StockX, the sneaker and luxury products marketplace, announced that the company has closed a $44 million Series B funding round co-led by global technology-focused investment firms GV (formerly Google Ventures) and Battery Ventures.

The $44 million investment will provide capital for StockX to expand its reach internationally and significantly increase its worldwide user access to the transparent, authentic, anonymous and liquid marketplace. The company said that prior to StockX it was very difficult to attain market pricing, sales histories, current best bid and lowest ask for these product categories, and these categories were highly susceptible to fraud and lacked the liquidity needed for a true, stock market-like platform. StockX also plans to utilize the funding to add and grow its authentication centers as well as broaden its range of product categories.

Joining GV and Battery Ventures in this round are several high-profile investors including famed DJ Steve Aoki; model and entrepreneur, Karlie Kloss; streetwear designer Don C; Salesforce founder chairman and co-CEO, Marc Benioff; Bob Mylod, founder and managing partner of Annox Capital; Shana Fisher, managing partner at Third Kind Venture Capital and Jonathon Triest, managing partner of Ludlow Ventures. Current investors who participated in the round include Detroit Venture Partners (DVP) and Courtside Ventures as well as high-profile individuals including Eminem, Mark Wahlberg, Ted Leonsis, Tim Armstrong, Scooter Braun and Ron Conway of SV Angel.

The Detroit-based company is one of the fastest-growing, e-commerce startups in the country. This landmark funding marks the largest round of high-tech venture capital-led investment ever raised by a Detroit startup.

“When we launched StockX just over two years ago, we did so with the idea that our innovative platform would revolutionize and dramatically improve the buying and selling experience of many categories of consumer products,” said Josh Luber, StockX CEO. “We are grateful to the incredible group of high-profile investors who have supported us from the beginning. Adding leading Silicon Valley venture capitalists, GV and Battery, to the investor group will not only provide the additional capital to take us through our next growth phase, but also bring the invaluable experience and knowledge of firms who have invested in so many household name tech-based success stories of the past decade or more.”

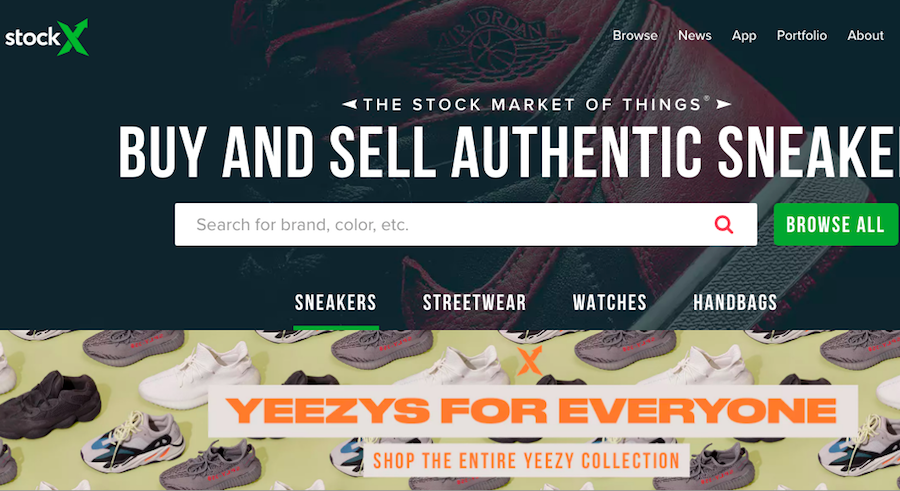

Co-founded in 2016 by Luber, StockX COO Greg Schwartz and Dan Gilbert, founder and chairman of Quicken Loans, StockX has added three additional verticals to its flagship sneaker marketplace to include streetwear, watches and handbags. Currently, the StockX platform is averaging over $2 million dollars in daily transaction value, moving thousands of products through its primary authentication center in Detroit as well as two satellite centers closer to the east and west coasts. The team has grown to more than 400 team members and continues to hire aggressively.

“When we talk about our vision of helping to remake Detroit into a job-producing, high-tech, 21st century urban center that is a talent magnet for the best and brightest, you could not be more excited about a company than StockX,” said Gilbert. “We are hopeful that StockX will not only continue its rapid growth, but that it will serve as confirmation that Detroit is one of the cities on the shortlist that entrepreneurs must consider to launch their high-tech startups.”

“There is a huge opportunity for StockX to continue to diversify and scale its products with the efficiency and transparency that have become hallmarks of the company’s marketplace,” said Joe Kraus, general partner at GV. “Between StockX’s rapid development and the founding team’s ability to create a high-growth enterprise, the company is well-positioned to meaningfully impact the market for sought-after consumer products. We’re excited about investing in Detroit, MI, which is emerging as an important hub for financial technology and innovation.”

Launched as Google Ventures in 2009, GV is the venture capital arm of Alphabet Inc. Battery Ventures is a 35-year-old, technology-focused investment firm that invests in early- as well as late-stage companies including online consumer marketplaces from six global offices.

“StockX is changing the way people buy consumer goods and doing so at a rapid rate,” said Battery Ventures General Partner Roger Lee. “The growth the company has seen in such a short time is notable and is due in large part to the team behind the platform; they bring the leadership, subject matter expertise and experience required for continued expansion and greater market share.”

The StockX platform currently features a wide range of brands across verticals including Jordan Brand, adidas and Nike; Supreme, BAPE, Palace and Kith in the streetwear category; handbag leaders Louis Vuitton, Goyard, Gucci and Chanel and Rolex, Audemars Piguet and Omega among other timepiece brands.

In addition to its core business, StockX has contributed more than one million dollars to foundations and nonprofits across the country through its Charity IPO program, an ongoing initiative aimed at raising funds for the world’s most important causes by partnering with noted philanthropic organizations and some of the world’s biggest celebrities, including: Eminem, Pharrell, Mark Wahlberg, Snoop Dogg, Virgil Abloh, DJ Skee, Steve Aoki, 2 Chainz, Don C, Jon Buscemi, Karlie Kloss, Gary Vaynerchuk, Emily Oberg, Russell Wilson, Steph Curry and the Wu-Tang Clan.

Photo courtesy StockX