Given the shift of Easter from March to April this year, the slight increase in March sales for Sport Footwear was seen as a positive development for the market even as growth slowed from the stronger February rate.

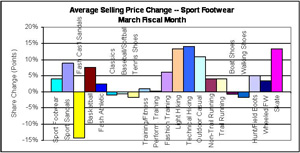

Based on retail point-of-sale data compiled by SportScanINFO, overall Sport Footwear sales, which represents the combination of all athletic and outdoor footwear categories, were up slightly in dollars. Average selling prices were up in the mid-single-digits for the five-month retail fiscal month of March ended April 4.

From a channel perspective, sales in the athletic/urban specialty sector were down slightly as launches moved up to February and back to April. Sport Footwear sales at full-line sporting goods were up in the mid-single-digits, with Easter having less of an impact on the channel. Sales in the family footwear channel were up in the low-singles, tempered by the shift in the Easter holiday buying season. The key drivers of the business remained the same in March as they did in February, with Brand Nike, Brand Jordan, Chuck Taylor, Running, Fashion basketball, Skate and Kids all posting positive results for the period.

Both the Nike brand and the Jordan brand added market share in the month versus the previous March, gaining 240 basis points and 190 basis points, respectively, for the period. Nike brand share topped 39.3% for the month and the combined share for the two NKE brands approached 50% for the period. ASICS was the other share gainer in the top five brands, picking up 60 basis points in share for the period. The other brands at the top of the leader board, Adidas and New Balance, both posted declines. Reebok fell to the #10 spot with just two points of share for the month.

The Performance Footwear categories posted a mid-single-digit increase in the aggregate for the retail fiscal month of March, while the non-Performance categories dipped slightly for the period. In Running, by far the largest category in Sport Footwear, Performance Running rose in the mid-singles and Fashion Running increased in the high-single-digits.

Nike again posted growth in Running, while New Balance declined and Adidas was flat. All the core running brands showed solid growth, with ASICS, Brooks, Saucony and Mizuno all showing gains in the lead up to todays Boston Marathon. Most of the growth in Running came at better price points, with product over $100 growing in strong double-digits, while product selling between $60 and $90 posted a decline for the month. Product under $50 also posted growth, delivering a low-single-digit increase as full-line sporting goods and mid-tier department stores drove growth at the lower price points.

Under Armour saw share in Running at just under 2% for the month.

Basketball continued to be a tale of two cities. Product with the Jumpman logo did well as the Jordan brand posted growth at the expense of the Nike brand, Adidas and Converse.

Training sales were flat in March, due to the flat performance turned in by brand Nike, but Jordan again took some share here, New Balance was the biggest loser, trading about seven points of share with Under Armour, who moved into the third spot on the chart. At Training product over $80, it was Under Armour and brand Nike trading share, with UA staking claim to more than 21 points of share for the month. Nike brand share at the higher price points was down by nearly a third versus the year-ago month.

Cleated footwear grew modestly in March, but overall Baseball Footwear posted a decent mid-single-digit improvement. Despite the weak economy, the kids are not going without shoes this spring as sales of kids Baseball Footwear were up in strong double-digits for the month.

Lifestyle Fashion continues to struggle, with sales down in the mid-single-digits for the retail fiscal month of March. Nike Lifestyle sales however grew strongly as the brand captures more share in the non-Performance categories. Skechers share held steady in a declining business, but both Adidas and K-Swiss posted share declines.

Classics struggled in March. Converse Chuck Taylor performed well, driven by growth in the Family Retailer sector, the only channels to post growth.

Skate sales grew more than 25% in March, with Nike taking a stronger position here as well on strong sales of Skeet and Dunk styles. Nike share in Skate increased in double-digits and the brand moved ahead of DC Shoes, which took an additional six points of share as well. World Industries was the other big winner here for the month.

Mens sales of sport footwear grew in the low-single-digits and kids sales improved in the mid-singles, while the womens business declined in the low-single-digits for the retail fiscal month of March.