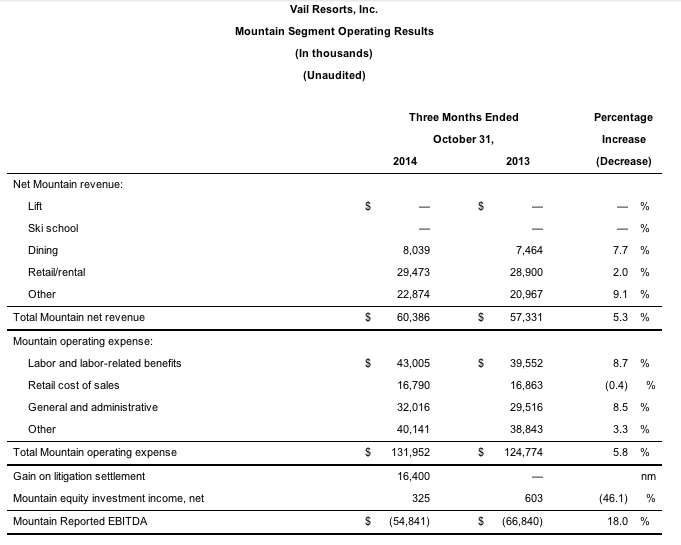

Vail Resorts, Inc. reported Retail and Rental revenue at its Mountain Segment grew 2.0 percent to $29.5 million in the fiscal first quarter ended Oct. 31, as compared to the same period in the prior year.

Cost of sales figures indicate Retail/rental gross margins of 43.1 percent, up 160 basis points from a year earlier.

The results compared with revenue growth of 5.3 percent at Vail Resorts Mountain Segment, which reflects the performance of all mountain based businesses except Lodging and Real Estate. Dining revenues, for example, increased 7.7 percent during the quarter, while other revenues increased 9.1 percent. Lift and ski school revenues were unchanged at zero, as Vail typically does not operate its lifts or ski schools until the fiscal second quarter.

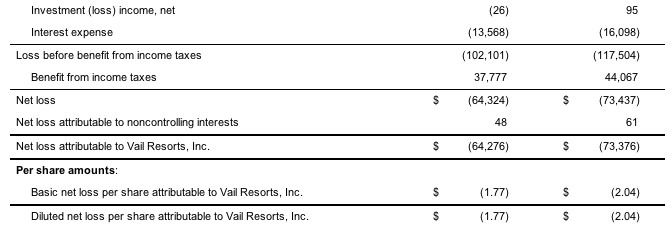

Including its Lodging and Real Estate segments, Vail Resorts reported total net revenue increased $4.9 million, or 3.9 percent, to $128.3 million for the three months ended Oct. 31, as compared to the same period in the prior year. Net loss attributable to Vail Resorts, Inc. was $64.3 million, or a loss of $1.77 per diluted share, compared to $73.4 million, or a loss of $2.04 per diluted share, in the first quarter of the prior year.

Vail Resorts historically loses money in the fiscal first quarter, which ends before ski operations begin. The quarter is driven primarily by summer mountain activities, dining, retail, and lodging operations, and administrative expenses for our year-round employees.

At the Mountain segment, reported EBITDA was a negative $54.8

million in the fiscal first quarter, including a $16.4 million non-cash gain on settlement of

litigation over the Park City Mountain Resort. Excluding that non-cash

gain, the Mountain segment reported negative EBITDA of $71.2 million,

compared with a loss of $66.8 million a year earlier. The increase

negative EBITDA includes an off-season operating loss for newly acquired

Park City, along with $3.1 million of litigation, integration and

transaction expenses in the current quarter. Mountain Reported EBITDA

also includes $3.2 million of stock-based compensation expense for the

three months ended Oct. 31, 2014 as compared to $2.7 million in the

same period in the prior year.

“Our Resort Reported EBITDA loss for the quarter was consistent with our expectations, reflecting strong operating results and the addition of Park City, which operated at a loss for the quarter,” said CEO Rob Katz. “Mountain segment net revenue in the quarter increased 5.3 percent to $60.4 million, compared to the prior year, driven by an increase in our summer activities revenue of 31.2 percent compared to the prior year, along with strong pre-ski season retail results. Our Lodging segment net revenue (excluding payroll cost reimbursements) increased $1.5 million, or 2.7 percent, driven primarily by a strong finish to the summer season at the Grand Teton Lodge company.”

Vail Resorts ended the quarter with $29.8 million of cash on hand, and $183.0 million in borrowings under the revolver portion of its senior credit facility. Net debt, including the capitalized Canyons obligation, was 3.1 times trailing-12-month Total Reported EBITDA excluding the non-cash gain on Park City litigation settlement, and does not include the contribution from a full year of Park City operations.

Katz also announced Tuesday that Vail Resort’s board of directors declared a quarterly cash dividend on Vail Resorts common stock. The quarterly dividend will be $0.4150 per share of common stock and will be payable on January 12, 2015 to shareholders of record on Dec. 29, 2014.

Season pass sales update

“Our season pass results continue to deliver very strong growth. As we approach the end of our selling period, season pass sales (including 4-Packs) are up approximately 13 percent in units and 16 percent in sales dollars through Dec. 4, 2014 compared with the similar period in the prior year and including results from Park City in both periods. The biggest driver of our growth was new pass sales in our United States and international destination markets. We continued to see very strong growth in Minneapolis and Detroit as well as in Utah. In Colorado, we saw very healthy growth and in Tahoe we experienced a modest decline, which was better than our expectations, given the very challenging conditions in the prior year.

“Our program now has over 400,000 pass holders and will generate more than $200 million in revenue in fiscal year 2015, far surpassing any other season pass program in the industry,” Katz continued. “Looking ahead to the ski season, we are seeing lodging bookings trending ahead of this time last year, with good momentum across our properties with strong rate growth, particularly in the Colorado markets. Based on historical averages, approximately 50 percent of the bookings for the winter season have been made by this time.”

Outlook

The company affirmed its September guidance for fiscal 2015 Resort Reported EBITDA of between $340 million and $360 million, which includes approximately $5 million of litigation, transaction and integration expense, and excludes the $16.4 million non-cash gain on Park City litigation settlement.

“We expect Resort EBITDA Margin (defined as Resort Reported EBITDA divided by Resort net revenue), excluding the impact of the non-cash gain on Park City litigation settlement, to be approximately 25.3 percent, using the midpoint of the guidance range,” said Katz. “This is an estimated 3.0 percentage point increase over fiscal 2014.”

Net income attributable to Vail Resorts, Inc. is expected to be between $75.5 million and $100.5 million in fiscal 2015, excluding the non-cash gain on Park City litigation settlement.”

Calendar Year 2015 Capital Plan

In a concurrent press release, Vail Resorts also announced its calendar year 2015 capital plan for Park City and Canyons. The transformative plan, which remains subject to regulatory approval, includes a new eight-passenger two-way gondola that will connect the two resorts, creating the largest single ski area in the United States with more than 7,300 acres of skiable terrain.

The capital plan also includes;

- a new high-speed six-person chairlift and an upgrade of a fixed-grip triple chairlift to a high-speed detachable quad chairlift, both of which will increase lift capacity in critical areas of Park City,

- a new 500-seat restaurant in Park City near the proposed gondola and upgraded chairlifts,

- a 250-seat expansion of an existing restaurant in Canyons, and

- an expanded maintenance plan to address the lack of spending at the resort over the past number of years.

The company estimates the total cost of the 2015 capital plan, including normal annual maintenance (and excluding any third party reimbursements) will be approximately $50 million. The company estimates the impact of the capital plan on the profitability of the Park City and Canyons resorts will be significant, and that the two acquisitions will add approximately $70 million of Resort EBITDA in fiscal 2016, with additional upside in future years.

The company’s preliminary estimate of the remainder of its calendar year 2015 capital plan totals between $60 million and $65 million (including estimates of third party reimbursements), which excludes investments in summer activities and the one-time $50 million investment in Park City and Canyons. While additional details will be outlined in March 2015, the company announced that a signature part of the remainder of the capital plan will be an upgrade of the Avanti Chair (Chair 2) at Vail Mountain from a four-person to a six-person high-speed chairlift, increasing capacity by approximately 30 percent at one of the most popular beginner and intermediate areas at the resort. The company also expects to provide details in March 2015 on its plans for material construction on summer activities at Vail in calendar year 2015, with all necessary approvals having been obtained.

In March 2014, the company provided long-term capital guidance of $85 million per year, such amount to be adjusted for inflation and growth in the number of operated resorts and excluding any expenditures in summer activities. Assuming no new resort acquisitions, the company expects capital expenditures in calendar year 2016 to be $96 million, excluding investments in summer activities, reflecting inflation and the inclusion of Park City’s ongoing routine capital into the plan.

“We are pleased to announce that we expect to connect Park City and Canyons into the single largest resort in the United States in 2015,” said Katz. “The transformational capital plan for our Utah resorts will be a dramatic step forward for the guest experience, creating access to vast terrain options for skiers of all abilities, significantly upgrading lift capacity in high traffic areas of the resorts and expanding and upgrading the dining experience. We believe this will further elevate the combined resort as one of the best destination ski resorts in North America.”