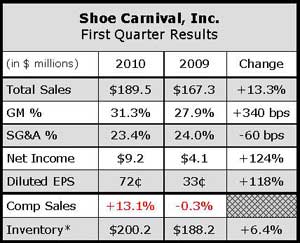

A 13.1% comp gain combined with improved gross profit margins and controlled expenses resulted in the strongest quarterly earnings performance in Shoe Carnival's history. Led by toning footwear, the comp gain beat guidance in the range of 8% to 9%, and compared with flat comps a year ago. Excluding toning, comps would have still been up high-single digits.

“Our comparable store sales increases are not one dimensional and are being driven from every department with key items and classifications that are not only driving historically higher average unit retails but also higher margins,” said Cliff Sifford, EVP and general merchandise manager, on a conference call with analysts.

Average unit retail was up 5%, traffic grew 5.5% and merchandise margins improved 220 basis points with every department either showing improvement or flat versus Q1 last year. Units sold increased high-single digits with higher average unit retails in every department.

In adult athletics, comps grew double digits with women's athletic up high teens and men's athletic up high-single digits. Outside of toning, the largest increases in women's athletic came from vulcanized canvas, primarily Chucks; as well as performance trail running. In men's athletic, basketball, retro basketball, cross training and trail running performed well. Toning is now receiving more focus in men's athletic.

In women's non-athletic, comps were up double digits with flat sandals, sport sandals, and athletic sandals all selling at much higher rates than last year. Gains were also achieved in wedges, both casual and dress, as well as trail hikers and vulcanized canvas. Men's non-athletic climbed double digits, led by vulcanized canvas, boat shoes, trail hiking, sandals, and work shoes. Outdoor hiking is becoming a more important category as Shoe Carnival expands West, Sifford said.

Children's increased high-single digits, primarily from the non-athletic categories with girls boots selling early in the quarter and fashion canvas and sandals selling later. Other key drivers were girls and boys running, Chucks, and fashion athletic for boys.

Regarding toning, Sifford expects the category “will continue to gain momentum in our stores as we rollout additional stores and styles from key brands.” Skechers and Avia are currently in all stores, and Reebok will be in all by the end of Q2. Also supporting the category is increased advertising by the brands as well as the arrival of a “fitness” offering from Nike at the end of the year. “I see this as a strong category that's going to continue for a good long while,” said Sifford.

Shoe Carnival will continue to focus on product in the $99 to $109 range as well as brands that are actively marketing their product.

Sifford added that walking may be a category where toning may cannibalize sales, while also adding, “I haven't seen any switch from running or walking or cross training into the toning category as of yet.”

Gross margins increased 340 basis points to 31.3% of sales, benefiting from increased unit prices partly due to less clearance activity, particularly in women's dress and casual product.

Inventories were up 7% on a per store basis at quarter end to support improved sales opportunities including toning, but Sifford noted that the increase is still well below its historic average for the end of Q1.

For Q2, comps are expected to rise in the range of 8% to 10%. EPS is expected to land in the range of 23 to 27 cents a share, versus 8 cents a year ago and at the high-end of its guidance.