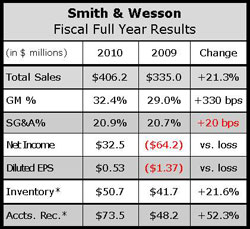

Smith & Wesson Holding Corporation wrapped up its fiscal year on a high note, delivering year-end results that represented growth in total revenues, gross margin and net income. Although management for the Springfield, MA-based company said consumer demand started to subside mid year from historically high levels in 2009, the company’s July 2009 acquisition of Universal Safety Response (USR) and strong sales of new firearms products helped offset tough comparisons from last year.

Citing considerable strength spurred by “ongoing growth at USR,” President and CEO Michael Golden estimated that Smith & Wesson expects Fiscal 2011 revenues to be between $430 million and $445 million, better than the $430.9 million analysts anticipated.

Results for Smith & Wesson’s fiscal 2010 fourth quarter ended April 30 outpaced most analysts’ estimates, buoying the year-end result after the company’s third quarter largely disappointed investors. Net sales for the fourth quarter improved 4.3% to $103.8 million from net sales of $99.5 million in the year-ago period. Firearms sales, which compared against near-record sales in the year-ago period, slipped a manageable 9.3% to $90.2 million from $99.5 million a year ago, but were offset by the addition of the USR business, which generated additional sales of $13.6 million during the quarter. The company’s year-ago sales only reflect the Firearms business.

S&W said firearms sales for fiscal Q4 “exceeded company expectations” and were driven by strong demand from the company’s M&P15-22 tactical rifle along with Walther firearms. Walther, a legendary handgun-specialist and the manufacturer of the PP series pistol of James Bond fame, was acquired by S&W in 1999. Hunting firearms, which consists of the Thompson/Center Arms brand, saw sales stabilize during the quarter, but management expressed optimism regarding the April 2010 launch of the new Impact Black Powder rifle.

In a conference call with analysts, management said strong demand from tactical rifles last year gave way to demand for concealed carry and personal protection handguns in 2010. International sales for the firearms segment fell about 38%, a development management attributed to “a more rigorous formal process” for qualification of customers, agents and distributors.

Management added that firearms order backlog was $108.0 million at quarter-end, up $33.8 million, or about 45.6%, from backlog of $74.2 million at the end of the third quarter. Backlog for the reporting period was driven primarily by surging demand for the company’s Bodyguard revolvers and pistols, which began shipping during the quarter.

Perimeter Security sales grew $2.7 million, or 25.0%, to $13.6 million compared with about $10.9 million a year ago. Management said the result was “less than company expectations, primarily due to a change in the underlying estimates associated with revenue expectations, one customer’s deferral of a significant order into future quarters, and generally longer sales cycles.”

Backlog for the Perimeter Security business was $35.1 million at the end of the fourth quarter, about $7.4 million lower than backlog of $42.5 at the end of the prior sequential quarter. Management attributed the decline to a lengthening of sales cycles. Unlike firearms backlog, which may not be indicative of future sales because of a higher rate of cancellations, backlog for Perimeter Security tends to be more in line with future sales because it consists of project-oriented contracts that are not typically cancelled.

Net income fell to $2.7 million, or 4 cents per diluted share, compared with net income of $7.4 million, or 14 cents per diluted share, in the year-ago period. Earnings for the fourth quarter included a non-cash, fair-value adjustment to the contingent consideration liability related to the USR acquisition that decreased fully diluted earnings per share.

Excluding the adjustment, net income for the fourth quarter would have been 8 cents per diluted share. Gross margins declined 20 basis points to 31.3% of total sales.

Inventory levels increased to $50.7 million at the end of fiscal 2010 as compared with $41.7 million a year ago, largely due to the inclusion of $5.8 million in USR inventory but also reflecting a replenishment of firearm inventories, which S&W said were depleted at the end of fiscal 2009.

Regarding outlook, the company expects total sales for the first quarter of 2011 to be between $92 million and $96 million against a prior-year period that saw the “single highest quarter on record for firearm sales.”

Management said Q1 guidance also reflects the company’s initiative to “aggressively address” the aforementioned qualification process for international firearms customers. First quarter 2011 Firearm Division sales are expected to be between $75 million and $78 million with the company’s Perimeter Security Business contributing to the balance.

Gross margins are expected to be between 31% and 32% of sales.