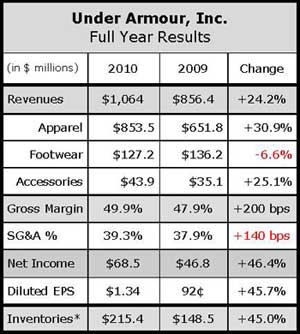

Under Armour, Inc. made history during 2010, breaking the billion dollar mark for the first time in company history as it continues to develop its product lines and build its endorsement portfolio.

Under Armour, Inc. made history during 2010, breaking the billion dollar mark for the first time in company history as it continues to develop its product lines and build its endorsement portfolio.

In a conference call with analysts, company Founder, Chairman and CEO Kevin Plank said surpassing the billion dollar mark was a “big deal” and added that key investments such as the recent signing of Patriots’ QB Tom Brady and the Auburn Tigers have allowed the company to finish strong while paving the way for continued growth in 2011. Plank also pointed to an emerging footwear business, which has seen solid results from in cleated product and encouraging early results from its recent basketball footwear launch. Plank added that the company will focus on five key drivers moving forward men’s apparel, women’s apparel, footwear, direct-to-consumer and international.

For the fourth quarter ended Dec. 31, total revenues increased 35.5% to $301.2 million from $222.2 million in the prior-year quarter. Growth came from strength in all major categories, including apparel, which improved 32.2% to $254.0 million from $192.1 million in Q4 2009.

Management said growth was driven by “sustained momentum” across the Men’s, Women’s and Youth businesses. Footwear, which benefitted from the aforementioned fall basketball launch and growth in baseball cleats, more than doubled to $21.9 million from $8.7 million in the prior-year period while Accessories jumped 28.0% to $14.8 million from $11.5 million in Q4 2009. The licensing business, which represents about 3% of the company’s overall business, increased 6.3% to $10.5 million. Direct-to-consumer sales, which represented about 33% of total net revenues, jumped 56%.

Earnings increased by about half to $22.9 million, or 44 cents per share, in the fourth quarter of 2010, compared with $15.2 million, or 30 cents per share, in the prior year's period.

Gross margin was 51.7% of net sales, up 50 basis points to 51.2% in Q4 2009, due primarily to a higher percentage of revenue from the company’s higher margin Direct-to-Consumer channel and lower footwear markdowns. Selling, general and administrative expenses as a percentage of net revenues were 40.0% in the fourth quarter of 2010 compared with 39.1% in the fourth quarter of 2009 as a result of continued expansion of the factory house stores and higher performance bonus expense given strong results.

Perhaps the most noteworthy news was the company’s announcement of launch information regarding its first cotton line, which was originally hinted at more than a year ago during a conference call with analysts. Once dubbed by Plank as “the enemy” as he kicked off trade shows by slamming a sopping wet cotton tee on a table, Under Armour will dive into the cotton business headfirst with its February shipment of Under Armour Charged Cotton, a “technology-based” product the company said takes “standard cotton fabric and infuse(s) it with performance material.”

Plank promised the new cotton line will bring “a whole new level of performance to a category where expectations have been low” and predicted it will be “one of the biggest product stories we’ve had since our first shirt in 1996.” Plank said one of the goals of the cotton campaign isn’t to establish new channels of distribution for UA, but to create a new premium price point in a $25 cotton tee.

When asked about the possible cannibalization effect cotton performance tees may have on UA’s collection, Plank said he doesn’t foresee any issues because it’s “almost a whole new category” that focuses more on the lifestyle aspect of apparel than the company’s core baselayer line. Plank also mentioned rising cotton prices, but said the effect on UA would be “minimal” because the company isn’t heavily reliant on cotton.

Among other developments, Plank confirmed UA has made a minority investment of approximately $10 million in Dome Corp., its Japanese licensing partner. Plank said the company sees growth in Japan as a “template for a model for approaching other international markets.” Sales in Japan topped $105 million during 2010 and Plank noted that UA is focused on broadening the Japanese consumer’s interest from compression and men’s to other categories.

Looking ahead, Under Armour raised revenue outlook for fiscal 2011 to a range of $1.33 billion to $1.35 billion, which would represent growth of between 25% and 27%. In October, UA forecast revenues of $1.29 billion for 2011. The company expects operating income in the range of $143 million to $147 million, representing growth of 27% to 31% over 2010.

In related news, UA will reportedly spend $60.5 million to buy the entire Tide Point waterfront office complex, home of its corporate headquarters, with plans to convert it into a “palatial corporate campus.”

Management said the purchase would give the company greater control over the development and expansion of its corporate headquarters and will have minimal impact on cash flow from both a purchase perspective and a go-forward operational basis.

>>> With no market testing evident, UA is clearly going out on a limb with its cotton product a strategy that didn’t work out so well with its first shoe launch a few years ago. It will be interesting to see if the consumer sees the difference between “performance cotton” and “basic cotton” and if that perceived difference is worth the extra money…