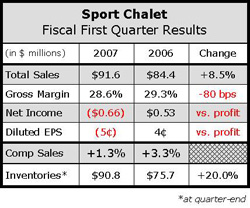

Sport Chalet continues to bolster its position in its home  SoCal market while at the same time investing in expansion into Northern California, Arizona, Nevada and Utah. However, a challenging retail environment in the back half of the quarter slowed the companys top-line and bottom line results during the fiscal first quarter. While sales and comps were both up, lower gross margins combined with higher SG&A expenses to pull the retailer into the red.

SoCal market while at the same time investing in expansion into Northern California, Arizona, Nevada and Utah. However, a challenging retail environment in the back half of the quarter slowed the companys top-line and bottom line results during the fiscal first quarter. While sales and comps were both up, lower gross margins combined with higher SG&A expenses to pull the retailer into the red.

Management said that strong sales performance in its newer markets was offset by slow sales at its mature stores. In addition, two extra selling days due to a calendar shift contributed $2.1 million in sales to last year's figures. Without this addition, sales would have increased 11.3%. SPCH also opened seven new stores since the fiscal first quarter last year, which contributed $7.9 million in sales. Because of these new stores, SPCH experienced some cannibalization in Southern California due to its “backfilling strategy.”

In addition, some of Sport Chalets mall-based stores, which are typically stronger in athletic footwear, experienced some difficulty due to the heavy promotional environment caused by some of the larger family footwear and athletic footwear specialty retailers. In hardgoods, SPCH saw growth in its mountain shop, fishing and water sports merchandise. The company also saw success in NFL, Hockey – spurred by the Anaheim Ducks Stanley Cup victory – and soccer sales – lifted by David Beckham's move to the LA Galaxy.

Gross margin in the first quarter decreased 70 basis points due to increased rent related to newer stores and increases in reserve for seasonal carryover merchandise. SG&A as a percentage of sales increased 120 basis points due to newer stores, which take time to reach operating efficiency.

Management pointed to effective inventory management as a bright spot for the retailer. Although there was a slight impact on the bottom-line from some seasonal merchandise, management is comfortable with current inventory levels.