Deckers Brands reported fiscal second-quarter results that beat analysts expectations with sales and earnings growth of more than 20 percent, prompting the parent of Uggs, Teva, Sanuk and Hoka One One to raise its estimates for its fiscal year.

Deckers Brands reported fiscal second-quarter results that beat analysts expectations with sales and earnings growth of more than 20 percent, prompting the parent of Uggs, Teva, Sanuk and Hoka One One to raise its estimates for its fiscal year.

The one disappointment was its guidance for the fiscal third quarter, which came in short of Wall Streets consensus estimate. Shares on Friday, the day after earnings were released the prior night, slid $6.54, or 7.4 percent, to $81.56 in over-the-counter trading.

But Decker officials said much of the second-quarters benefit came at the expense of orders being shifted from the third and remained bullish on the holiday period.

We believe that our current momentum has the company well-positioned as we head into our biggest, most important selling season, said Angel Martinez, president and CEO, said on a conference call with analysts.

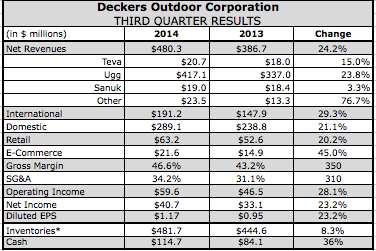

In its second quarter ended Sept 28, revenues rose 24.2 percent, to $480.3 million while earnings climbed 23.2 percent to $40.7 million, or $1.17 a share. Results exceeded its revenue guidance by approximately $22 million and EPS guidance by 19 cents a share. The upside revenue was driven mostly by the timing of domestic and international wholesale sales, which shifted into the second quarter and out of the third quarter. The EPS upside was attributed to the higher sales recorded in the quarter combined with a shift of some planned marketing expenses to the third fiscal quarter.

Martinez said the fiscal second quarter is a transitional period for the company.

The Ugg, Teva, and Sanuk brands summer collections wrapped up a solid selling season as consumers responded favorably to our improved offering of sandals and casual shoes, said Martinez. At the same time, Hoka continued to grow at a rapid pace driven by increased distribution of the brand’s innovative running shoes that are now reaching a broader consumer audience.

Ugg, by far its largest brand, drove the gains with sales ahead 23.8 percent to $417.1 million. The increase was driven by higher global wholesale sales, the sales contribution from new worldwide retail store openings and an increase in global e-commerce sales, partially offset by a decrease in same store sales and international distributor sales. The decrease in international distributor sales was mainly due to the conversion of the German market from distributor to direct wholesale.

Martinez said Uggs sell-throughs this fall were helped by a focus on sharper opening price points.

Sell-in for the fiscal quarter was ahead of our projections as some international and domestic wholesale customers requested earlier deliveries into this quarter, said Martinez. In terms of sell-through, it has been a good start to the fall with consumer demand for our collections up nicely over last year and in line with our expectations.

Transitional sneakers, casuals, and slippers sold well early in the second quarter while casual boots saw good demand later in the period as consumers responded to enhanced styling and a stronger value component. Said Martinez, With temperatures turning cold in recent weeks, sell-through of weather boots and classics have gained pace across the majority of our markets.

Uggs Classics collections are expected to gain a boost from ramped-up marketing this year, including building on the August launch of ‘This is Ugg, its first global campaign. Men’s casual shoes and boots have consistently sold well since its ‘This Is Ugg campaign with Tom Brady kicked off at the start of the NFL season. Ugg home and loungewear, two small categories have been very strong and will gain a full presentation this holiday at its own stores as well as Nordstrom, Dillard’s and Neiman Marcus.

Overall were clearly seeing the benefits of our expanded Ugg product line as we build on the strength of the Ugg brand to increase our exposure to new audiences and improve our performance across all seasons, Martinez said.

Teva brand sales increased 14.9 percent in the quarter to $20.7 million. The increase in sales was driven by higher domestic wholesale sales and global e-commerce sales, partially offset by a decrease in international wholesale and distributor sales.

Martinez said Teva’s performance continues to benefit from efforts to position the brand’s Original Sport Sandal with promotional platforms and events that click with todays younger consumers. The brands integrated digital PR, social and sponsorship campaign has generated over 500 million impressions year-to-date, significantly broadening Tevas consumer reach.

The Originals Collection has been a halo for the brand’s entire product line, helping drive sales of flip-flops, casual shoes and boots, and hiking boots during the second quarter, said Martinez. To build on the momentum and extend the brand’s selling season, Teva in October launched a collaboration campaign with Woolrich entitled Socks and Sandals thats being sold at Urban Outfitters as well as teva.com and woolrich.com. In addition, Teva is pulling forward a select 2015 introductions for holiday selling, especially in warmer weather locations.

Looking ahead to next year, we are refreshing our Originals line with new colors and new materials, while at the same time leveraging the Originals DNA to launch a new collection of lifestyle footwear featuring canvas casuals and boots for men and women, said Martinez.

Sanuk brand sales increased 3.2 percent in the quarter to $19.0 million. The increase was driven by higher global e-commerce sales, domestic retail sales and international wholesale and distributor sales, partially offset by a decrease in domestic wholesale sales.

Martinez said sales of women’s sandals, especially from the brand’s popular Yoga Mat collection, performed very well during the quarter. In men’s, new styles of the brand’s iconic Sidewalk Surfer, as well as new canvas casuals helped drive sales.

The plan is to build early momentum for spring 2015 over the next two quarters by emphasizing new product introductions in stores and on our website including women’s yoga ballet flats, our women’s Cat collection of casual contemporary shoes, and men’s casual with a focus on the stylish Boulevard Collection, said Martinez. We believe that we have a great long-term potential for Sanuk with the casual footwear market and believe that we can leverage the brand’s authentic surf heritage into more mainstream opportunities.

In its Other Brands segment, sales catapulted 76.5 percent to $23.5 million, primarily attributable to a $9.3 million increase in sales for Hoka. The division also includes Tsubo, Mozo and Ahnu.

Martinez said Hokas performance benefited from the launch of the Clifton, which won Editor’s Choice awards from both Runner’s World and Competitive magazine. The styles more-commercial aesthetic has helped broaden Hokas consumer appeal and comes as the running brand is looking to expand beyond running specialty doors and international sporting goods chains early next year. These include reaching The Sports Authority, Finish Line, and Hibbett Sports in January 2015.

These sporting goods chains, combined with Sports Chalet and others, will put us in 100 sporting goods stores by spring of 2015, and in addition, were launching a trail running shoe exclusively for REI called the Challenger ATR, which will be featured this holiday season in all 136 REI doors, said Martinez. So overall, we are very pleased with how the brand is progressing at this stage, and were excited about the broader distribution opportunities that lie ahead.

Sales for the global retail store business, which are included in the brand sales numbers, increased 20.1 percent to $63.2 million, driven by 33 new stores opened after Sept. 30, 2013, partially offset by a same-store decrease of 8.8 percent. E-commerce sales jumped 45.1 percent to $21.6 million, driven primarily by strong domestic and international sales for the Ugg, Teva and Sanuk, plus the domestic launch of the Hoka, and the addition of new international e-commerce websites.

Domestic sales increased 21.1 percent to $289.1 million while international sales jumped 29.2 percent to $191.2 million.

Gross margin expanded 340 basis points in the period to 46.6 percent while SG&A expenses as a percent of sales were 34.2 percent compared to 31.1 percent for the same period last year.

Deckers Brands plans to increase marketing expenditures in Q3 and Q4 to drive traffic to its brick-and-mortar locations and to its online sites. Based on Ugg’s second fiscal quarter performance, strong backlog, and e-commerce trends, Deckers now anticipate revenues for its full fiscal year to increase approximately 15 percent to $1.825 billion, up from the previous guidance of 14 percent. Ugg brand revenue is now projected to increase approximately 14 percent versus its prior expectation of approximately 12 percent.

EPS is now expected to increase 15.8 percent to $4.71, up from previous guidance of 14.5 percent growth.

For the third quarter ended Dec. 31, Deckers expects revenues to increase approximately 10 percent compared to the same period in the prior year, and diluted EPS to increase approximately 10 percent to $4.46 per share. Wall Streets consensus estimate had been $4.75 a share.

For the fiscal fourth quarter ending Mar. 31, it expects revenues to increase approximately 10 percent and EPS to land at 15 cents per share compared to a loss per share of 8 cents for the same period in the prior year. Wall Streets consensus estimate had been 4 cents.

Deckers also noted that it recently completed its sheepskin negotiations for fall 2015 and spring 2016 and expects a mid-single-digit decrease compared to the last year. The benefit will partially be offset by higher prices for other raw materials, namely leather, and an expected carryover of sheepskin inventory at higher prices. In sum, Deckers believes this will lead to a 40- to 50-basis-point improvement in FY16 gross margins over projected FY15 levels.

Regarding the overall environment, Martinez said the retailer industry as a whole is seeing traffic declines and macro shifts but he believes Deckers efforts to build its omni-channel approach will help address these challenges.

We plan to continue to learn and adapt our strategy as necessary to address these issues in real time, said Martinez. Going into our peak selling season, we believe that we can continue to drive strong sales and earnings growth, notwithstanding a mixed macroeconomic backdrop and continued pressure on the consumer.