With a particularly encouraging performance from its footwear category and international overall, Under Armour reported second-quarter results that exceeded expectations, prompting it to sharply raise its guidance for the full year. The company took its full-year revenue guidance for 2014 to a range of $2.98 billion to $3 billion. That represents growth of 28 percent to 29 percent for the year, an increase from its prior range of 24 percent to 25 percent. Operating income is now projected to expand 29 percent to 30 percent, up from its previous guidance calling for a 25 percent to 26 percent increase.

With a particularly encouraging performance from its footwear category and international overall, Under Armour reported second-quarter results that exceeded expectations, prompting it to sharply raise its guidance for the full year. The company took its full-year revenue guidance for 2014 to a range of $2.98 billion to $3 billion. That represents growth of 28 percent to 29 percent for the year, an increase from its prior range of 24 percent to 25 percent. Operating income is now projected to expand 29 percent to 30 percent, up from its previous guidance calling for a 25 percent to 26 percent increase.

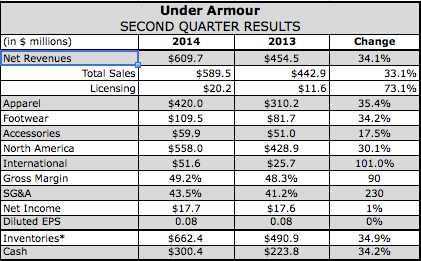

In the second quarter, earnings were basically flat at $17.7 million, or 8 cents a share, against $17.6 million, or 8 cents, a year ago, albeit ahead of Wall Street's consensus estimate of 7 cents. Profits were expected to be squeezed by higher expenses tied to investments in wearable technology related to the company's November acquisition of MapMyFitness as well as spending around new Brand House stores.

Revenues jumped 34.1 percent to $610 million, representing its 17 consecutive quarter of growing revenues more than 20 percent. Wall Street on average had expected $574 million.

On a conference call with analysts, Brad Dickerson, CFO, attributed the topline upside to positive trends in its international and footwear businesses, a desire from wholesale partners for earlier delivery of back-to-school product, and a healthy performance at both its factory house and e-commerce channels.

By category, Apparel revenues jumped 35.4 percent to $420 million, the 19th consecutive quarter of more than 20 percent growth in its core category. In women’s, the company’s running and Studio lines remained strong, while its youth business was driven by training and golf. Men’s was boosted by particular strength in golf and outdoor.

“In general, we continue to see success where we drive newness and excitement for the consumer, including innovation stories like ArmourVent, as well as an enhanced design elements through products such as Alter Ego, UA Tech and graphic tees,” said Dickerson.

Footwear increased 34.2 percent $109.5 million, led by new introductions in running.

“We continue to offer more balanced running price points across our sporting goods distribution and remain encouraged by the early success of our SpeedForm platform,” said Dickerson. “Our momentum is also continuing in our Speed business but we are increasing market share in both baseball and football this year. “

Accessories climbed 17.5 percent to $59.9 million, primarily driven by headwear.

Direct-to-consumer revenues increased 38 percent for the quarter, representing approximately 31 percent of revenues. In North America, square footage in its factory house channel grew 22 percent year-over-year. It had 118 factory house stores at the end of the quarter, up 12 percent from the second quarter of 2013. The sales growth also reflected expansions. UA now has five Brand House stores in North America following the April opening of its SoHo location in New York City

International revenues, which represented 8 percent of total revenues for the quarter, grew 80 percent year-over-year. “Strong results” in Europe were driven by higher brand awareness and a more focused in-country strategy around three key markets: the U.K., Germany, and France. In Asia, the company is accelerating store openings with its partner in the region while adding both wholesale and distributor relationships across the region. The Latin America business is benefiting from the conversion of its Mexico distributor to an Under Armour subsidiary at the beginning of 2014, as well as its market entry into Brazil. North American sales grew 30.1 percent to $558 million.

Gross margins expanded to 49.2 percent compared with 48.3 percent in the prior year's quarter, primarily driven by favorable year-over-year sales mix and product margins. SG&A expenses as a percentage of revenues increased to 43.5 percent compared with 41.2 percent in the prior year's period, primarily driven by the timing of marketing expenses and investments in product development. Second quarter operating income increased 7.4 percent to $34.7 million.

On the call, Kevin Plank, chairman and CEO, said he expects 2014 will go down “as a pivotal year in our diversification, one where we've built solid foundations in these newer businesses.” He highlighted successes in five areas – footwear, women's, connected fitness, direct-to-consumer, and international for that progress.

On footwear, Plank said that with the success of the SpeedForm Apollo, “we've made a strong impression with runners looking for great technical footwear.” The launch next year of the SpeedForm Gemini promises to reach “an even broader base of running consumers.”

Women’s has become more than a $500 million business for UA and the first global campaign dedicated to women is launching in the last week of July featuring Misty Copeland, principal dancer with the American Ballet Theatre. Added Plank, “We've built a large women's business and look at this next phase as a great opportunity to bring dimension to our brand outside of our core men's apparel business.

Addressing its ‘connected fitness’ push, Plank said MapMyFitness is enabling UA to get “deeper into the conversation with potential technology partners around the intersection of proactive health and wearable technology,” alluding to market reports that the company is speaking to Samsung about co-partnering on a wearable device. By year-end, it expects to have over 30 million registered users under the MapMyFitness platform, with about one-third coming from outside of the U.S.

Plank said its direct-to-consumer business is helping the brand reach new customers, “whether that's a 25-year-old athletic female in our SoHo store, or a 14 -year-old future Premier League player who just happens to live now in London, Sao Paulo, or Singapore.” Providing a full-breadth of merchandise also showcases the brand’s potential. Women’s is selling particularly strongly at its new SoHo store while footwear is checking out well across its stores.

Finally, the international push will be partly supported by store openings. Eighty percent of Brand House square footage being opened in 2014 will come from outside the U.S. Stores recently opened in in Panama City, the Philippines and Singapore. International expansion is also being aided by partnerships such as Cruz Azul in Toluca in Mexico, Colo-Colo in Chile, and Tottenham Hotspur of the English Premier League.

“We hope to look back on 2014 as a year where we transformed from being just a great US apparel brand to truly establishing ourselves as players in both the footwear and international market,” said Plank. “That confidence stems from the investments we've made in past years in these areas and reinforces our strategy of investing in our brand for the long term.”