The Sports & Fitness Industry Association (SFIA) has begun working with its members on petitions requesting tariff relief consideration in an effort to maximize duty relief on eligible imports.

SFIA noted that earlier this year Congress passed the American Manufacturing Competitiveness Act of 2016 (AMCA), which allows U.S. businesses to reduce duties on imports. Under the AMCA, a new process for consideration of duty relief via the Miscellaneous Tariff Bill (MTB) was approved. The MTB now will be initiated by the International Trade Commission (ITC).

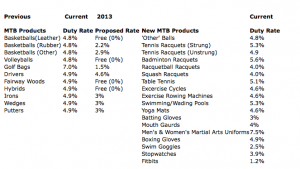

The goal of the MTB is to reduce or eliminate import tariffs on products not manufactured in the United States. In order to receive this benefit, imported products will need to be “noncontroversial” and “noncompetitive” with domestic manufacturers. The amount of duty relief is $500,000 per product per year for three years. Historically, tariffs on sporting goods and fitness products have been reduced approximately 3 percent.

Under SFIA’s initiative, members are encouraged to review their import and purchasing data to identify potential MTB tariff relief opportunities. With the ITC petition filing period only open for 60 days, it is important to prepare now. The MTB duty-relief opportunity will not be available again until 2019.

The new process requires companies interested in tariff relief to file a petition with the ITC, which will vet all the requests for relief. After review, the ITC will recommend approval or dismissal of petitions and send a report on their findings to Congress. As part of the review process, the public will be provided an opportunity to comment on the petitions. Congress will be able to strike certain ITC recommendations, but will not be permitted to add new ones.

The AMCA provides certain important timelines for MTB that the ITC must follow. The MTB process will begin at the latest October 15, 2016 and conclude no later than August 2017. Below is the projected timeline for the MTB process. Petitions will be due within 60 days of the Federal Register notice (no later than December 14, 2016).

• ITC will publish a list of petitions submitted and the public comment period opens within 30 days of the petition submission deadline (no later than January 13, 2017).

• The public comment period would close 45 days later (no later than February 27, 2017).

• ITC would then publish a preliminary report to Congress between 120-150 days of the public comment period opening, or May 13-June 12, 2017.

• ITC will publish a final report to Congress within 60 days of its preliminary report (between July 12 and August 11, 2017).

Assuming the new Congress promptly considers the ITC report and passes the MTB bill, importers could receive benefits as early as the fourth quarter of 2017.

SFIA has identified the following products for potential MTB tariff relief; some were previously vetted and others are new. Information on proposed tariff relief for repeat products is included below:

Companies interested in pursuing this duty-relief opportunity for these products should contact Bill Sells, SFIA’s Vice President for Public Affairs at bsells@sfia.org