Under Armour once again rode sales of its flagship performance apparel segment and direct sales to consumers past analysts earnings estimates for the third quarter and subsequently hiked full year earnings guidance roughly five percentage points above original forecasts.

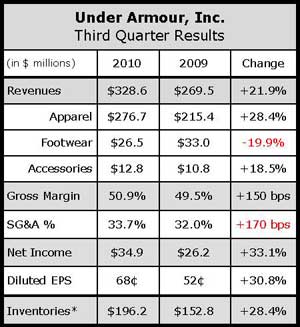

Total third quarter sales jumped 21.9%, largely due to 28.4% growth from the apparel segment, which recorded growth of at least 25.0% from all three segments men’s, women’s and youth. Also contributing to revenue growth were the openings of five factory outlet stores, solid same-store sales and a direct business that jumped 47.0% on strong returns from the company’s higher margin e-commerce division.

Total third quarter sales jumped 21.9%, largely due to 28.4% growth from the apparel segment, which recorded growth of at least 25.0% from all three segments men’s, women’s and youth. Also contributing to revenue growth were the openings of five factory outlet stores, solid same-store sales and a direct business that jumped 47.0% on strong returns from the company’s higher margin e-commerce division.

“ we see significant opportunities ahead to broaden our consumer reach, supported by continued growth in both our wholesale apparel and Direct-to-Consumer channels,” said Founder, Chairman and CEO Kevin Plank during a conference call with analysts. “We expect these businesses, along with bringing our licensed hats and bags business in-house and an expected return to growth in footwear, will continue to drive results through 2011.”

As the company forecasted prior to Q2, UA’s footwear segment continued to decline during the third quarter, with year-over-year sales falling nearly 20%, significantly worse than the 4.5% year-over-year drop reported for the second quarter when the company had to anniversary prior-year running shoe “launch” sales.

Footwear sales were the company’s only downfall during the quarter as UA continues to invest in a business segment that has experienced its share of missteps since launching in 2006. Shortly following the company launched a limited release of its inaugural and highly-anticipated basketball footwear, Plank admitted it would be a long process to achieve significant market share in the footwear category, saying, “ (Under Armour is) thinking more about Under Armour 2020 that we are about Under Armour 2011.”

The plan seems to be well underway, however, considering Plank recently hired away three Nike veterans. As multiple reports have detailed, Under Armour’s goal is to be the number two player in basketball within the “next several years.” Plank added that the company initiated a very limited launch of its Micro G basketball shoe in efforts to preserve the line’s intrigue and generate consumer excitement. It’s somewhat fitting that Brandon Jennings of the NBA’s small-market Milwaukee Bucks is UA’s only current Micro G promoter and will “take on” Nike’s esteemed signees, which include future Hall of Famers like Kobe Bryant and LeBron James.

Among other results, UA’s international sales increased 60.0% to $21 million during the quarter and represented 6.0% of revenues compared to about 5.0% in the year-ago period. Plank said growth was generated by strong sales from Europe, where base layer sales drove results, and Japan, where the company has launched marketing campaigns that branch out beyond American football. Under Armour has now set its sights on China, with the first full priced store scheduled to open its doors next year.

Plank added that the “next chapter” to the UA athletic apparel book will arrive next spring, which is a sure indicator that the company has finally committed to entering the cotton market something it has publically condemned in the past.

“ we never had an issue with cotton t-shirts as much as we had an issue with non-performance,” Plank said when asked about the company’s inevitable entrance into the cotton market. “ the addressable market of what cotton product would be is a large opportunity.” When asked about a possible launch date for cotton product, Plank mostly deflected the question, venturing only that UA would offer more information during the first quarter of 2011.

Margins for the quarter improved 140 basis points to 50.9% of sales due to lower sales returns, fewer markdowns, a more favorable impact of liquidations and inventory reserves and a higher percentage of revenue from the higher margin Direct channel.

Inventory at quarter-end increased 28.0% due to an increase in safety stock and “continued investments” around product made for the outlet factory stores. It also includes new product categories for 2011, including hats and bags coming in house and the introduction of new cotton products.

Regarding outlook, the company now expects 2010 annual net revenues in the range of $1.03 billion to $1.035 billion, an increase of 20.0% to 21.0% over 2009. This compares to original forecast of sales to range between $990 million and $1.01 billion. Diluted earnings per share are expected to be in the range of $1.23 to $1.24, an increase of 34.0% to 35.0% over 2009.