Although international remains a strong spot for Skechers USA, weakening sales in the U.S. prompted the company to lower its fourth quarter guidance. SKX now expects fourth quarter sales in the range of $305 million to $320 million, and EPS in a range of 15 cents to 23 cents a share.

The Street consensus estimate was 27 cents a share on sales of $323 million, or flat EPS to the year-ago period.

For the third quarter, domestic wholesale net sales decreased by almost 5%. When it reported its second quarter results in July, Skechers anticipated domestic wholesale sales to be flat based on early third quarter sales, incoming orders and backlog.

Company owned-retail stores “are posting mixed results” with comps down high-single digits due to the “extremely difficult” economic environment.

“Although we believe we have fared relatively well in the soft retail environment, our revenues were slightly lower than anticipated due to the reduced traffic at retail and general economic conditions,” said David Weinberg, Skechers COO, on a conference call wit analysts.

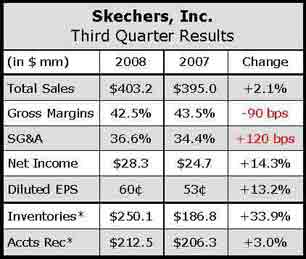

Third quarter revenues were up 2.1% to $403.2 million, driven by a 24.5% wholesale gain in the international business and 26% gain in its international subsidiaries. International backlogs were up double-digits at the quarters close. Representing 23% of total sales in the quarter, international wholesale “can be at least 30% to 35% of our total sales in the near future,” according to Weinberg.

Domestic wholesale order backlogs were up low-single-digits. Although domestic wholesale missed plan in the quarter, Weinberg believes Skechers diversity of offerings and its “reasonable price points have always resonated with consumers, and we believe this is even more so in this very difficult environment.”

Overall kids backlogs were said to be up for most of the companys major lines.

The fashion division grew a combined 16% in part due to the addition of Punk Rose and Public Royalty, as well as the Bebe license. The companys new Marc Ecko men’s, women’s and kids footwear line continued to grow as did the Zoo York men’s and women’s footwear line. Said Weinberg, “The backlogs of our fashion lines are very strong going into the remainder of the year.”

Worldwide retail sales increased 1.2% for the third quarter as a net 37 store increase from the prior year offset an 8.7% total comp decrease. Weak economic conditions and reduced foot traffic led to lower domestic comps in all three of its store types.

Said Weinberg, “While sales within our domestic company owned stores were lower than projected, we are pleased that our margins remain consistent with the prior year.”

Nonetheless, Skechers is planning store growth more conservatively, with 20 to 25 now set for 2009 versus an original forecast for 30 to 35 stores. It ended the quarter with 215.

In the third quarter, net earnings rose 15% to $28.3 million, or 60 cents a share, from $24.7 million, or 53 cents, a year ago. But the 2008 quarter included a tax benefit resulting from an advanced pricing agreement reached with the IRS during the quarter which will lower its ongoing effective annual tax rate from 34% to 27%. Before income taxes and minority interest, earnings fell 37.1% to $24.3 million from $38.6 million.