Smith & Wesson Holding Corp. reported sales for the third quarter were $130.6 million, a decrease of

10.5 percent from net sales of $145.9 million for the third quarter

last year. Revenue exceeded the high end of the company's stated

guidance range as a result of order strength from distributors and key

retailers in January 2015.

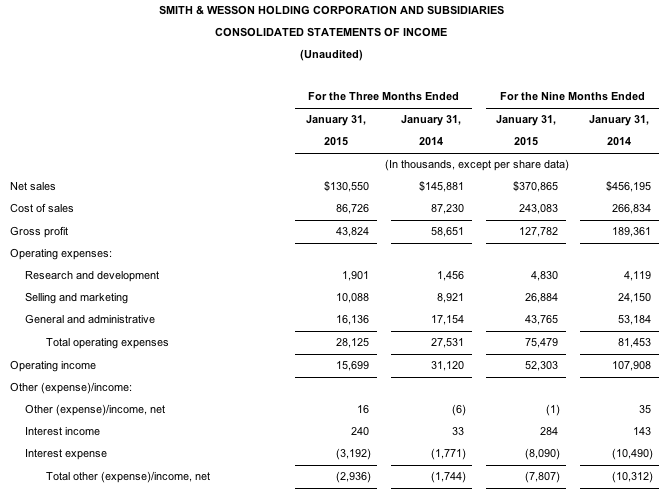

Total net sales for the third quarter were $130.6 million, a decrease of 10.5 percent from net sales of $145.9 million for the third quarter last year. Revenue exceeded the high end of the company's stated guidance range as a result of order strength from distributors and key retailers in January 2015.

Firearm division net sales for the third quarter totaled $124.5 million, a decrease of 14.7 percent from the comparable quarter last year. The company believes that during the quarter a portion of the consumer demand for handguns and long guns was satisfied with excess industry channel inventory. Accordingly, net sales of the company's handguns declined $6.8 million, or 6.8 percent, and net sales of the company's long guns declined $13.5 million, or 39.8 percent, from the comparable quarter last year.

Accessories division net sales for the third quarter were $6.1 million, or 4.6 percent of total net sales. The company's accessories division is comprised entirely of Battenfeld Technologies, Inc. (BTI), which was acquired on December 11, 2014. Therefore, accessories division net sales reflect only a partial quarter of revenue.

Gross profit margin for the third quarter was 33.6 percent compared with gross profit margin of 40.2 percent for the third quarter last year. The decline was a result of reduced firearm manufacturing volumes, unfavorable product mix changes, increased promotions, and decreased fixed-cost absorption, partially offset by favorable spending relative to sales volumes. Amortization of the inventory step-up related to the acquisition of BTI caused a 1.4 percentage point reduction in gross profit. Excluding that accounting-related effect, gross margin for the quarter would have been 35.0 percent.

Operating expenses for the third quarter were $28.1 million, or 21.5 percent of total net sales, compared with operating expenses of $27.5 million, or 18.9 percent of net sales, for the third quarter last year when the company did not have an accessories division. Third quarter operating expenses now include those ongoing operating expenses related to BTI operations as well as $2.9 million in amortization of acquired intangibles and other acquisition-related costs.

Operating income for the third quarter was $15.7 million, or 12.0 percent of total net sales, compared with $31.1 million, or 21.3 percent of net sales, for the third quarter last year. Excluding the $4.8 million in acquisition-related expenses noted above, total company operating income for the three months ended January 31, 2015 was $20.5 million, or 15.7 percent of total net sales.

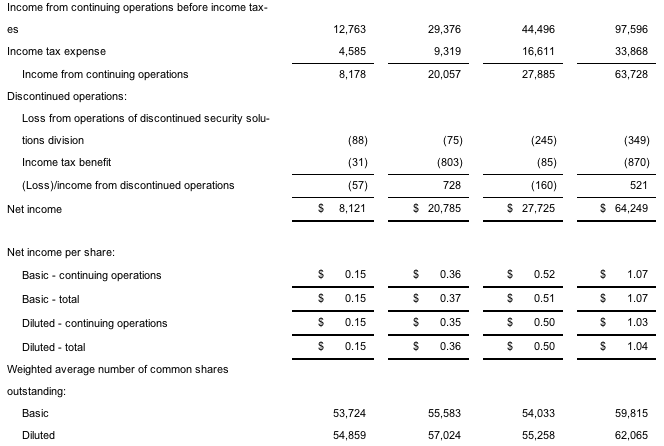

Income from continuing operations for the third quarter was $8.2 million, or 15 cents per diluted share, compared with $20.1 million, or 35 cents per diluted share, for the third quarter last year. Non-GAAP income from continuing operations for the third quarter was 20 cents per diluted share, compared with 35 cents per diluted share for the third quarter last year.

Adjusted EBITDAS from continuing operations for the third quarter was $28.7 million, or 22.0 percent of net sales, compared with $37.5 million, or 25.7 percent of net sales, for the third quarter last year.

Cash flow from operations was $33.4 million, although cash decreased by $5.4 million for the third quarter driven primarily by the $36.2 million of cash used for the BTI acquisition.

James Debney, Smith & Wesson Holding Corporation president and chief executive officer, stated, “Our third quarter results reflect the successful navigation of a normalizing firearm market following an earlier consumer surge in firearm purchases, combined with the ongoing focused execution of our long-term strategy. Sales in our firearm division exceeded our updated expectations, reflecting solid orders from distributors and key retailers at the start of our annual industry show season in January. At the SHOT Show, we continued to expand our product offering, providing consumers with some exciting new choices in our M&P line of firearms as well as new hunting firearms from Smith & Wesson, Performance Center, and Thompson/Center Arms. Our products remain popular with consumers and our internal data indicates that we remained the market leader in the handgun and the modern sporting rifle categories.”

“In our newly created accessories division, the acquisition of BTI in December 2014 provides us an avenue to expand our presence in firearms accesories. With a prolific product development capability and sophisticated infrastructure, BTI has established a track record of solid growth and highly accretive gross margins. Moreover, BTI has amassed a broad portfolio of hunting and shooting accessory brands that are popular with consumers. At SHOT Show in January, BTI unveiled 38 new products. We are excited about the opportunities for additional growth and profitability that our newly established accessories division will provide us.”

Jeffrey D. Buchanan, Smith & Wesson Holding Corporation Executive Vice President and Chief Financial Officer, stated, “We were pleased that inventories in our firearm division declined by $14.1 million in the quarter. During the quarter, we used $100.0 million of our credit line combined with $36.2 million of cash on hand for the acquisition of BTI. At the end of the quarter, we had $75.0 million available to us associated with the unused portion of the accordion feature of our line of credit and $59.0 million in cash. Accordingly, our balance sheet remains strong as we enter our fiscal fourth quarter, which seasonally is our strongest quarter for cash generation.”

Financial Outlook

For the fourth quarter of fiscal 2015, the company expects net sales to be between $162 million and $166 million and earnings per diluted share from continuing operations to be between 24 and 26 cents a share. On a non-GAAP basis, the company expects earnings per diluted share from continuing operations to be between 29 and 31 cents a share. In the 2013 fourth quarter, it earned 44 cents a share on sales of $170.4 million

For full fiscal 2015, the company is raising its guidance and now expects net sales to be between $532 million and $536 million and earnings per diluted share from continuing operations to be between 75 and 77 cents a share. On a non-GAAP basis, the company expects earnings per diluted share from continuing operations to be between 87 and 89 cents a share. Last year, the company earned $1.49 a share on sales of $626.6 million.