Volcom, Inc. finished its first full quarter shipping product  into its new European operations with management describing the results on a conference call with analysts as “right on target.” However, because of the general caution pervading the soft retail environment and a PacSun business that the company now sees being down approximately 10% for the full year instead of just down in the mid-single-digits, VLCM lowered its annual guidance causing its share price to close the week down nearly 30% to $27.42 on Friday.

into its new European operations with management describing the results on a conference call with analysts as “right on target.” However, because of the general caution pervading the soft retail environment and a PacSun business that the company now sees being down approximately 10% for the full year instead of just down in the mid-single-digits, VLCM lowered its annual guidance causing its share price to close the week down nearly 30% to $27.42 on Friday.

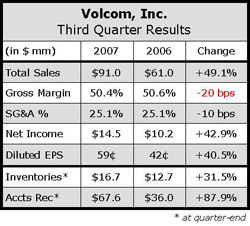

Consolidated sales jumped 49.1% in the third quarter as the company added in $25.8 million of revenue attributable to European operations, where it only had revenues of $1.1 million in the year-ago quarter from its lone direct distributor in Switzerland .

U.S. revenues increased 9% to $65.2 million for the quarter, up from $59.9 million last year. The company said its operating margin in Europe is 37%, suggesting that operating profit for the region was approximately $7.0 million. In the U.S. , operating margin was 21%, suggesting operating income of approximately $13.7 million.

Within Europe, the companys top five territories include France ,

Germany , Austria , Spain and Italy , with management also calling out Switzerland and Norway as strong markets. The eastern European countries, such as Poland , Hungary and the Ukraine , were said to be “just getting going,” but that they could be potential growth drivers down the line. However, for 2008, the company expects to focus the majority of its EU growth in its existing account base.

On a consolidated basis, men's product revenue increased 72% to $41.4 million for Q3, compared to $24.1 million for the third quarter of last year.

In the U.S., men's revenue was $27.4 million, a 16% increase. Girl's product revenue increased 15% to $21.2 million versus $18.5 million in the third quarter of 2006. In the U.S. , girl's revenue decreased 11% to $16 million, reflecting a decline in the companys PacSun girl's business, which management said comes as a result of the retailer moving to a higher percentage of private label product in the segment. Boy's revenue, which includes the companys nascent kid's line, increased 78% to $5.5 million, compared with $3.1 million last year. Boy's revenue totaled $5.1 million in the U.S. market, representing a 69% increase.

Revenues from the snow division increased 56% to $20.4 million for the quarter, up from $13.1 million in Q3 of last year, but grew only 11% in the U.S. to $14.3 million. In new product initiatives, revenue from the girl's swim line was $97,000 for the quarter, and revenues from the Creedler footwear line was $1.2 million. The company said that going forward its focus in the footwear line would be open-toed product, with some work on bedroom slippers around holiday. Europe did not carry the girls swim line and accounted for only $200,000 in footwear sales. The company said in giving guidance that “weakness in the overall vulcanized slip-on category … hurt the company's new footwear business.”

Volcom reported that revenue from its five largest accounts decreased 12% to $21.1 million in the third quarter, or 23% of total product sales, due to the decreased PacSun business. Revenue from PacSun decreased 23% to $10.3 million for the quarter, or 11% of total product revenue, compared to $13.4 million, or 22% last year. The company noted that excluding PacSun, revenue from the next four largest accounts increased 2.6% to $10.8 million. Outside of those top five accounts and Europe , revenue increased 26% to $43.6 million for the third quarter.

The company said theyre owned-retail stores have “shown that they can serve as a solid distribution channel.” The company currently has five stores in operation with plans to open its sixth retail operation in Berkley, CA in the next several months. The companys seventh store, in Waikiki, HI , is planned to open in late spring of next year.

Looking ahead, the big question mark for the company remains its business with PacSun and whether it can manage to expand its account base to temper any ups and downs there. For the fourth quarter, revenues are expected to be between $70 million and $73 million, representing an increase of 24% to 30% compared to the fourth quarter of 2006. On the bottom line, VLCM expects earnings per share to range between 30 cents and 32 cents.

Following the worries surrounding Q4, the company lowered its full year guidance to revenues ranging from $270 million to $273 million, or an increase of 31% to 33% over the prior fiscal year. EPS should come in between $1.37 and $1.39 a share.

Looking specifically at the European business, the company raised its expectations for the second half following the strong third quarter showing. For H2, VLCM expects revenues to range from $32 million to $33 million, up from earlier guidance of a range of $29 million to $31 million. Given third quarter revenues from Europe of $25.8 million, this translates to $6 million to $7 million for the fourth quarter with management noting the region experiences a different sell cycle than the U.S. as holiday and BTS have much less importance across the pond.