Shimano Group reported operating income fell 15.4 percent in the third quarter ended September 30 due to lower revenues and earnings in the company’s cycling division.

Revenues in the quarter dropped 4.5 percent to ¥79.2 billion ($706 mm). Operating income slid 15.4 percent to ¥13.3 billion ($119 mm) while net profits gained 31.1 percent to ¥12.3 billion ($110 mm).

In the Bicycle Components in segment, revenues gained 6.8 percent to ¥62.0 billion ($553 mm). Operating income slumped 17.8 percent to ¥11.5 billion ($103 mm).

In the Fishing Tackle segment, sales rose 5.0 percent to ¥17.1 billion ($153 mm). Revenues rose 6.9 percent to ¥1.76 billion ($16 mm).

The figures for the third quarter were gleaned by subtracting six-month results from nine-month results.

For the nine months, sales increased 3.2 percent to ¥253.9 billion. Operating income inched up 2.7 percent to ¥47.8 billion, and net income increased 42.4 percent to ¥40.0 billion.

Shimano in the company’s earnings statement indicated that overall conditions in the U.S. were healthy, while Europe showed modest growth and the company’s core market of Japan showed some recovery.

Shimano said that during the first nine month that in Europe, “moderate economic expansion continued with firm personal consumption backed by improvements in employment and income environments. In the U.S., the economy grew steadily, boosted by strong business confidence among companies against the backdrop of solid business conditions as well as a strong consumer sentiment due to an improved employment environment and the income tax reduction policy. In Japan, despite weakening of exports and production activities in the aftermath of disasters such as heavy rain, the overall economy remained on a gradual recovery track, as personal consumption has continuously recovered owing to improvements in employment and income environments.”

In the Bicycle Components in the nine months, sales from this segment increased 2.2 percent to ¥200.9 billion while operating income decreased 0.1 percent to ¥41.1 billion.

Shimano wrote, “In Europe, with the stable weather continuing through the summer season, retail sales of completed bicycles, mainly sport E-BIKE, stayed robust, and distributor inventories of bicycles remained at a slightly lower level, though they were in an appropriate range. In North America, retail sales of completed bicycles were on par with an average year, and distributor inventories remained at an appropriate level. In China, retail sales of completed bicycles remained feeble, and retail sales of low-end and middle-range bicycles continued to be sluggish. On the other hand, bike sharing is facing a period of realignment, and the number of products supplied to the market has stabilized; thereby distributor inventories remained at an appropriate level.

With regard to the other emerging markets, Southeast Asia as a whole lacked vigor, although retail sales of completed bicycles showed signs of a gradual recovery in Indonesia. In South America, consumption showed signs of slowdown due to the effects of continuing currency depreciation and political instability in Brazil and Argentina. Distributor inventories were at an appropriate level both in Southeast Asia and South America. In the Japanese market, although retail sales of sports bicycles and community bicycles remained sluggish owing partly to the unseasonable weather conditions persisting since the beginning of the year, sales of E-BIKE as a whole increased, and particularly sport E-BIKE has gained more attention. Distributor inventories remained at an appropriate level. Under these market conditions, the new 105 Series, which is one of the high-end road bike components, was well-received in the market.”

In the Fishing Tackle segment, net sales increased 7.3 percent in the nine months to ¥53.7 billion, and operating income increased 24.7 percent to ¥6.8 billion.

The company wrote, “In the Japanese market, retail sales were sluggish due mainly to heavy rains and typhoons since summer. Overseas in the North American market, sales remained robust supported by a steady economic expansion despite the non-negligible impacts of the hurricane hitting the east coast. Distributor inventories remained at an appropriate level. Sales in Europe are recovering steadily, while distributor inventories remained at a slightly higher level in the U.K., one of the major markets. Sales in Asia continued to be robust driven by further growing popularity of sports fishing.

In Australia, the market was booming and sales remained strong since favorable weather continued. Under these market conditions, sales in Japan exceeded the previous year’s level, due partly to contributions from the new lure-related products which were continuously well-received in the market. Overseas, the new model of baitcasting reel, Curado DC, was highly acclaimed, particularly in North America, where sales exceeded the previous year’s level. Overseas sales on the whole exceeded the previous year’s level with sales in Europe and Australia on par with the previous year and sales in Asia as well as in North America exceeding the previous year’s level.”

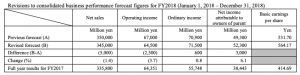

Shimano slightly revised the company’s forecasts for the year in light of non-operating income recorded owing to relative weakness of major Asian currencies along with the progression of the U.S. dollar’s appreciation during the third quarter as well as the factor that the normalization of delivery time is carried over to the next fiscal year due to the shortage of supply for the products of which orders received are favorable.

Photo courtesy Shimano