Tillys Inc. reported glimpses of improvement in the teen market in the third quarter ended Nov. 1, when its same-store sales fell 1.2 percent, or half the rate of a year earlier.

Tillys Inc. reported glimpses of improvement in the teen market in the third quarter ended Nov. 1, when its same-store sales fell 1.2 percent, or half the rate of a year earlier.

Among the signs were higher average dollar sales (ADS), higher response rates to marketing campaigns, higher conversion rates and higher merchandise margins, which the company attributed to less promotion retail environment.

“Were seeing some slight improvement in the fundamentals of their behavior,” TLYS President and CEO Dan Griesemer said of the action sports retailer target demographic. “That’s a slight improvement in the traffic trends, slight improvement in conversion trends and ADS trends, a slight improvement in the response to our marketing efforts. It just seems like things are improving slightly.”

Griesemer said a back-to-school men’s footwear initiative rolled out late in the second quarter helped drive improved footwear comps during the third quarter and is carrying over into the fourth quarter. Sales of Men’s, Footwear, Accessories and Kids all improved.

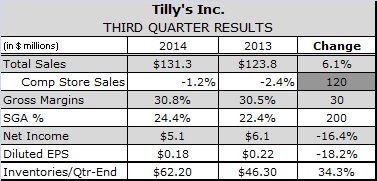

Gross profit increased 7.1 percent to $40.5 million, or 30.9 percent of net sales compared to 30.6 percent in the third quarter of 2013, primarily due to a 30 basis point increase in product margins, which set a five year record in 2013.

SG&A, however, grew more than twice as fast, or by 15.4 percent and reached 24.3 percent of net sales, up 170 basis points (bps) from a year earlier. The increase was due primarily to deleveraging on store payroll and incremental marketing expense during the quarter, including a catalog mailing.

Operating income declined 15.7 percent to 6.5 percent of net sales, down 170 basis bps from a year earlier. Net income was $5.1 million, or 18 cents per diluted share, compared to net income in the third quarter of 2013 of $6.1 million, or 22 cents per diluted share.

The company ended the quarter with cash and marketable securities of $61.3 million, an increase of 21.2 percent over the third quarter of last year. Inventory totaled $62.2 million at the end of the quarter, up approximately 2.5 percent on a per square foot basis compared to the prior year as planned, and reflecting the significant reductions to inventory last year.

The retailer expects fourth quarter comparable store sales to be flat to negative low single digits, and net income per diluted share to be in the range 15-19 cents, compared with 19 cent a year earlier based on a stable tax rate and no significant change in shares outstanding.

Griesemer sees the improvement coming from a new responsive design e-commerce platform TLYS implemented on time and on budget during the third quarter that he said puts the retailer significantly ahead of its peers, who include Pacific Sunwear of California Inc. and Zumiez Inc., which also reported earnings last week. The new platform will greatly enhance TLYS ability to craft custom messages for the more than 1 million members of its Hooked Up loyalty program. TLYS will no longer break out comp store sales for its bricks-and-mortar stores and online stores because the shopping behavior has made such distinctions meaningless.

The retailer also added several categories and brands it expects to fuel sales growth in the fourth quarter, including GoPro, Stance, Sector 9 and Full Tilt Dream, as well as exclusive products from Hurley and LRG, Volcom, Adidas and Vans.

“In terms of discounting, we have seen a good start to the holiday season,” said Griesemer. “Through the Black Friday weekend and Cyber Monday, we actually were no more promotional than the year prior.”