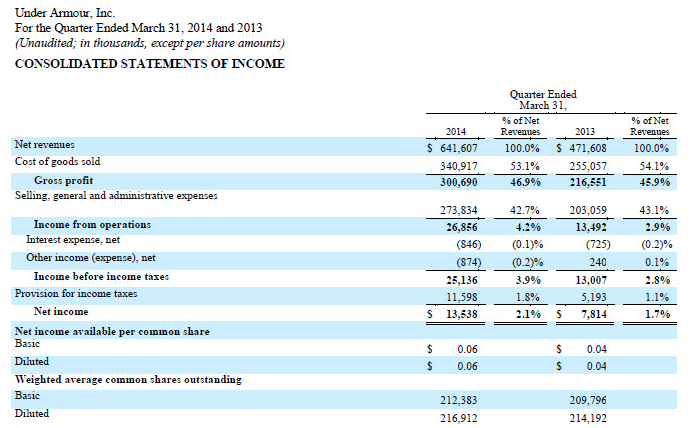

Under Armour, Inc.'s net revenues increased 36.0 percent in the first quarter of 2014 to $642 million compared with net revenues of $472 million in the prior year's period. Net income surged 73.3 percent in the first quarter of 2014 to $13.5 million, or 6 cents a share, compared with $7.8 million, or 4 cents, in the prior year's period, exceeding Wall Street's consensus estimate of 4 cents a share.

Under Armour, Inc.'s net revenues increased 36.0 percent in the first quarter of 2014 to $642 million compared with net revenues of $472 million in the prior year's period. Net income surged 73.3 percent in the first quarter of 2014 to $13.5 million, or 6 cents a share, compared with $7.8 million, or 4 cents, in the prior year's period, exceeding Wall Street's consensus estimate of 4 cents a share.

Diluted earnings per share calculations for both periods reflect the company's two-for-one stock split effective April 14, 2014.

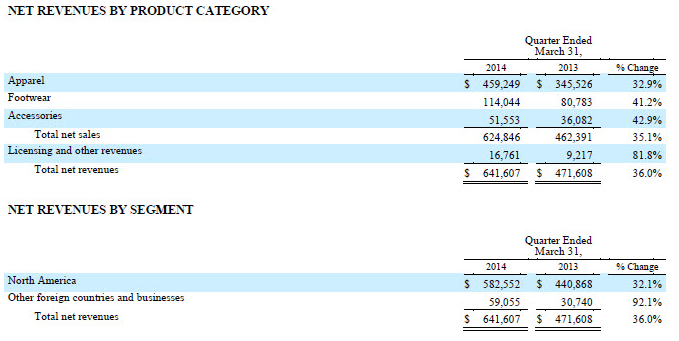

First quarter apparel net revenues increased 33 percent to $459 million compared with $346 million in the same period of the prior year, including expanded offerings in categories such as golf, hunting, training, studio, and basketball. First quarter footwear net revenues increased 41 percent to $114 million from $81 million in the prior year's period, led by new introductions in running including SpeedForm Apollo. First quarter accessories net revenues increased 43 percent to $52 million from $36 million in the prior year's period, primarily driven by headwear. Direct-to-Consumer net revenues, which represented 26 percent of total net revenues for the first quarter, grew 33 percent year-over-year. International net revenues, which represented 9 percent of total net revenues for the first quarter, grew 79 percent year-over-year.

Kevin Plank, Chairman and CEO of Under Armour, Inc., stated, “We are off to a great start in 2014 driven by broad-based strength across our Apparel, Footwear, and International growth drivers. Our formula for driving newness and innovation in Apparel continues to resonate with consumers and helped deliver over 30 percent growth for our largest product category. That same model is contributing to success in Footwear, where we accelerated growth in running and brought award-winning product to the marketplace with the SpeedForm Apollo. Finally, we enhanced our ability to reach the global athlete, including the recent expansion of our brand in key Latin American markets, as well as strong gains across Europe and Asia.”

Gross margin for the first quarter of 2014 was 46.9 percent compared with 45.9 percent in the prior year's quarter, primarily driven by supply chain enhancements and a favorable sales mix in the Factory House outlet business. Selling, general and administrative expenses as a percentage of net revenues were 42.7 percent in the first quarter of 2014 compared with 43.1 percent in the prior year's period. First quarter operating income increased to $27 million compared with $13 million in the prior year's period.

Balance Sheet Highlights

Cash and cash equivalents decreased 30 percent to $180 million at March 31, 2014 compared with $256 million at March 31, 2013. Inventory at March 31, 2014 increased 46 percent to $472 million compared with $324 million at March 31, 2013. The company had $100 million in debt outstanding under its $300 million revolving credit facility at March 31, 2014. In support of the company's Connected Fitness platform, the $150 million purchase of MapMyFitness in December was funded using $50 million in cash and $100 million under the revolving credit facility. Long-term debt, including current maturities, decreased to $52 million at March 31, 2014 from $60 million at March 31, 2013.

Updated 2014 Outlook

Based on current visibility, the company expects 2014 net revenues in the range of $2.88 billion to $2.91 billion, representing growth of 24 percent to 25 percent over 2013, and 2014 operating income in the range of $331 million to $334 million, representing growth of 25 percent to 26 percent over 2013.

On Jan. 30 when reporting fourth-quarter results, UA projected 2014 net revenues in the range of $2.84 billion to $2.87 billion, representing growth of 22 percent to 23 percent over 2013, and 2014 operating income in the range of $326 million to $329 million, representing growth of 23 percent to 24 percent over 2013.

Plank concluded, “This strong start to 2014 illustrates the unlimited potential that still lies ahead for our Brand, whether it is today's opening of our Brand House in New York City or our product hitting shelves for the first time in Brasil. Our opportunity requires that we remain focused on building powerful product platforms that service athletes at home and abroad, on and off the playing field. In the quarters ahead, we will continue to build upon some of our most recent platform launches like SpeedForm and ColdGear Infrared, while also delivering the overall product innovation and performance that athletes have come to expect from our Brand. Through the lens of our global Brand Holidays and leveraging our diverse array of sports marketing and Connected Fitness assets, we are well positioned to tell these stories in new and powerful ways.”