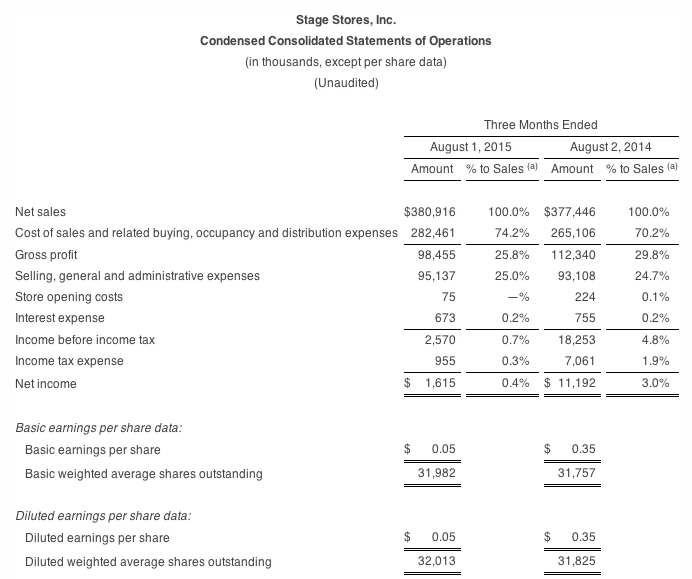

Stage Stores Inc. reported reported net income in the the second quarter tumbled to $1.6 million, or 5 cents a share, from $11.2 million, or 35 cents, a year ago. It also launched a multi-year plan to close approximately 90 underperforming stores representing 4 percent of total sales.

Sales increased 0.9 percent and comparable sales increased 0.8 percent. On an adjusted basis, net income was $7.0 million, or $0.22 per diluted share compared to $0.35 per diluted share in the prior year.

“While we delivered a positive comp, second quarter earnings fell short of our expectation,” said Michael Glazer, president and CEO. “We were challenged by the impact of a weaker peso and economic softness in parts of Texas, Louisiana, Oklahoma, and New Mexico. Our earnings decline over the prior year was driven by a decrease in merchandise margin as we accelerated markdowns on seasonal categories. On a comparable store basis, our quarter ending inventory, excluding cosmetics, was down by 2 percent.”

“During the second quarter, we continued to make progress on our strategic initiatives including the expansion of our omnichannel presence, achieving direct-to-consumer growth of 21 percent. We are also increasing our emphasis on trends and style, improving our store environment and strengthening our connection to our customers.”

The company also announced that, as part of a strategic evaluation of its real estate portfolio, it has launched a multi-year plan to close approximately 90 underperforming stores representing 4 percent of total sales.

Glazer continued, “The closure of stores should enhance our capital efficiency, deliver higher productivity and be accretive to earnings.”

2015 Guidance

The company now expects adjusted earnings to be between $1.05 to $1.15 per diluted share, compared with previous guidance of $1.20 to $1.28 per diluted share. Comparable sales are projected to be flat, compared to the previous guidance range of flat to 2 percent. Weighted average diluted shares for the year are expected to be 32.5 million, and the company anticipates a full-year tax rate of 36.6 percent. The company now expects to open three new stores and close 27 store locations in fiscal 2015.

Glazer concluded, “Although we are excited for the positive benefit of our initiatives, we are reducing our full year guidance, as we expect that the macro headwinds of the first half are likely to extend to the remainder of the year. Longer term, we believe that the strategic initiatives we have in place will drive strong and consistent earnings growth and increased shareholder returns.”

Second Quarter Reported Results

Sales increased 0.9 percent to $380.9 million compared to $377.4 million in the prior year period. Comparable sales increased 0.8 percent. Net income was $1.6 million, or $0.05 per diluted share, versus $0.35 per diluted share for the prior year.

On an adjusted basis, net income was $7.0 million, or $0.22 per diluted share. Adjusted second quarter results exclude charges associated with the consolidation of the company’s headquarters of approximately $0.6 million, or $0.01 per diluted share and impairment charges associated with the planned store closings of approximately $8.1 million, or $0.16 per diluted share.

For the year, adjusted earnings will exclude the impact of $8.7 million in year-to-date impairment charges in connection with the strategic store closures and the estimated $2.4 million in expenses associated with the previously announced corporate headquarters consolidation.

Stage Stores, Inc. operates 850 specialty department stores in 40 states and a direct-to-consumer channel under the BEALLS, GOODY'S, PALAIS ROYAL, PEEBLES and STAGE nameplates.