Led by growth from The North Face, Vans and 7 For All Mankind, and higher margins resulting from its owned-retail expansion, VF Corp. wrapped a better-than-expected fourth quarter and forecast profitable growth in 2010. Still, overall Q4 earnings declined 42.2% to $66.9 million, or 60 cents per share, for the period after a one-time charge to reduce the value of goodwill related to its Nautica, Reef and lucy brands.

VFCs overall revenues inched up 0.2% to $1.92 billion in Q4. Excluding a 2008 cost-reduction charge and adjusting 2009 earnings for higher pension, foreign currency and impairment impacts, Q4 earnings climbed 28% to $1.62 a share. Better-than-expected performances by the Outdoor & Action Sports, Jeanswear America, Sportswear and Imagewear coalitions helped VF exceed Wall Streets consensus EPS estimates for the period. But the quarter included a $114.4 million after-tax impairment charge because results for Nautica, lucy and Reef have been below VFC expectations since each was acquired.

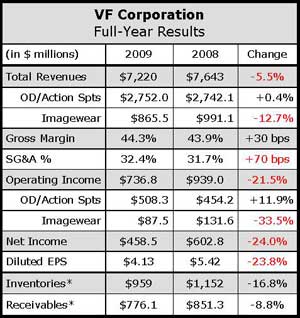

Outdoor & Action Sports Coalition revenues grew 8.2% to $730.9 million in the fourth quarter. The North Face and Vans grew 7% and 14%, respectively, in Q4. Revenues in the Americas rose 4%, while International was up 9% in constant dollars, led by exceptionally strong growth in Asia. The Coalitions Direct-to-Consumer business rose 21% in the quarter. Operating income soared 45% to $147 million with operating margins hitting 20%. Prior year results included $8.2 million in cost-reduction expenses. For the full year, Coalition revenues inched up 0.4% to $2.75 billion and operating earnings climbed 11.9% to $508.3 million.

Asked about the lucy vertical retail business, CEO Eric Wiseman said the brand was reassigned to its Outdoor coalition this past fall to leverage that divisions expertise in technical performance. We still think women’s activewear, particularly yoga-inspired activewear, is a viable proposition, and we are committed to its future, he said.

Wiseman said Reef is already benefiting from a substantial organizational restructuring conducted last year.

Wiseman said Reef is already benefiting from a substantial organizational restructuring conducted last year.

It’s obviously a spring/summer oriented business but our spring/summer numbers are coming in as planned and there is momentum going into 2011 in the product and brand area we are quite frankly excited by, he noted.

On the call, Wiseman noted that Vans has been VFs most successful brand to date in leveraging social media. We are going to continue to build our social and digital media capabilities this year, by investing behind proprietary content on our Web sites, creating new mobile applications and ramping up our social media networking, said Wiseman. On the product side, Vans is introducing a new line of surf footwear that is lightweight, packable and washable. Vans new upscale California collection with upgraded design and materials is also intended to extend the reach of the brand.

At TNF, about a dozen markets across the U.S. have been identified for regional advertising and TV and online video are being added to the brands marketing mix for the first time. TNF has also continued to expand its social media and mobile marketing efforts. The TNF iPhone snow report app was reportedly one of the top rated applications on Apple’s iTunes stores in 2009.

The Imagewear Coalition, which includes the Majestic, Red Cap and The Force businesses, as anticipated, saw its rate of revenue decline slowing in Q4, led by a resumption of growth in Licensed Sports, where revenues grew 7% for the period. Total Coalition revenues fell 8.4% to $222.3 million in Q4, reflecting high unemployment levels impacting the companys industrial and protective apparel businesses. Operating income slid 4% to $26 million in Q4. The prior-year results included $2.0 million in cost reduction expenses. For the full year, Imagewear Coalition revenues decreased 12.7% to $865.5 million while operating profits fell 33.5% to $87.5 million.

Overall, VFs international revenues increased slightly on a constant currency basis, with growth in the Outdoor & Action Sports and Contemporary Brands businesses largely offset by weakness in European jeanswear. International accounted for 30% of VFs sales in 2009.

Direct-to-consumer business increased 7% in the quarter, driven by strong increases in the Vans, The North Face, 7 For All Mankind and Napapijri. Q4 comps were flat with stronger comps at TNF, Vans and 7 For All Mankind offsetting weakness at lucy and Nautica. The ROI for the business remained over 20% in 2009. Thirty One stores were opened in the quarter and 90 in the year, leaving 757 at year-end. The Direct-to-Consumer business grew to 17% of sales from 15.5% in 2008.

The 380-basis point improvement in gross margin in Q4 was fueled by margin expansion in each of the coalitions. About half came from VFCs higher-margin Direct-to-Consumer business. Significant reductions in inventories across coalitions also contributed to healthier margins.

Looking to 2010, overall VF Corp. revenues are expected to grow 2% to 3%. Among coalitions, Outdoor & Action Sports revenues should see high-single digit rate gains, driven by strong growth at TNF and Vans. Contemporary Brands sales are expected to increase 10% to 15%.

Jeanswear, Sportswear and Imagewear are expected to remain relatively stable although operating margins should improve for each.

Direct-to-Consumer revenues are expected to increase over 10% in 2010. Growth will be driven by 80 to 90 new stores and low-single digit comp store growth. About two-thirds of the openings will be TNF, Vans, and 7 For All Mankind, with most international locations.

Direct-to-Consumer revenues are expected to increase over 10% in 2010. Growth will be driven by 80 to 90 new stores and low-single digit comp store growth. About two-thirds of the openings will be TNF, Vans, and 7 For All Mankind, with most international locations.

Incremental investments totaling $50 million will support future growth,

with $40 million boosting marketing for TNF, Vans and 7 For All Mankind as well as the Asian business. The remaining $10 million targets product development and sustainability initiatives.

In Asia, a substantial investment in retail fixturing and visual merchandising will support a planned 40% increase in distribution in China for the Lee, TNF and Vans brands. TNF is rolling out additional sponsored events such as a 100-kilometer race in Beijing. Vans will focus on digital and event marketing in key cities.

Company gross margins are expected to improve more than 100 basis points for the year, with VFs focus on higher-growth lifestyle brands and the expanding Direct-to-Consumer business. Excluding the 2009 impairment charges, EPS is expected to increase 9% to 11% to approximately $5.60 to $5.70 per share.