Sequential Brands Inc., the parent of Heelys, Avia, And1 and several fashion brands, reported a loss in the fourth quarter but operating earnings significantly improved.

Fourth Quarter 2014 Results:

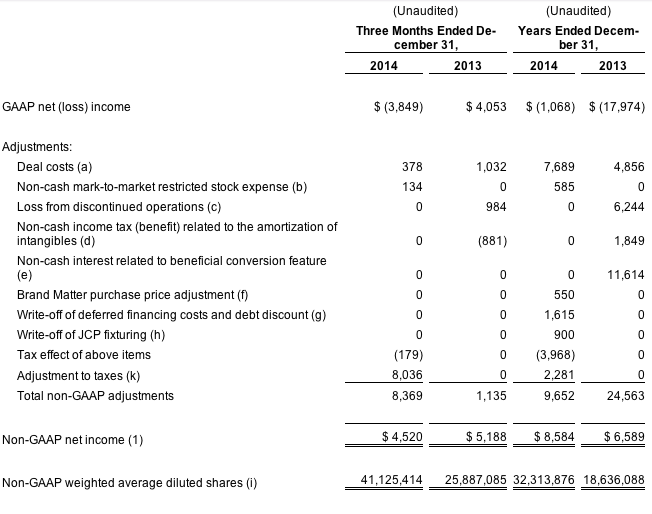

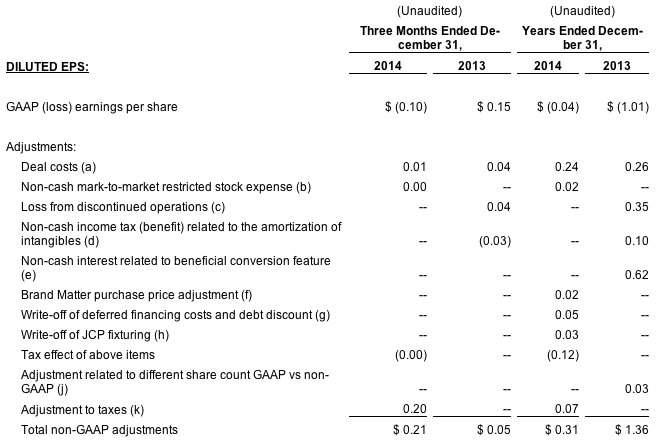

Total revenue for the fourth quarter ended December 31, 2014 increased to $18.6 million, compared to $10.6 million in the prior year quarter. Adjusted EBITDA for the fourth quarter was $11.1 million, compared to $7.1 million in the prior year quarter. On a non-GAAP basis, net income for the quarter was $4.5 million, or $0.11 per diluted share, compared to $5.2 million, or $0.20 per diluted share, in the prior year quarter. On a GAAP basis, net loss for the quarter was $3.8 million, or ($0.10) per diluted share, compared to net income of $4.1 million, or $0.15 per diluted share, in the prior year quarter. See tables below for a reconciliation of GAAP to non-GAAP measures.

Yehuda Shmidman, Sequential's Chief Executive Officer, commented, “2014 was another transformational year for Sequential. Our platform grew substantially, and the company delivered strong financial results. Looking ahead, we remain focused on executing the chapters of our playbook inclusive of both organic and acquisition growth, as we look to achieve our three-year plan of $3.5 billion in annual global retail sales, $100 million in revenue and $70 million of adjusted EBITDA.”

Full Year 2014 Results:

Total revenue for the year ended December 31, 2014 increased to $41.8 million, compared to $22.7 million in the prior year. Adjusted EBITDA for the year ended December 31, 2014 was $24.0 million, compared to $12.3 million in the prior year, and the company's non-GAAP net income was $8.6 million, or $0.27 per diluted share, for the year ended December 31, 2014, compared to $6.6 million, or $0.35 per diluted share, in the prior year. On a GAAP basis, net loss was $1.1 million for the year ended December 31, 2014, or ($0.04) per diluted share, compared to $18.0 million, or ($1.01) per diluted share, in the prior year, as the company incurred certain costs in each year, both cash and non-cash, that were not representative of the company's ongoing business. See tables below for a reconciliation of GAAP to non-GAAP measures.

2014 GAAP and Non-GAAP Taxes:

For GAAP purposes, in the fourth quarter of 2014 the company recorded $10.3 million of taxes on $6.4 million of pre-tax income and for the full year 2014 the company recorded $2.9 million of taxes (of which approximately $2.5 million were non-cash taxes) on $1.9 million of pre-tax income. The company believes this is an anomaly and in future years the company's statutory tax rate will be 35 percent. Therefore, the non-GAAP tables below demonstrate the 2014 financials inclusive of this statutory tax rate of 35 percent.

Financial Update:

For the year ending December 31, 2015, the company is reiterating revenue guidance of $61 – $64 million with adjusted EBITDA of $38 – $40 million. The company's contractual guaranteed minimum royalties for 2015 are approximately $45 million.

Consistent with the company's historical quarterly results, the company expects revenue for 2015 to be weighted to the third and fourth quarters due to seasonality in the businesses of many of the company's licensees. Therefore, revenue for the first half of the year will be close to minimum revenue, with overages being recognized in the second half of the year. As a result of this seasonality, the company expects its adjusted EBITDA margins to be lower in the first half of the year, and higher in the second half of the year.

Sequential Brands Group, Inc. (SQBG) owns, promotes, markets, and licenses a portfolio of consumer brands that presently includes Avia(R), AND1(R), Ellen Tracy(R), William Rast(R), Revo(R), Caribbean Joe(R), Heelys(R), DVS(R), The Franklin Mint(R), Nevados(R), People's Liberation(R) and Linens 'N Things(R).