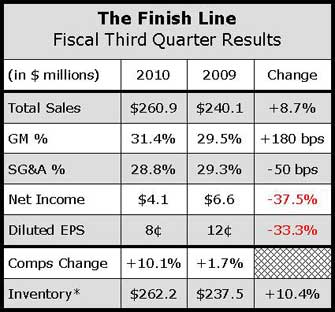

Led by a continuing resurgence in the running shoe category and a pickup in basketball, The Finish Line reported sales rose 8.7% to $260.9 million in its third quarter ended Nov. 27. Comp store sales increased 10.1% for the period on top of a 1.7% increase in fiscal Q3 last year. Comps for the current month-to-date period from Nov. 28 through Dec. 19 increased 4.5% on top of a 4.9% increase for the same period one year ago.

Excluding a year-ago tax benefit, third quarter earnings rose to $4.1 million, or 8 cents per share, from only $16,000, or zero cents a share, a year ago.

By month, comps grew 7.5% in September, 14.6% in October, and 9.6% in November. The comp increase during the quarter, was driven by strong sales in running and improving sales in basketball. Store traffic in the quarter was up almost 1% and conversion was up over 2%, while average dollars per transaction were up 6%.

On a category basis, footwear comps increased 10.8% for the quarter. By month, footwear comps grew 8.5% in September, 16.7% in October, and 9.1% in November. Footwear ASPs increased 5% in the quarter due to strong sell-through at full price and reduced aged inventory.

Running continued to lead footwear in the quarter with double-digit increases in both men's and women's. Running was led by Nike's platforms, including Air Max, Shox and lightweight running models such as Lunar and Free. The Finish Line is on schedule to roll out Nike Track Club to about half of its chain by June. The running category also saw strong performances from Puma, as well as ZigTech from Reebok, particularly in men's. Tech running also performed well, led by Asics, Mizuno, and Brooks.

Basketball rebounded to deliver its first positive comp of the year, “driven by a stronger product lineup than we've seen in some time,” said company President and COO Steve Schneider during a conference call with analysts. Brand Jordan drove basketball's mid-single-digit comps with strong retro, team and lifestyle footwear while Nike Hyperfuse also performed well. Reebok's new ZigTech basketball shoe endorsed by last year's NBA's top-pick John Wall performed well and Under Armour's entry into basketball with the Brandon Jennings shoe “was also a hit,” said Schneider.

Toning, representing about 2% of total sales, continued to be a positive contributor to Q3 comps as well. Schneider said that while toning will remain “a small but contributing part of the business for some time to come,” the retailer will begin to anniversary significant growth in this category in the fiscal fourth quarter. Schneider also noted that the toning opportunity is evolving to a training and muscle activation focus. Added Schneider, “Nike has entered this marketplace with its pre-training shoe which is keeping innovation fresh.

Athletic casual was down double-digits as inventory investments were shifted to running and other categories but the decline still was better than its internal plan, led by core basic styles from Nike, Adidas, Lacoste and Polo. Boots “started off a little slow this season,” but continued to gain momentum as colder months arrived, according to Schneider. Solid performances in boots have lately been coming from Nike, Polo and Timberland.

Kids' comps were up high-single-digits, rebounding from a decline a year ago. Kids’ was driven by running, with strength in Reebok Zig and Nike Shox as well as basketball and boots. FINL’s exclusive Lego collection continued to perform well.

Softgoods comps increased 6.9% in fiscal Q3, “improving steadily throughout the quarter as seasonal apparel such as fleece, jackets and pants kicked in, led by Jordan and Under Armour, as well as its substantial licensed and branded fleece program,” said Schneider. Softgoods comps grew 12.2% in November boosted by a positive apparel comp of 11.2% in the month. Apparel comps overall were up low-single-digits in the quarter, led by strong sales in Jordan and Nike for men, and a “powerful performance” by The North Face, which the Schneider said is “significantly up” in both men's and women's. Accessory sales remained strong, up double-digits, driven by socks and watches as well as the Power Balance Band.

E-commerce sales were up 25% for the quarter, with traffic and conversion rates both up in double-digits. Mobile commerce has grown to account for about 10% of their online traffic. The retailer is participating in Google's Local Shopping feature, which allows consumers to check their mobile or desktop to see if the item they want at Finish Line in the right size and color is available immediately at a nearby store. Special order sales through its We've Got It program were up 15% in Q3, and Winner's Circle loyalty sign-ups jumped 11%.

Aged inventory is at historical low levels.

Fiscal fourth quarter comps and earnings excluding non-operating adjustments are projected to increase although product margins are expected to decline due to the slowdown and lower prices in the toning category.