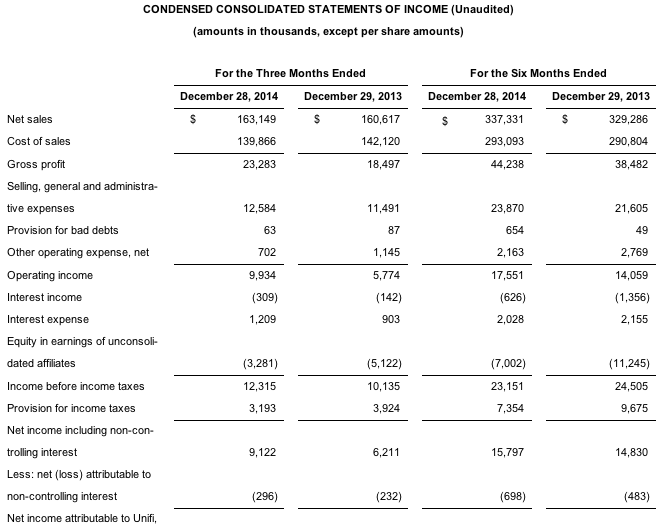

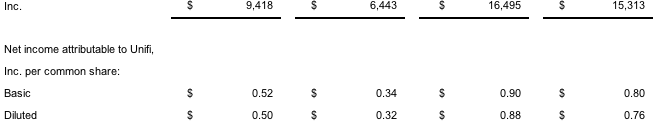

Unifi, Inc. reported net income jumped 46.9 percent in its second quarter ended Dec. 28, to $9.4 million, or 52 cents a share, from $6.4 million, or 34 cents, a year ago. Improved results for the company's global operations and a lower effective tax rate were partially offset by a decrease in earnings from the company's equity affiliates.

Other highlights for the December 2014 quarter included:

- Higher sales volumes as compared to the prior year quarter due to increased demand for textured polyester yarn in the North and Central American regions and improvements in Brazil and China;

- Gross profit improved to $23.3 million, or 14.3 percent of net sales, from $18.5 million, or 11.5 percent of net sales, for the prior year quarter;

- Adjusted EBITDA of $16.2 million for the December 2014 quarter, an improvement from $12.6 million for the prior year quarter; and

- The company was added as a new constituent to the S&P SmallCap 600®.

Net sales increased $2.5 million, or 1.6 percent, to $163.1 million for the quarter compared to net sales of $160.6 million for the prior year quarter. The year-over-year improvement in net sales is primarily attributable to improved volume in all three of the company's reportable segments, partially offset by devaluation of the Brazilian Real relative to the U.S. dollar.

“We are very pleased with the year-over-year improvements to our business, which are being led by the continued success of our mix enrichment strategy, increased demand for textured polyester, and volume growth in our international business,” said Roger Berrier, President and Chief Operating Officer of Unifi. “The consumption of synthetic yarn continues to grow in the CAFTA region, particularly with incremental apparel programs moving into the region from Asia. We are addressing this opportunity by adding new texturing capacity in both the U.S. and El Salvador, which will become operational over the course of the second half of the fiscal year.”

Cash and cash equivalents of $17.9 million as of December 28, 2014, increased $2.0 million compared to $15.9 million as of June 29, 2014. Net debt at the end of the December 2014 quarter was $93.4 million, compared to $83.6 million at June 29, 2014. The company had $60.9 million available under its revolver as of December 28, 2014, relatively unchanged compared to $61.1 million as of June 29, 2014.

Net income was $16.5 million, or $0.90 per basic share, for the six months ended December 28, 2014, compared to net income of $15.3 million, or $0.80 per basic share, for the prior year six-month period. Net sales increased $8.0 million, or 2.4 percent, to $337.3 million for the current year six-month period compared to net sales of $329.3 million for the prior year six-month period, primarily due to improved sales volume, partially offset by unfavorable currency translation in Brazil.

“The strength of our balance sheet will allow us to remain focused on our key growth-related initiatives throughout fiscal year 2015 and beyond, which includes making investments to increase our manufacturing flexibility to support the ongoing growth in our premium value-added products,” said Bill Jasper, Chairman and CEO of Unifi. “Our ability to generate excess cash from operations, coupled with our strong borrowing capacity, permits us to evaluate new growth opportunities that are consistent with our corporate strategies, provide a high return on investment, and positively impact shareholder value.”