.3 million and EBITDA of $30.7 million last year. Net income and earnings per share were $1.9 million and $0.08, respectively, compared to net income of $7.8 million and $0.32 earnings per share last year. Excluding a $0.8 million tax valuation allowance, net income was $2.8 million, or $0.11 per share.

Excluding the impact of the 53rd week in the more recent fiscal year, comparable store sales increased by 0.1 percent for the year and by 2.8 percent for the fourth quarter.

The results came despite costs that exceeded forecasts,

such as: higher employee benefits expense, including healthcare claims;

increased share-based compensation expense due to the unanticipated

increase in our stock price late in the year; and higher-than-expected

unit buying and distribution costs due to bringing in additional

inventory to support early-season sales growth and to bolster our core

boat product sales in our traditional stores.

“We're pleased with our strong fourth quarter results,” said West Marine CEO Matt Hyde. “From increased comp store sales to a strong holiday response, our key growth strategies delivered solid top line growth. We are optimistic that these strategic initiatives, combined with a strengthening boating industry, will give us good momentum as we start this year's boating season.”

The company made the follow progress toward its strategic goals throughout the the year:

- E-commerce: Sales from our eCommerce website were up by 1.4 percent, as compared to last year, and represented 7.7 percent of total sales, compared to 7.6 percent for the same period last year. Overall our eCommerce results this year were negatively affected by the replatform of our website earlier in the year. However, with the replatform behind us, our eCommerce sales returned to positive year-over-year growth in mid-July and continued to improve throughout the remainder of the fiscal year. We remain committed to our goal for eCommerce to represent 15 percent of total sales by 2019.

- Store optimization: Sales through our optimized stores, markets where we have consolidated or revitalized stores to improve the shopping experience for our customers, increased to 42.4 percent of total sales compared to 35.0 percent last year. This year-over-year increase supports our goal to deliver 50 percent of our total sales through optimized stores by 2019.

- Merchandise expansion: Sales in these product lines, which include footwear, apparel, clothing accessories, fishing products and paddle sports equipment, were up by 14.1 percent, with core product sales down 1.7 percent, compared to last year.

Fiscal year highlights

Net revenues for the fiscal year 2014 ended Jan. 3, 2015 were $675.8 million, an increase of 1.9 percent compared to net revenues of $663.2 million for fiscal year 2013. Fiscal 2014 was a 53-week year and included an extra week in the fourth quarter. Comparable store sales for this year increased 0.1 percent and for the fourth quarter increased 2.8 percent, excluding the impact of the 53rd week in 2014.

Net income for fiscal year 2014 was $1.9 million, or $0.08 per diluted share, compared to fiscal year 2013 net income of $7.8 million, or $0.32 per diluted share. Excluding the impact of the $0.8 million tax valuation allowance related to our Canadian operations, net income was $2.8 million, or $0.11 per share.

Total inventory as of Jan. 3, 2015 was $214.3 million, an $11.3 million, or 5.5 percent, increase compared to the balance at Dec. 28, 2013, and a 5.0 percent increase on an inventory per square foot basis. Inventory turns for fiscal 2014 decreased to 2.15, as compared to 2.17 for 2013.

Return on Invested Capital (“ROIC”) for the 53-week period ended Jan. 3, 2015 was 4.0 percent, which compares to 5.0 percent ROIC for the 52-week period ended Dec. 28, 2013. ROIC based on GAAP net income was 4.0 percent and 5.3 percent for fiscal 2014 and 2013, respectively. EBITDA for fiscal year 2014 was $22.6 million, compared to $30.7 million for the same period last year.

West Marine ended the year debt-free with $101.1 million available on its revolving credit line.

Fiscal 2015 Outlook

Our key financial projections for full-year 2015 are in the following ranges:

- Comparable store sales growth of 1 percent to 4 percent, on a comparable 52-weeks year-over-year

- EBITDA of $26 million to $31 million

- Pre-tax income of $6 million to $11 million

- Earnings per share of $0.14 to $0.27

Reflected in the above outlook is the continuation of our “15/50 plan,” and includes continued investments in our strategic growth initiatives, including capital expenditures in 2015 of approximately $22 million to $25 million. Successful execution of this plan, supported by our merchandise expansion strategy, will deliver incremental sales and operating margin improvement. The first number in the 15/50 plan refers to our objective to grow our eCommerce business to 15 percent of total sales. The second number reflects our expectation that sales derived from consolidated and revitalized stores will grow to 50 percent of total sales. The 15/50 plan represents the diversification of West Marine, positions us to realize higher profitability, and to be less seasonal and weather dependent, and allows us to serve our customers' lives more completely as a waterlife outfitter.