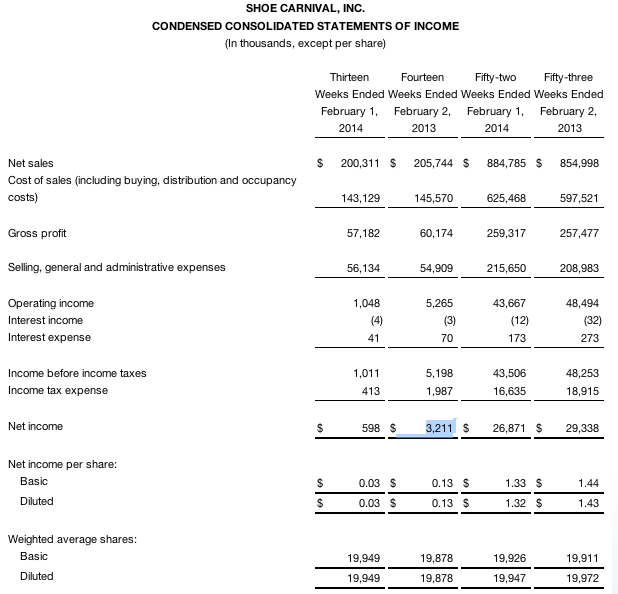

Shoe Carnival, Inc. reported profits fell 81.4 percent in the fourth quarter, to $598,000, or 3 cents a share, from $3.2 million, or 13 cents, a year ago. Comparable store sales for the 13-week period ended Feb. 1 decreased 2.5 percent as unfavorable weather led to significant declines in traffic and sales in December and January.

On Jan. 9, Shoe Carnival had warned that double-digit traffic declines through the first three weeks of December would cause its Q4 to land in the range of 3 to 6 cents a share. On Dec. 2 when reporting third-quarter results, Shoe Carnival forecast earnings of 18 cents to 22 cents a share.

The fourth quarter of fiscal 2013 included 13 weeks compared to 14 weeks in the fourth quarter of fiscal 2012 and fiscal year 2013 included 52 weeks compared to 53 weeks in fiscal year 2012.

Fourth Quarter Financial Results

The company reported net sales of $200.3 million for the 13-week fourth quarter ended February 1, 2014, as compared to net sales of $205.7 million for the 14-week fourth quarter ended February 2, 2013. The net effect of this extra week on the sales comparison for the fourth quarter was approximately $12.7 million. Comparable store sales for the 13-week period ended February 1, 2014 decreased 2.5 percent as compared to the 13-week period ended February 2, 2013.

The gross profit margin for the fourth quarter of fiscal 2013 decreased to 28.5 percent compared to 29.3 percent for the fourth quarter of fiscal 2012. The merchandise margin decreased 0.2 percent while buying, distribution and occupancy expenses increased 0.6 percent as a percentage of sales.

Selling, general and administrative expenses for the fourth quarter increased $1.2 million to $56.1 million. As a percentage of sales, these expenses increased to 28.0 percent compared to 26.7 percent in the fourth quarter of fiscal 2012 primarily due to the deleveraging effect of the decline in comparable store sales.

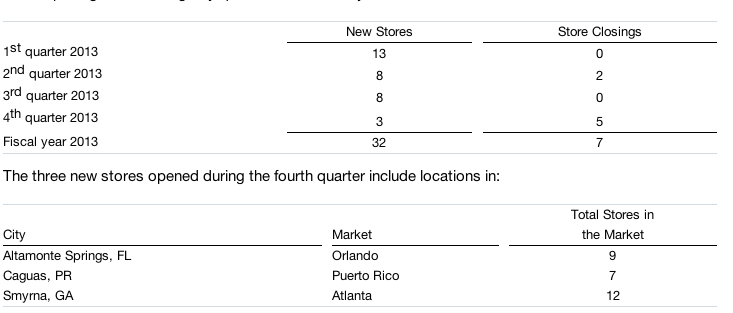

The company opened three new stores during the fourth quarter of fiscal 2013 as compared to one store in the fourth quarter of fiscal 2012.

Net earnings for the 13-week fourth quarter ended February 1, 2014 were $0.6 million, or $0.03 per diluted share. For the 14-week fourth quarter ended February 2, 2013, the company reported net earnings of $3.2 million, or $0.13 per diluted share.

Fiscal Year 2013 Financial Results

Net sales increased 3.5 percent to $884.8 million for fiscal 2013, as compared to net sales of $855.0 million for fiscal 2012. Comparable store sales for the 52-week period ended February 1, 2014 were flat compared to the 52-week period ended February 2, 2013. Net earnings for fiscal 2013 were $26.9 million, or $1.32 per diluted share, compared to net earnings of $29.3 million, or $1.43 per diluted share, in the last fiscal year. The gross profit margin for fiscal 2013 was 29.3 percent compared to 30.1 percent last year. Selling, general and administrative expenses, as a percentage of sales, for fiscal 2013 were unchanged as compared to fiscal 2012. The company opened 32 stores during fiscal 2013 as compared to 31 stores last year.

Speaking on the results, Cliff Sifford, President and CEO, said, “Unfavorable weather in the fourth quarter negatively impacted our customer traffic, and consequently, our sales and earnings results. In particular, robust traffic and sales in November were followed by significant declines in traffic and sales in December and January. Despite this tough sales environment, we ended fiscal 2013 with inventories in excellent shape and believe we are well positioned with the right assortment of family footwear at the right price to capitalize on the Easter selling season.”

Store Growth

During fiscal 2013, the company opened 32 new stores and seven were closed to end the year at 376 stores. Three stores were opened and five were closed in the fourth quarter of fiscal 2013. Total retail selling space increased to 4.1 million square feet at the end of fiscal 2013 from 3.8 million square feet at the end of fiscal 2012.

Store openings and closings by quarter for the fiscal year were as follows:

In fiscal 2014, the company expects to open 30 to 35 new stores, relocate three stores and close one store. For the first quarter of fiscal 2014, the company will open seven stores, relocate two stores and close one store. In the first quarter of fiscal 2013, the company opened 13 stores, relocated three stores and no stores were closed.

First Quarter Fiscal 2014 Earnings Outlook

The company expects first quarter of fiscal 2014 net sales to be in the range of $232 million to $241 million, with comparable store sales in the range of flat to down 3.5 percent. Earnings per diluted share in the first quarter of fiscal 2014 are expected to be in the range of $0.45 to $0.52. In the 13-week first quarter of fiscal 2013, total net sales were $232.3 million, comparable store sales increased 4.3 percent and the company earned $0.47 per diluted share.

Sifford concluded, “While general consumer economic uncertainty keeps our outlook conservative for the first quarter of fiscal 2014, our Shoe Carnival team remains committed to managing the controllable aspects of our business to best position us for future growth as consumer spending begins to improve. We believe the April launch of our spring creative on national cable television will increase Shoe Carnival brand awareness in new and existing markets and will help to drive customer traffic to our stores and website.”

As of Mar. 20, the company operated 379 stores in 32 states and Puerto Rico.