Boosted by favorable weather and strength in boots, Shoe Carnival Inc. reported earnings rebounded in the fourth quarter to $2.97 million, or 15 cents a share, up from $598,000, or 3 cents a share, a year ago. Results easily topped the off-price shoe chain's guidance calling for earnings between 6 to 10 cents.

Boosted by favorable weather and strength in boots, Shoe Carnival Inc. reported earnings rebounded in the fourth quarter to $2.97 million, or 15 cents a share, up from $598,000, or 3 cents a share, a year ago. Results easily topped the off-price shoe chain's guidance calling for earnings between 6 to 10 cents.

Comparable-store sales rose 9.5 percent, also easily beating its projected range between 3 to 5 percent. Net sales improved 13.6 percent to $227.6 million.

On a conference call with analysts, Cliff Sifford, president, CEO and chief merchandising officer, said the positive gain along with a 2.3 percent comp gain in the third quarter led to a 5.6 percent combined comp gain for the second quarter.

Store traffic was flat in the quarter, which marked improvement to the trend experienced over the past several years. Said Sifford, “A combination of moderate weather patterns, which generated strong athletic sales; along with a very strong boot trend drove sales throughout the quarter.”

Sifford said boots overall posted comp increases in the mid-20s. But the overall gains were broad-based. For instance, athletic shoes, which accounts for approximately half of its sales on an annual basis, delivered a high single-digit comp increase for the quarter.

In its women's nonathletic department, comps were up in the low teens, with boots ahead in the 30s. A double-digit comp increase was seen in in dress shoes.

Men's nonathletic advanced low single digits, with dress shoes and boots each producing comp gains. Its children's business ended the quarter with a high single-digit comp increase with boots driving girls and boots, basketball, running and canvas leading boys.

Adult-athletics comps were up by single digits for the quarter. Said Sifford, “We experienced a nice quarter of men's and women's running, men's and women's canvas, along with men's cross-training.”

Conversion rates at its comparable stores were up 150 basis points, which drove a mid single-digit increase in the number of transactions. Units, average transaction, and average unit retails all showed positive growth for the quarter.

Although weather played a role in our overall comps, sequential improvements in comps increases were seen as it moved through each month of the quarter. Added Sifford, “We believe that our key initiatives of national advertising, better brands in our women's department, and aggressive multichannel initiatives continued to bring new customers to our stores, e-commerce site, and mobile touchpoints.”

Gross margins decreased 10 basis points to 28.6 percent. Merchandise margin fell 40 basis points, due primarily to an increase in inbound freight expense due to the slowdown of the West Coast ports and an acceleration of its e-commerce business. Shoe Carnival estimated that the port congestion decreased diluted EPS by approximately 3 cents in Q4 versus its original guidance on a 1 cent per share cost.

SG&A expenses were reduced to 26.6 percent of sales from 28.5 percent due to the sales leverage. It ended the quarter with inventory down approximately 5 percent on a per-store basis, in line with expectations.

Sifford said Shoe Carnival benefited in the second half from several newer initiatives, including the launch of national advertising that helped introduce Shoe Carnival to customers in new markets and led to greater exposure in existing markets.

A focus on bringing new customers into its Shoe Perks loyalty program also helped. It started the year with approximately 3 million Shoe Perks members and ended the year with more than 6 million members, accounting for over 43 percent of sales.

Online was aided by opening up store-level inventory to e-commerce orders. Finally, Shoe Carnival better utilized technology to select real estate that helps in negotiating terms or identifying relocation opportunities. Said Sifford, “In addition, with a better understanding of the volume a potential site can produce, we will negotiate a box size that will allow us to achieve higher average sales per square foot. Through these actions over the next few years, we should see improved operating margins and accelerated EPS growth.”

Regarding the West Coast port situation, Sifford that while the slowdown came to an end at February’s close, “it has taken some time to get caught up with container ships that were backlogged and to reposition the empty containers.”

Shoe Carnival is still experiencing up to two-week delays on many of the orders slated for February and March deliveries through the West Coast. It began utilizing East Coast ports for containers delivering in mid-March and forward to ensure a more timely delivery. Said Sifford, “It is believed that it will take 60 to 90 days before the West Coast issues get fully resolved. We are monitoring the progress at West Coast ports and will begin utilizing them again as we see the situation improving.”

Shoe Carnival closed the year with 400 stores, opening 31 during 2015. It plans to open 18 to 22 this year while closing 11.

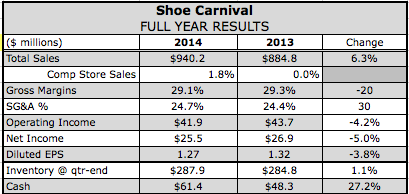

For 2015, Shoe Carnival expects sales in the range of $977 million to $991 million, which compares to $940.2 million in 2014. Comps are expected to improve in the range of 1.5 percent to 3 percent. EPS is expected to be in the range of $1.40 to $1.48, which compares with $1.27.

Sifford said the year “got off to a very strong start” until the second half of February, when winter snows hit the Midwest and Southern regions. Much like last year's late January and early February, Shoe Carnival experienced over 400 closed or partially closed store days.

“However, as soon as the weather moderated, we saw an immediate lift and sales similar to what we were experiencing throughout the fourth quarter,” said Sifford. “We believe with the current momentum in sales, we'll finish the quarter with a low single-digit increase on a comparable-store basis. As we look forward to the rest of the year, we will continue to think conservatively, but with the ability to react quickly to opportunities, as we did in the second half of last year.”