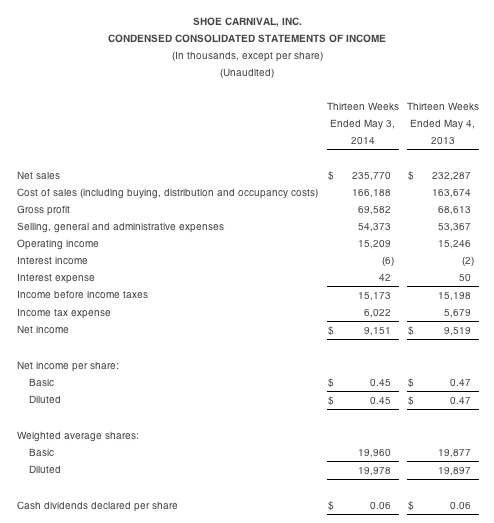

Shoe Carnival, Inc. reported net earnings for the first quarter declined slightly to $9.2 million, or 45 cents per share, from $9.5 million, or 47 cents, per diluted

share. Sales of $235.8 million for the first quarter of fiscal 2014, a 1.5 percent increase, as compared to net sales of $232.3 million for the first quarter of fiscal 2013. Comparable store sales decreased 1.7 percent in the first quarter of fiscal 2014.

The gross profit margin for the first quarter of fiscal 2014 remained flat at 29.5 percent. The merchandise margin increased 0.5 percent while buying, distribution and occupancy expenses increased 0.5 percent as a percentage of sales.

Selling, general and administrative expenses for the first quarter of fiscal 2014 increased $1.0 million to $54.4 million. As a percentage of sales, these expenses increased to 23.0 percent compared to 22.9 percent in the first quarter of fiscal 2013.

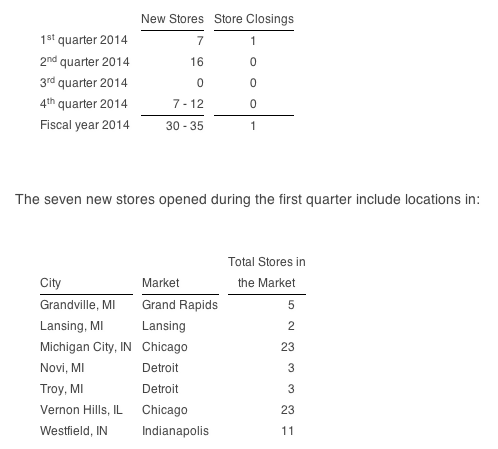

The company opened seven new stores during the first quarter of fiscal 2014 as compared to 13 stores in the first quarter of fiscal 2013.

Cliff Sifford, President and CEO, stated, “Our continued focus on store growth led to a first quarter net sales increase of 1.5 percent. However, severe weather and higher utility and health care costs adversely impacted our consumer contributing to our comparable store sales decline. Despite the difficult quarter, we were pleased with the initial response to our first-ever national television advertising campaign. While achieving brand recognition in new markets takes time, we did see an immediate increase in online traffic and sales in large markets such as New York City and Los Angeles where we do not currently have a store presence. Longer term, as we enter new markets we expect to benefit from enhanced brand awareness. In the second quarter we will have record store growth with the opening of 16 stores, including our first entry into Miami, Florida and upstate New York.”

Second Quarter Fiscal 2014 Earnings Outlook

The company expects second quarter net sales to be in the range of $223 to $228 million with comparable store sales in the range of flat to a decline of 3.0 percent. Earnings per diluted share in the second quarter of fiscal 2014 are expected to be in the range of $0.12 to $0.16. Included in the earnings estimate is an increase in store pre-opening costs of approximately $0.05 due to the expectation of opening 16 stores in the second quarter this year compared with opening eight stores in the second quarter of last year. In the second quarter of fiscal 2013, comparable store sales increased 2.6 percent and the company earned $0.29 per diluted share.

Store Growth

The company expects to open 30 to 35 new stores and close one store in fiscal 2014. Store openings and closings by quarter for the fiscal year are as follows: