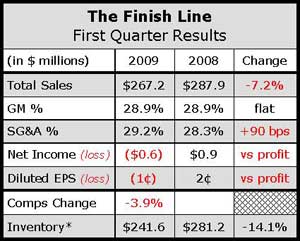

Finish Line Inc. posted a small loss in its first quarter ended May 1 due to a pre-tax loss of $3.9 million from its Man Alive division, which is in the process of being divested (see page 6), but weak traffic remains a drag on its core Finish Line business.

At the Finish Line concept, pretax operating income slid 26.8% in the quarter to $3 million from $4.1 million in the year-ago period. Comp store sales declined 3.9% for the quarter. Gross margins at the chain increased 15 basis points while SG&A expenses increased 50 basis points as a percent of sales.

On a conference call with analysts, CEO Glen Lyon cited “some real bright spots” in the quarter, including strength in the running category, steady improvement in conversion rates and robust e-commerce growth. But he said the retail climate remains challenging.

“Traffic continues to be down, and unlike this time last year, there are no economic stimulus tax rebate checks,” said Lyon. “Against this backdrop, during the first quarter our core Finish Line business performed on plan.”

Average dollars per transaction and customer conversion both increased over last year, partially offsetting traffic declines.

By month, comps decreased 1.9% in March, 3.6% in April, and 6.8% in May. Month-to-date June comps were running down 12.7%. FINL said the declines largely reflect tough year-ago comparisons given 2008's mailing of stimulus checks, particularly April through July. The toughest comparison is June, when year-ago comps leapt 10.3%. On a two year basis, month-to-date comps for June are down about 2%, consistent with the two-year first quarter comp decline of 2.3%.

Ed Wilhelm, The Finish Line's new CFO, suggested that Q2 of last year was the most difficult quarterly comparison they face this year. The comparisons are expected to get a bit easier in the back half.

Among categories at the Finish Line concept, footwear comps in Q1 were down 2.6%, with mens and kids down 3%, and womens down less than 1%. For the quarter, ASP's were up 3%. The best performing brands included Nike, Brand Jordan and Puma.

“Our biggest partner, Nike, continues to perform above the average,” Sam Sato, Finish Line's chief merchandising officer, told SEW. “While we are seeing softness in certain categories of Nike, they've introduced new innovative products like Max 09 that's selling very well and retails at $160.” He also pointed to “other core brands” like Puma and Asics as “doing well too.”

Running was up mid-single digits, driven by fashion running from Nike and Puma and the Air Max 2009 introduction. Performance running also continued to trend positive, led by Asics. Sato also said the introduction of Under Armour running shoes has done “pretty good.”

Basketball was down mid-single digits against tough comparisons.

Encouraging results in performance basketball were offset by declines in Jordan Retro. Jordan Fusion results were below expectations. Lifestyle comps were down high-single digits, although the company “continued to see an upside” in vulcanized and Nike products for both men and women, led by high tops.

In apparel, comps plunged low-double digits, but margins were up over 600 basis points and the gross margin dollar plan was exceeded due to a focus on premium apparel brands such as Jordan, North Face and Oakley.

Accessories sales were up in the mid-singles for the first time in over a year driven by shoe care along with positive trends in bags, sunglasses and watches.

E-commerce sales were up 14% as the chain tested several free shipping models. Redemption of Q1 direct mail pieces was up 21% from last year. Finish Line also experienced a “significant increase” in in-store pick up, and sign ups in their Winner Circle loyalty program were up 32%.

Gross margins were flat at 28.9%. Product margin including shrink increased 30 basis points but that was offset by an increase in occupancy costs as a percent of sales. Occupancy cost in dollars declined 5.4% due to successful lease renegotiations. For Finish Line only, occupancy cost was down 4.5% in dollars and up 10 basis points as a percent of sales.

For Finish Line only, SG&A costs dropped 3.3% in dollars, but increased 50 basis points as a percent of sales. Investments in e-commerce and special order sales accounted for almost half of the 50 basis point increase in SG&A.

On a per square foot basis, Finish Line inventories decreased 10%.

Looking ahead, Lyon expects continued positive results in running for the rest of the year and remains “optimistic about the dynamics we are seeing” in lifestyle as more consumers are wearing sneakers as “everyday attire.” But he said the downturn is making consumers more discriminating in their buying decisions. The assortment of products considered premium has been reduced and their premium status doesn't last as long..”