The Finish Line, Inc. wasnt talking much last week about its planned merger deal with Genesco, Inc., except to outline some of the financing in place to fund the deal. The high debt load the deal will bring with it had a number of analysts skittish enough about the deal that the FINL share price is running down about 27% since the deal was announced two weeks ago. The other issue here is based on the concern about diverting The Finish Line managements attention away from the task at hand — turning around the business at the retailers Finish Line nameplate — as they focus on getting this deal done and the companies integrated.

Through all of this, FINL still needs to deal with the realities of the marketplace. Performance footwear continues to be troublesome, the womens business has moved sharply away from athletic, classics are hurting, and lifestyle fashion athletic product just doesnt deliver the same price-points as the performance side of the business.

As for the Genesco deal, management said the $1.6 billion in committed financing in place with UBS included a $450 million asset-based revolver, of which $250 million is expected to be drawn at close, a $690 million senior secured term loan, and a $700 million senior unsecured bridge loan. Management was adamant that there was no “out” for UBS based on a decline in share pricing or other factors.

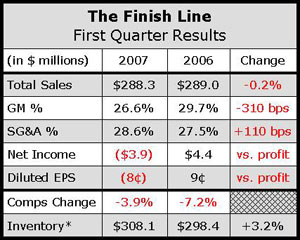

The sales decline at The Finish Line, Inc. for the fiscal first quarter ended June 2 was due in large part to a very weak apparel business. Comps at the companys Finish Line format were down 4.1%, while comps at the Man Alive business were up 0.6% for the period. The direct-to-consumer business was once again up in the double-digits for the quarter.

At Finish Line, footwear comps were down less than one percent after a high-single-digit decline in Q1 last year, but the softgoods end of the business comped down more than 20% for the period. The Finish Line CEO Alan Cohen said the Finish Line business saw “continued strong demand [for] premium products,” such as Shox Running, Jordan and Nike LE, along with “significant growth” with many brands in its sports style business, which includes casual athletic, sandals and outdoor footwear. However, he also said the strength was not enough to offset the continued weakness in the mid-price-point and classics running product, most notably a tough go for the New Balance 574 program that was very strong last year. The declines were offset a bit by continued strength in Air Force 1, which posted a “strong double-digit increase on substantially higher sell-throughs versus last year, and the adidas Superstar, which is still “selling very well.”

In performance running, average selling prices were up in mid-single-digits, driven by improved sell-through trends, Asics, and Shox. Sales in the mens Shox business were up in mid-singles on a comp basis, while the womens business was “down slightly, but performed above plan.” Cohen said that Puma “nearly doubled” its running business from last year. The basketball business was all about Jordan.

The sport style business was up in double-digits in both mens and womens in the first quarter, growing to about 25% of the total mens footwear sales and 40% of the womens business. Cohen called out Puma, adidas, Lacoste, and Ekko. Mens and womens sandals “nearly doubled” on a comp sales basis and they saw strength in mens and womens canvas, driven by Chucks, Rocket Dog, Keds, and Roxy.

The kids footwear business was a bright spot, delivering a double-digit gain for the quarter, driven by strength in Heelys and Jordan.

Overall average selling prices were down 4.1% for the quarter and down 8.1% in May alone. FINL said the May decline was exacerbated by higher sales in the canvas and sandals categories. Promotions also cut into product margins, which were down 210 basis points for the quarter.

The decline in apparel sales was attributed to weakness in branded apparel, but management did see positive results with Under Armour and NCAA product. Mr. Cohen seemed particularly pleased with their role as the exclusive mall specialty outlet for Under Armour and said that the brand will be in a “little over half” the Finish Line doors by the time the Holiday period rolls around. He made no mention of Under Armours first non-cleated footwear program, which will hit retail next spring.

The Finish Line format will see more square footage going to footwear and away from apparel even as the retailer moves to reduce the size of its stores. More footwear is expected to come off the wall and onto tables and fixturing on the floor, but will be in both places in many cases. Apparel inventories have been reduced by approximately 15%, still short of the sales decline, but the retailer expects to see that line up as they move into the back half of the year. Apparel was roughly 15% of first quarter sales, but generates about 18% to 19% of sales during the Holiday period.

>>> With all the red on the chart above this is either the perfect time or the wrong time for the GCO deal. Its a matter of perspective. Go Big or Go Home may be the new FINL position…