Sports Direct reported underlying EBITDA in its U.S. Retail segment, including Eastern Mountain Sports and Bob’s Stores, was a loss of £23 million ($30.6 million) in the first half ended October 29 on sales of £63.9 million ($85.1 million.)

The results reflect the period from May 18, when it acquired the businesses out of bankruptcy proceedings, until October 29.

Sports Direct noted that U.S. Retail’s underlying EBITDA includes £5.5 million of operating losses as group processes and strategies are implemented, and £17.5 million of losses relating to fair value accounting adjustments and accounting policy alignments.

On April 21, Sports Direct said in a statement it paid an aggregate cost of $101 million in cash for the two chains, all of which had either been advanced by Sports Direct by way of debtor-in-possession and other loans to Eastern Outfitters, the former owner of Eastern Mountain Sports and Bob’s Stores.

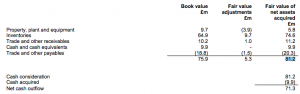

According to its filing for the first half of 2017, Sports Direct paid a total cash consideration of was £81.2 million for the two businesses and provided a chart indicating its adjustments to book value.

Companywide, Sports Direct’s revenues were up 4.7 percent in the first half to £1.71 billion ($2.3 billion), aided by favorable Euro exchange rates and the acquisition of Bob’s and EMS during the period. This was offset by store closures as part of a strategy launched last year to “elevate” its stores. Excluding the acquisition of Bob’s and EMS, the disposal of Dunlop and on a currency neutral basis, revenue were up 1.2 percent.

Sales at Sports Direct’s UK shops, including the Sports Direct, USC and Heatons chains, fell 1 percent during the half year to £1.1 billion ($1.5 billion) on the back of 13 store closures as the company shifted space to its three-in-one shops.

Gross margin for the company overall decreased 180 basis points to 38.6 percent in part due to increased inventory markdowns and the continued impact of an adverse U.S. exchange rate. Operating costs decreased 3.9 percent to £496.5 million ($661 million). Excluding acquisitions and disposals and currency neutral, operating costs were down 3.5 percent, largely due to prior-period onerous lease provisions and the closure of money-losing stores in Europe.

As a result, underlying EBITDA increased 7.4 percent to £156.1 million ($208 million).

Reported profit before tax decreased 67.3 percent to £45.8 million ($61 million). The prior period included a profit of £119.7 million ($159 mm) relating to the sale of JD Sports’ shares. Underlying profit before tax increased 22.9 percent to £88 million ($117 million).

Sports Direct told analysts that it had formed partnership with Nike to support both its Sports Direct and USC chains. Nike has reportedly agreed to provide launch product, including £249.99 soccer boots, for sales at its locations.

The Telegraph stated: “Sports Direct has had a fragile relationship with sports brands who have shunned the business in recent years amid fears that its ‘pile it high, sell it cheap’ strategy was undermining their brands.” In response, the retailer last year embarked on a strategy to become the “Selfridges of Sport” by investing in extensive refurbishments across its store base.

Mike Ashley, CEO, said, in a statement, “Our high street elevation strategy is currently delivering spectacular trading performance within our flagship stores. We intend to open between 10 and 20 new flagship stores next year.

“Whilst our reported profit before tax has been impacted by fair value adjustments and transitional factors such as the disposal of assets in FY17; our underlying profit before tax remains healthy. We will continue to invest for the long-term and our net debt has increased in line with management expectations.

“We continue to anticipate that growth in underlying EBITDA during FY18 will be within our forecast range of 5 percent to 15 percent.”

Photo courtesy Sports Direct