West Marine Inc. lowered its guidance for the year after disappointing second quarter. Second-quarter earnings were down 17.7 percent to $$18.3 million, or 75 cents a share, short of Wall Street's consensus estimate of 86 cents a share. Comparable-store sales slipped 0.7 percent.

Second quarter highlights include:

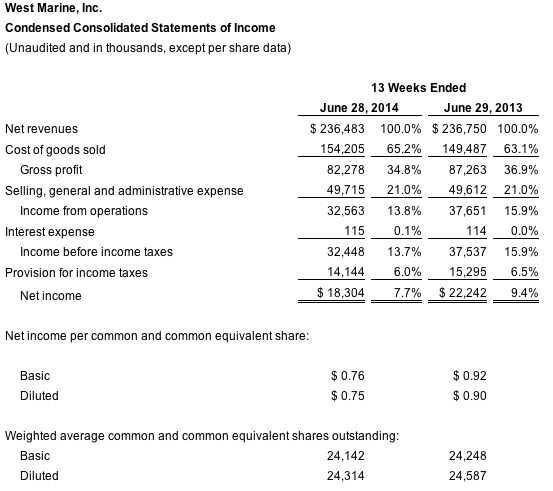

- Net revenues were $236.5 million, a decrease of 0.1 percent compared to last year.

- Comparable store sales decreased by 0.7 percent.

- Pre-tax income was $32.4 million, compared to pre-tax income of $37.5 million last year.

- Net income was $18.3 million, or $0.75 per share, compared to net income of $22.2 million, or $0.90 per share last year.

- The company is lowering 2014 full-year guidance, with pre-tax income now expected to be in the range of $8.5 million to $11.0 million, compared to pre-tax income of $15.3 million for 2013.

- The company remained debt-free at quarter-end.

Matt Hyde, West Marine's CEO, commented: “We were disappointed by second quarter sales, which were about flat to last year. At the product level, we saw the strongest increases in our merchandise expansion categories, including paddle sports and women's clothing, but sales of core products were soft. During the second half of the year, we'll continue to reduce operating expenses to drive nearer-term profitability, while continuing our careful investments in our strategic initiatives to drive long-term profitable growth.”

Progress on our growth strategies year-to-date through the second quarter was as follows:

- eCommerce: Sales from our eCommerce website were up 0.5 percent and represented 7.2 percent of total sales, the same as last year. We believe our eCommerce results so far this year were negatively impacted by implementation delays and fixes required in connection with the transition to our new eCommerce platform. We remain committed to our three to five-year goal for eCommerce to represent 15 percent of sales.

- Store optimization: Sales through our optimized stores increased to 41.5 percent of total sales compared to 34.0 percent last year. This year-over-year increase supports our three to five-year goal to deliver 50 percent of our total sales through optimized stores.

- Merchandise expansion: Sales in these product lines, which include footwear, apparel, clothing accessories, fishing products and paddle sports equipment, were up by 12.1 percent, with core product sales down 2.2 percent, compared to last year.

- Net revenues for the 26 weeks ended June 28, 2014 were $349.8 million, a decrease of 0.3 percent, compared to net revenues of $351.0 million for the 26 weeks ended June 29, 2013. Comparable store sales decreased by 1.1 percent for the first six months of 2014 versus the same period last year. For the first six months last year, we reported a 4.0 percent decrease in comparable store sales.

Net income for the first six months was $7.3 million, or $0.30 per diluted share, compared to net income of $12.5 million, or $0.51 per diluted share, for the first six months last year.

Total inventory at the end of the second quarter was $243.6 million, a $6.5 million, or 2.7 percent increase versus the balance at June 29, 2013, and a 1.5 percent increase on an inventory per square foot basis. Inventory turns for 2014 were down 2.3 percent versus the first six months of last year.

Return on Invested Capital (“ROIC”) for the 52-week period ended June 28, 2014 was 4.9 percent, which compares to 6.1 percent ROIC for the 52-week period ended June 29, 2013. ROIC based on GAAP net income was 3.2 percent and 6.6 percent for the 52-week periods ended June 28, 2014 and June 29, 2013, respectively. Earnings before interest, taxes, depreciation and amortization (“EBITDA”) for the second quarter of 2014 was $37.2 million, compared to $41.4 million for the same period last year.

2014 Guidance

During the first half of 2014, our sales and gross profit results were lower than expected. Although we experienced solid gains in sales to our professional customers and in our merchandise expansion categories, our core product sales suffered and the shift in the product mix and customer type put pressure on our margins. Our core product sales tend to be dependent on boat-usage and include boat maintenance items, sailboat hardware, electrical parts and boating safety products. Consequently, we are lowering our previously-issued sales and earnings guidance for fiscal year 2014. We now expect pre-tax income in the range of $8.5 million to $11.0 million, approximately $7.0 million lower than our previously-communicated pre-tax income guidance. This will result in diluted earnings per share of approximately $0.19 to $0.25. Comparable store sales for full-year 2014 are now anticipated to range from down 1.0 percent to up 1.5 percent, with total revenues now expected to be in the range of $665 million to $680 million.We are now estimating EBITDA to be in the range of $27.5 million to $30.0 million. We anticipate capital expenditures for fiscal 2014 to be in the range of $28 million to $32 million.