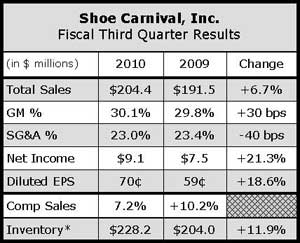

Despite some slow down in toning, Shoe Carnival's third quarter earnings climbed 21.3% to $9.1 million, or 70 cents a share. Comps grew 7.2% on top of a 10.2% jump in Q3 last year.

Despite some slow down in toning, Shoe Carnival's third quarter earnings climbed 21.3% to $9.1 million, or 70 cents a share. Comps grew 7.2% on top of a 10.2% jump in Q3 last year.

The family shoe chain joined a number of other retailers raising guidance for the year.

On a conference call with analysts, company EVP and GMM Cliff Sifford said traffic was up 4.5% and gains were seen in both conversion rates and average transaction size. Excluding toning, comps grew mid-single-digits with gains seen across categories.

In women's non-athletic, comps increased mid-single-digits, driven by summer sandals. Double-digit increases were seen in boots for the first two months of the third quarter.

While trending down during October, boots have been generating increases in excess of 40% for the first two weeks of November. Strong comps were also seen in women's sport casual, including hikers, vulcanized canvas and molded footwear. Men's non-athletic comped up in mid-single-digits on top of a double-digit increase last year and continued to be driven by the boot and casual categories, including vulcanized canvas and sandals. Children's was up double-digits, driven by girls’ fashion canvas and girls’ and boys’ sandals.

Double-digit increases were also seen in both girls’ and boys’ running. Adult athletics comps rose high-single-digits, driven primarily by running. Performance running in both genders generated gains in excess of 20%. Without the benefit of toning, adult athletics saw low-single-digit increases.

Sifford said toning pairs sold for the quarter as a percent of total stayed relatively flat to 2010's first and second quarters but the categoriy’s net sales declined as a percent of sales. Average unit retail in toning declined 12% sequentially compared to the second quarter and 18% versus the first quarter.

“Retailers reacted to sales that leveled out after a few quarters of unprecedented growth,” said Sifford. “We certainly expect toning to continue to be a very important category in our overall business, including this holiday time period and we definitely expect the category to continue to have a positive impact on comparable store sales for the fourth quarter of 2010.”

Shoe Carnival also noted that even with the decline in average unit retail and toning for the quarter, total AUR, including toning, was flat for Q3, and has grown low-single-digits over the past several weeks.

Looking to holiday selling, Sifford expects the boot category to be a “very important gift item.” Positive results are also expected from women's non-athletic sport casual, children's, men's basketball and performance running.

Inventories ended the quarter up 12% on a per door basis. Excluding toning, inventories were up mid-single-digits per door, in line with plans. Aged inventory remains at an all-time low.

For 2010, earnings are expected to reach $2.03 to $2.05, up from previous expectations of $1.89 to $1.95. SCVL earned $1.20 in 2009. Revenues are expected to range between $737 to $741 million with comps increasing between 8.1% to 8.6%.

Fourth quarter sales are expected to range between $178 to $182 million with comps up 4% to 6%. EPS is forecast in the range of 30 cents to 32 cents, which compares with 20 cents in Q4 last year.

Shoe Carnival also ramped up its store expansion plan for fiscal 2011 with 20 new stores expected, up from ten opened this year.